Social Security Direct Deposit Dates

What is social security direct deposit dates?

Social security direct deposit dates refer to the specific dates on which social security benefits are deposited directly into a person's bank account. Instead of receiving a physical check in the mail, individuals can choose to have their social security benefits electronically deposited into their preferred bank account on predetermined dates. This method provides a faster and more convenient way for recipients to access their funds.

What are the types of social security direct deposit dates?

There are two main types of social security direct deposit dates: recurring and non-recurring. Recurring direct deposit dates are set up for individuals who receive social security benefits on a regular basis, such as monthly or quarterly. Non-recurring direct deposit dates, on the other hand, are used for one-time payments or special circumstances, such as retroactive payments or lump-sum amounts. Both types of direct deposit dates ensure that individuals receive their social security benefits in a timely and secure manner.

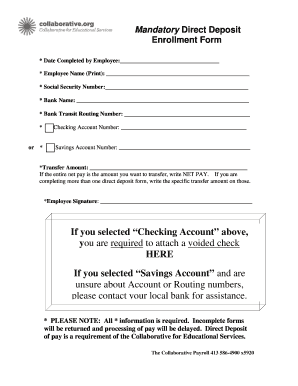

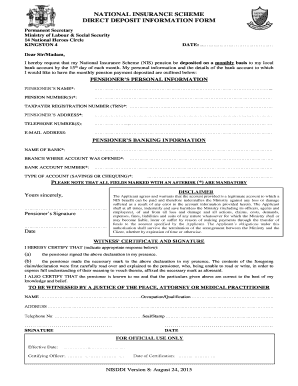

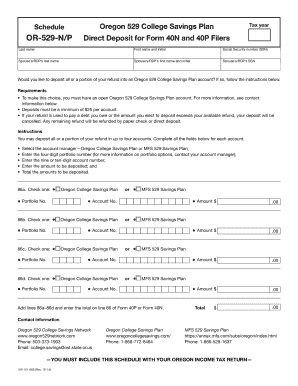

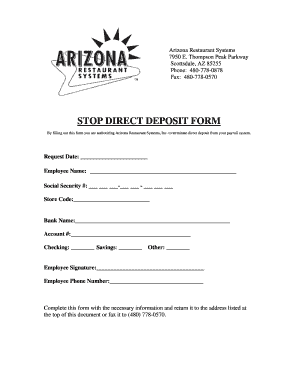

How to complete social security direct deposit dates

To complete social security direct deposit dates, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.