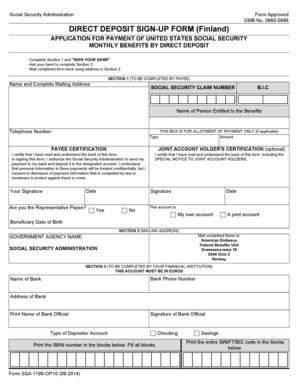

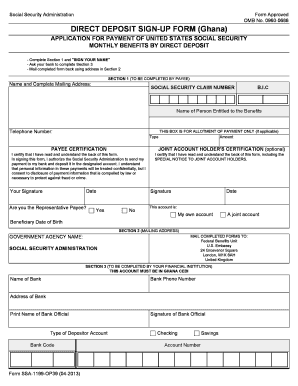

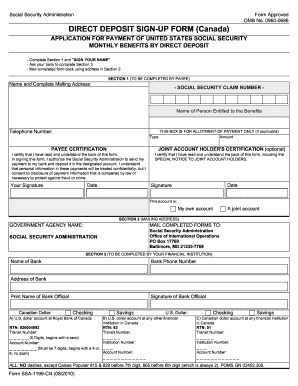

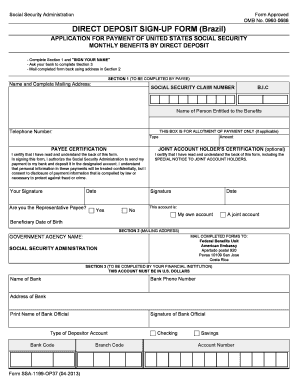

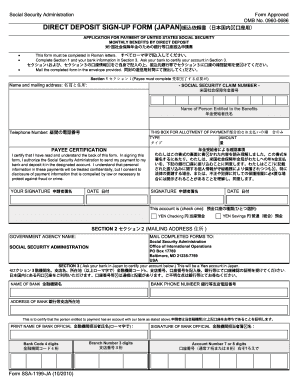

Social Security Direct Deposit Form - Page 2

What is Social Security Direct Deposit Form?

The Social Security Direct Deposit Form is a document that allows individuals to authorize the Social Security Administration (SSA) to deposit their Social Security benefits directly into their bank account. By using this form, individuals can avoid the hassle of receiving paper checks and can receive their benefits quickly and securely.

What are the types of Social Security Direct Deposit Form?

There are two types of Social Security Direct Deposit Forms: the SSA-1199 and the SF-1199A. The SSA-1199 form is used for individuals who receive Social Security benefits, while the SF-1199A form is used for federal employees who receive their salary through direct deposit. Both forms serve the same purpose of authorizing the direct deposit of funds into a bank account.

How to complete Social Security Direct Deposit Form

Completing the Social Security Direct Deposit Form is a simple process. Follow these steps:

By following these steps, you can easily complete the Social Security Direct Deposit Form and authorize the direct deposit of your Social Security benefits or salary. Remember, pdfFiller empowers users to create, edit, and share documents online, including the Social Security Direct Deposit Form. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to efficiently manage your documents.