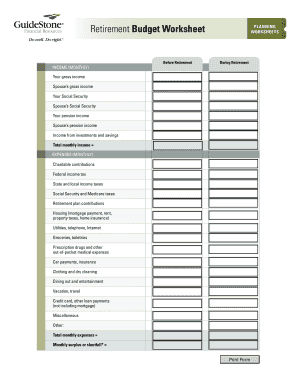

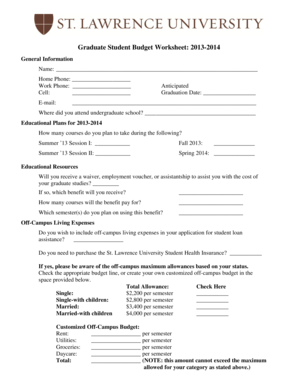

Student Budget Planning Worksheet

What is a Student Budget Planning Worksheet?

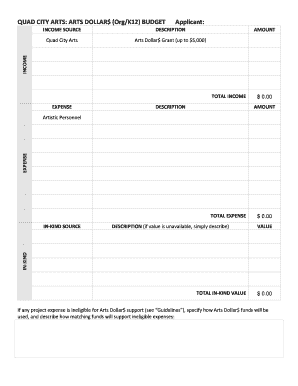

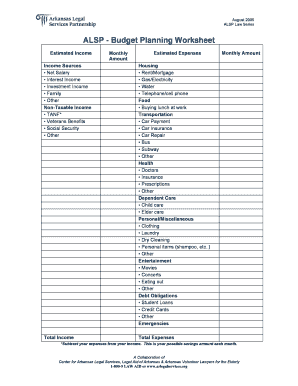

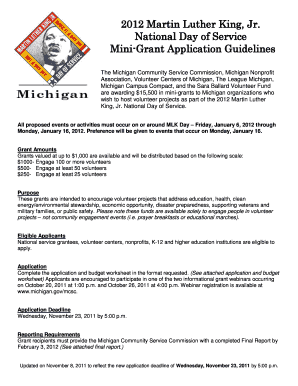

A Student Budget Planning Worksheet is a tool that helps students organize and track their finances. It allows students to plan their income and expenses, set savings goals, and make informed financial decisions.

What are the types of Student Budget Planning Worksheet?

There are different types of Student Budget Planning Worksheets available, each catering to specific needs and preferences. Some common types include: - Monthly Budget Worksheet: Helps students track their income and expenses on a monthly basis. - Semester Budget Worksheet: Designed for students who want to plan their finances for an entire semester. - Weekly Budget Worksheet: Allows students to monitor their weekly income and expenses. - Daily Budget Worksheet: Provides a detailed breakdown of daily expenses and helps students track their spending habits.

How to complete a Student Budget Planning Worksheet

Completing a Student Budget Planning Worksheet is easy and can be done in a few simple steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.