What is Students Loan Application Form?

The Students Loan Application Form is a document that is required to apply for a loan specifically designed for students. This form contains important information about the borrower, such as their personal and financial details, educational background, and the desired loan amount. It is a crucial step in the loan application process and helps the lending institution assess the borrower's eligibility and determine the loan terms.

What are the types of Students Loan Application Form?

There are different types of Students Loan Application Forms available depending on the lending institution and the type of loan being applied for. Some common types include:

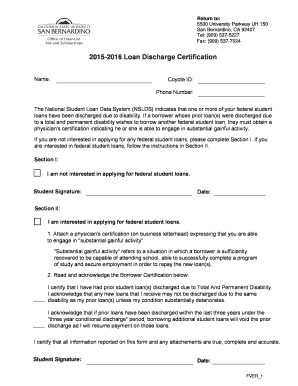

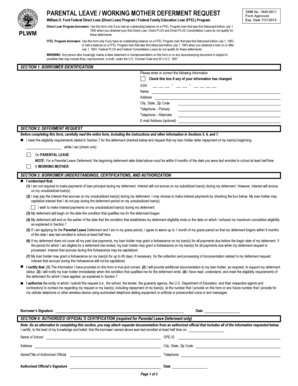

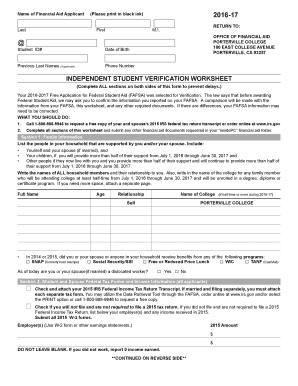

Federal Student Loan Application Form: This form is used to apply for federal student loans, which are funded by the government. These loans often have lower interest rates and more flexible repayment options compared to private loans.

Private Student Loan Application Form: Private lenders provide these loans, and the application form may vary depending on the lender. Private loans often have higher interest rates and strict eligibility criteria.

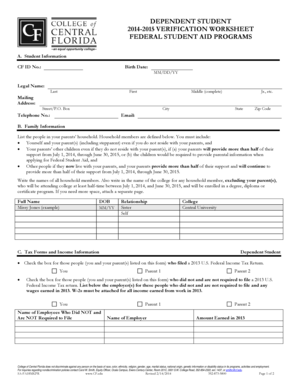

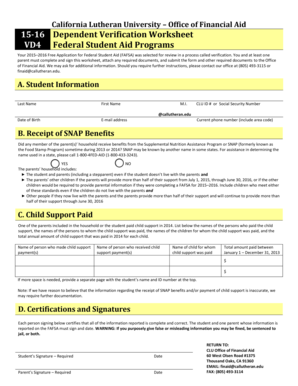

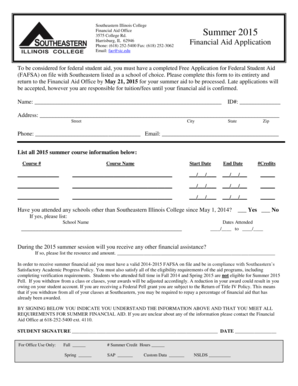

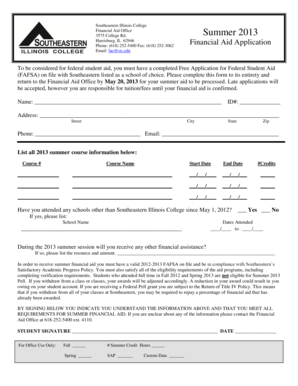

Institution-Specific Student Loan Application Form: Some educational institutions offer their own loan programs for students. These forms can be specific to a particular institution and may have unique criteria and terms.

How to complete Students Loan Application Form

Completing the Students Loan Application Form correctly is crucial to ensure a smooth loan application process. Here are some steps to help you complete the form:

01

Gather all the required information: Before starting the application, make sure you have all the necessary documents and information handy. This may include your Social Security number, income details, educational information, and any relevant financial documents.

02

Read the instructions thoroughly: The application form may come with instructions or guidelines. Read them carefully to understand the requirements and how to fill out each section.

03

Provide accurate information: Double-check the information you enter to avoid any mistakes or discrepancies. Providing accurate and honest information is essential for a successful loan application.

04

Submit additional documents if required: Some loan applications may require supporting documents, such as proof of income or educational transcripts. Make sure to submit these documents along with the application form, if needed.

05

Review before submitting: Before submitting the form, review all the information entered to ensure its accuracy. Mistakes or missing information can lead to delays or rejection of your application.

06

Submit the application: Once you are satisfied with the information provided, you can submit the application form as per the instructions provided.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.