Best Place For Student Loans

What is the best place for student loans?

When it comes to finding the best place for student loans, there are several factors to consider. It's important to find a trusted and reputable lender that offers competitive interest rates and flexible repayment options. Additionally, you'll want to look for a lender that provides excellent customer service and resources to help you navigate the loan process. One great option to consider is pdfFiller, which empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you'll need to get your documents done.

What are the types of best place for student loans?

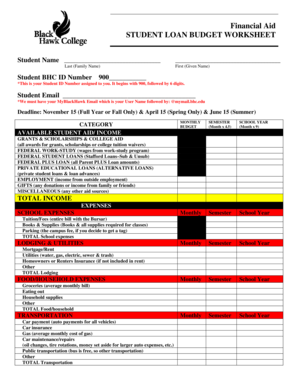

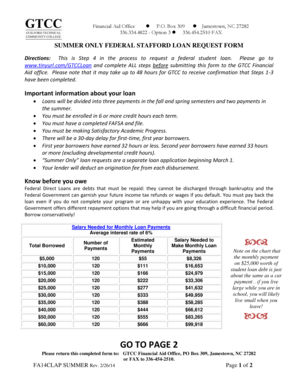

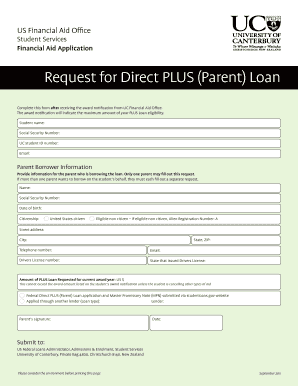

When it comes to the types of best places for student loans, there are a few options to explore. Some students opt for federal student loans, which are offered by the government and often come with lower interest rates and more flexible repayment options. Private student loans are another option, often offered by banks and other financial institutions. Private loans may have higher interest rates but can sometimes offer more borrowing options. Additionally, some schools or universities may offer their own loan programs. It's important to thoroughly research and compare your options to find the best fit for your needs.

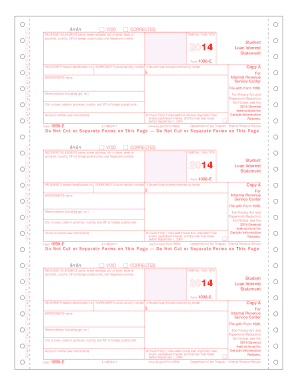

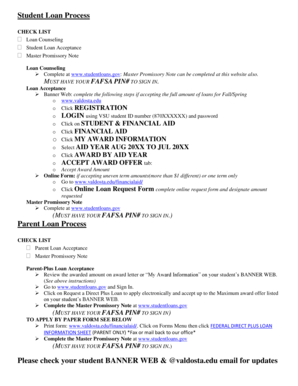

How to complete the best place for student loans

Completing the best place for student loans involves a few key steps. First, research and compare lenders to find the one that offers the best terms and benefits for your situation. Next, gather all necessary documents, such as proof of enrollment and financial information. Once you've chosen a lender, follow their application process and submit all required materials. Review the loan terms carefully before accepting and make sure you understand your repayment obligations. Finally, make timely payments to ensure you maintain a good credit history and avoid any negative consequences. Remember, pdfFiller can be a valuable resource throughout this process, offering unlimited fillable templates and powerful editing tools to streamline your loan application.

With pdfFiller empowering users to create, edit, and share documents online, getting your student loan documents done has never been easier. Take advantage of the unlimited fillable templates and powerful editing tools offered by pdfFiller and ensure a smooth loan application process.