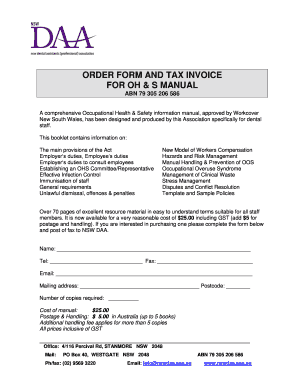

Tax Invoice Definition

What is tax invoice definition?

A tax invoice is a document that is issued by a supplier to a customer, providing detailed information about the goods or services provided, along with the corresponding tax amount. It serves as proof of the transaction and is used for tax purposes.

What are the types of tax invoice definition?

There are several types of tax invoices, including:

Full tax invoice - provides detailed information about both the supplier and the customer, along with the goods or services and corresponding tax details.

Simplified tax invoice - contains summarized information, suitable for small transactions or when less detailed information is required.

Modified tax invoice - issued when there are changes to the original tax invoice, such as corrections or amendments.

Credit note tax invoice - issued when a refund or credit is given to the customer.

Debit note tax invoice - issued when additional charges or fees are added to the original tax invoice.

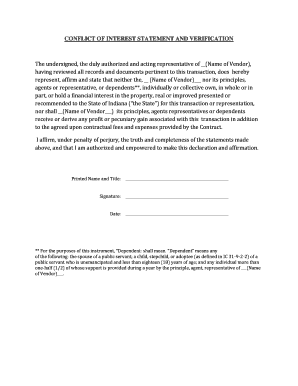

How to complete tax invoice definition

To complete a tax invoice definition, follow these steps:

01

Include the word 'Tax Invoice' prominently at the top of the document.

02

Include the supplier's name, address, and contact information.

03

Include the customer's name, address, and contact information.

04

Provide a unique invoice number and the invoice date.

05

Include a description of the goods or services provided, along with quantities and prices.

06

Clearly state the tax amount charged and any applicable tax rates.

07

Include the total amount payable by the customer.

08

Add any additional terms and conditions, if necessary.

09

Sign and date the tax invoice.

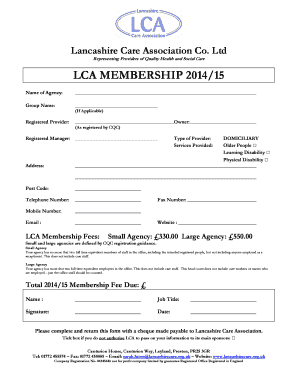

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out tax invoice definition

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

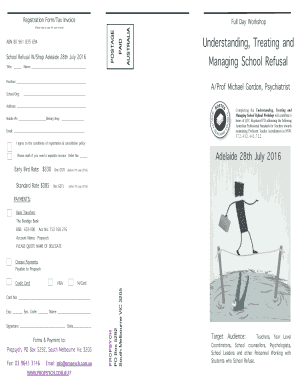

How do you write a payment description?

Best Practices for Writing Invoice Terms and Conditions Use of simple, polite, and straightforward language. Mentioning the complete details of the firm and the client. Complete details of the product or service, including taxes or discounts. The reference number or invoice number. Mentioning the payment mode.

How do you write an invoice description?

What you need to include on any invoice Your name or company name. Your contact information. Your customer's company name and address. The date the goods or services were provided. The date of the invoice. A breakdown of costs that show prices, hours, or quantities of the goods and services delivered. A subtotal of net costs.

How do you write a detailed invoice?

How to create an invoice: step-by-step Make your invoice look professional. The first step is to put your invoice together. Clearly mark your invoice. Add company name and information. Write a description of the goods or services you're charging for. Don't forget the dates. Add up the money owed. Mention payment terms.

How do you prepare a tax invoice?

A tax invoice should ideally contain the below details: Supplier name and contact. Customer name and contact. Tax invoice number. PAN and GSTIN of the supplier and customer. Date of issue of invoice. Place of supply of goods. Tax rate, HSN code and tax amount. Description of goods sold.

How do you describe services on an invoice?

To list your services on the invoice you should: List the service with a brief description of the work completed. List the hours worked or the quantity provided beside each service. List the rate of pay for each service provided. Finally, list the subtotal for each of the services listed.

What are 5 things that should be included in an invoice?

What should be included in an invoice? 1. ' Invoice' A unique invoice number. Your company name and address. The company name and address of the customer. A description of the goods/services. The date of supply. The date of the invoice. The amount of the individual goods or services to be paid.

Related templates