What is term sheet template for angel investment?

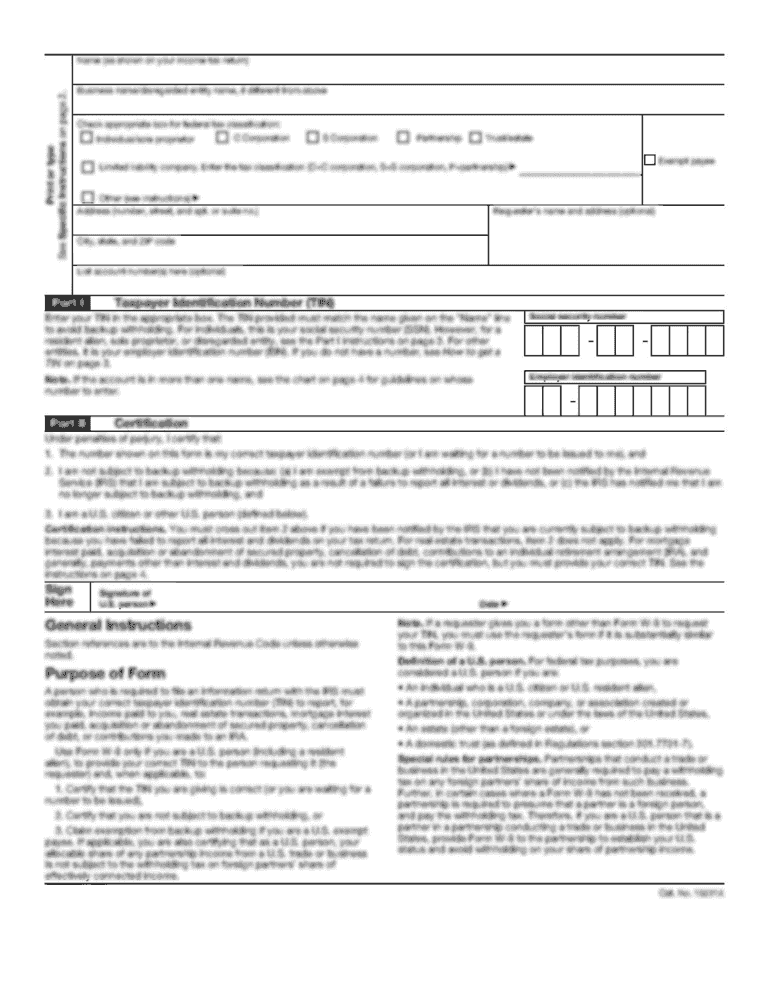

A term sheet template for angel investment is a document that outlines the terms and conditions of an angel investor's investment in a startup or early-stage company. It serves as a blueprint for the investment deal and contains key details such as the amount of investment, valuation of the company, rights and privileges granted to the investor, and other important terms.

What are the types of term sheet template for angel investment?

There are several types of term sheet templates for angel investment, each tailored to different investment scenarios. Some common types include:

Convertible Note Term Sheet: This type of term sheet outlines the terms for a convertible note investment, where the invested amount can later convert into equity.

Equity Term Sheet: An equity term sheet is used when the angel investor intends to acquire a percentage of ownership in the company in exchange for their investment.

SAFE (Simple Agreement for Future Equity) Term Sheet: SAFE is a popular type of term sheet that provides an investor with the right to receive equity in the future, without determining the valuation at the time of investment.

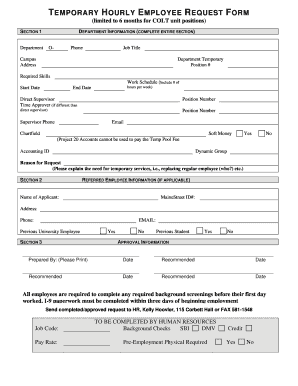

How to complete term sheet template for angel investment

Completing a term sheet template for angel investment involves the following steps:

01

Review the terms: Carefully go through all the terms outlined in the template and ensure you understand them.

02

Customize the details: Fill in the specific details of the investment deal, such as the investment amount, valuation, and any special rights or conditions.

03

Seek legal advice: It's always recommended to consult with a lawyer experienced in angel investments to ensure the terms are fair and legally binding.

04

Sign and share: Once the term sheet is complete, sign it along with the other parties involved and share copies with all relevant stakeholders.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.