Triple Net Lease Template - Page 2

What is Triple Net Lease Template?

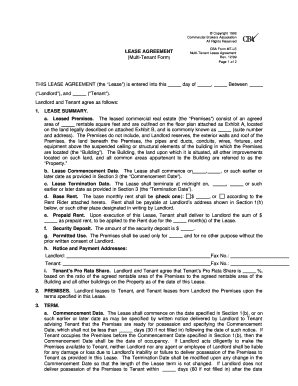

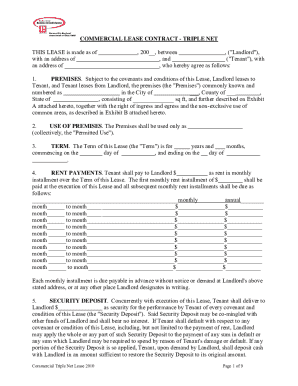

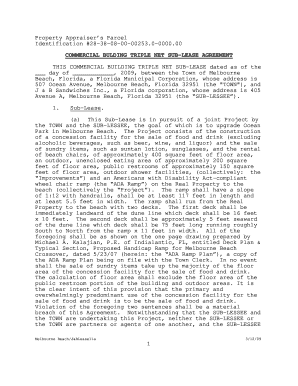

A Triple Net Lease Template is a legal document that outlines the terms and conditions of a lease agreement in which the tenant is responsible for the payment of property taxes, insurance, and maintenance expenses. This type of lease is commonly used in commercial real estate and provides the landlord with a predictable income while transferring the financial responsibility for the property to the tenant.

What are the types of Triple Net Lease Template?

There are several types of Triple Net Lease Templates available, including:

How to complete Triple Net Lease Template

Completing a Triple Net Lease Template can be done in a few simple steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.