Types Of Buy Sell Agreements

What is types of buy sell agreements?

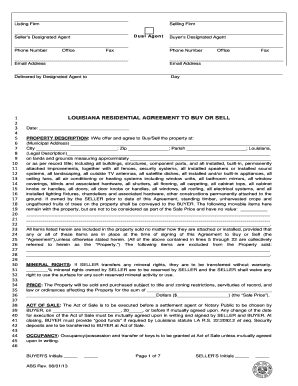

A buy sell agreement is a legally binding contract that governs the transfer of ownership interest in a business if certain triggering events occur, such as the death, disability, retirement, or voluntary departure of one of the owners. There are different types of buy sell agreements that can be used depending on the specific needs and circumstances of the business owners.

What are the types of types of buy sell agreements?

The types of buy sell agreements include cross purchase agreements, entity purchase agreements, and wait-and-see agreements. 1. Cross purchase agreements: In a cross purchase agreement, each owner agrees to purchase the interest of a departing owner. This type of agreement is typically used in businesses with a smaller number of owners and is relatively simple to implement. 2. Entity purchase agreements: In an entity purchase agreement, the business entity itself agrees to purchase the interest of a departing owner. This type of agreement is often used in larger companies or when there are many owners involved. 3. Wait-and-see agreements: A wait-and-see agreement combines elements of both cross purchase and entity purchase agreements. In this type of agreement, the remaining owners initially have the option to purchase the departing owner's interest individually, but if they do not exercise that option, the business entity will purchase the interest.

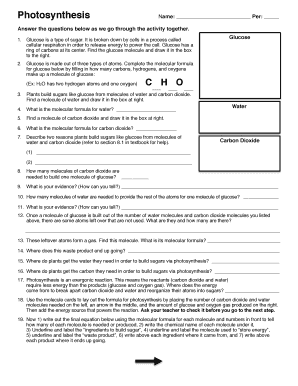

How to complete types of buy sell agreements

Completing a buy sell agreement requires careful consideration and the assistance of legal professionals. Here are some steps to help you complete the process: 1. Identify the triggering events: Determine the events that will trigger the buy sell agreement, such as death, disability, retirement, or voluntary departure of an owner. 2. Choose the type of buy sell agreement: Select the most suitable type of buy sell agreement for your business and discuss it with the other owners. 3. Determine the valuation method: Decide how the value of the business will be determined in case of a triggering event. 4. Draft the agreement: Work with a lawyer to draft the buy sell agreement, ensuring that it includes all the necessary provisions and addresses the specific needs of your business. 5. Review and negotiate the agreement: Carefully review the draft agreement with all the owners and make any necessary revisions or negotiations. 6. Sign and execute the agreement: Once all parties are satisfied with the agreement, sign it and have it executed according to the legal requirements.

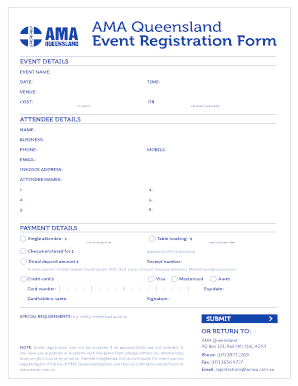

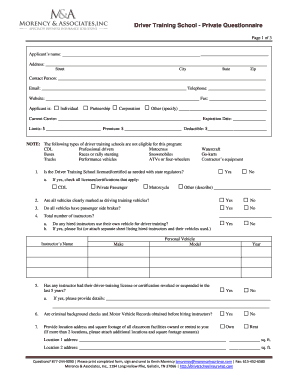

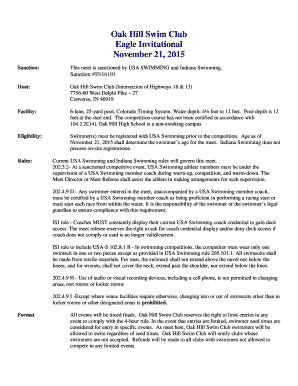

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.