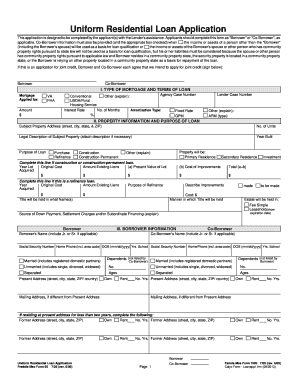

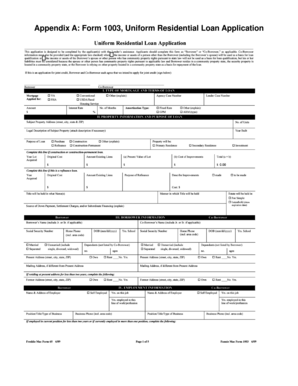

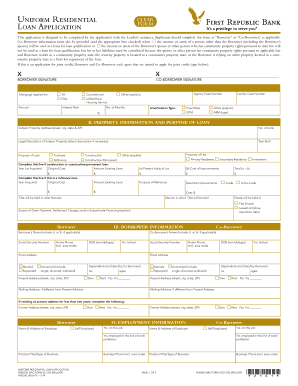

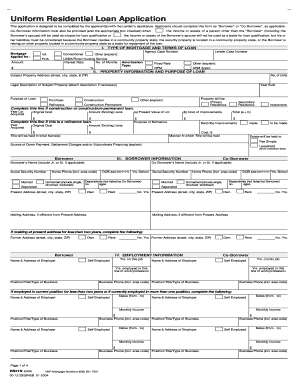

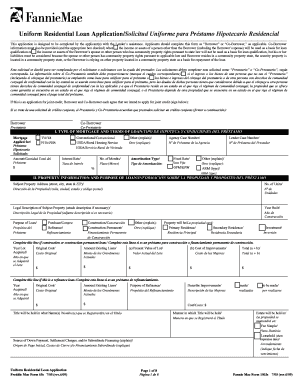

Uniform Residential Loan Application Fillable

What is uniform residential loan application fillable?

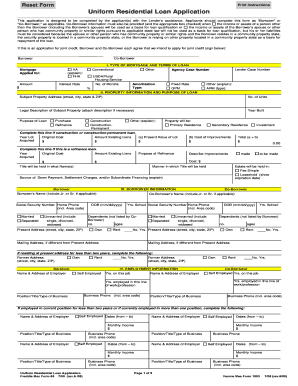

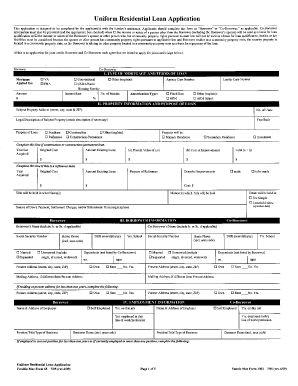

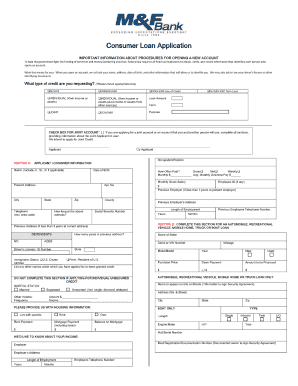

Uniform residential loan application fillable is a document that allows individuals to apply for a residential loan by providing relevant information regarding their financial situation, employment, and property details. This fillable form is designed to make the application process more convenient and efficient.

What are the types of uniform residential loan application fillable?

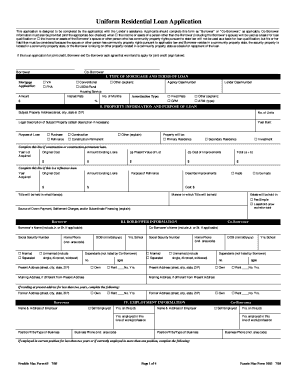

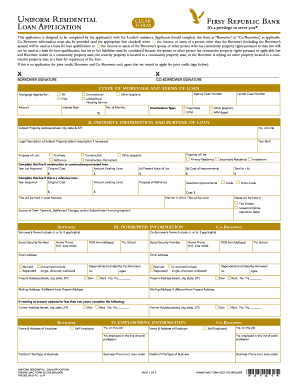

There are several types of uniform residential loan application fillable forms available, depending on the specific lending institution and loan program. Some common types include: 1. Form 1003: Standard application form used for most residential loans. 2. Form 1003-SS: Self-employed borrowers form. 3. Form 1003C: Cooperative units form. 4. Form 1003D: Manufactured housing form. These different forms cater to various loan scenarios and ensure that all necessary information is collected accurately.

How to complete uniform residential loan application fillable

Completing a uniform residential loan application fillable form is a straightforward process. Here are the steps to follow: 1. Download the fillable form from the lender's website or obtain a physical copy. 2. Gather all the required documents and information, such as personal identification, income statements, and property details. 3. Open the fillable form using a compatible PDF editor or software. 4. Carefully fill in all the necessary fields, providing accurate and up-to-date information. 5. Review the completed form for any errors or missing details. 6. Save the filled form and submit it to the lender as instructed.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.