What is Venture Capital Term Sheet?

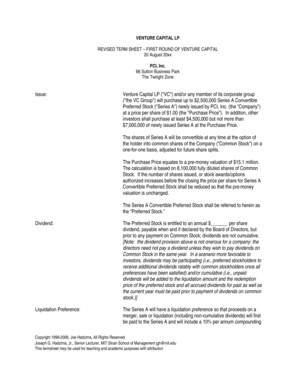

A Venture Capital Term Sheet is a document that outlines the terms and conditions of an investment made by venture capitalists in a startup or early-stage company. It serves as a blueprint for the legal agreement and covers important aspects such as the amount of funding, valuation of the company, board composition, and investor rights.

What are the types of Venture Capital Term Sheet?

There are different types of Venture Capital Term Sheets that can be used depending on the specific situation and needs of the parties involved. The most common types include:

Convertible Note: A term sheet that includes provisions for the investment to be converted into equity at a later stage.

Preferred Stock: A term sheet that gives the investors priority over other shareholders in terms of dividends and liquidation proceeds.

Simple Agreement for Future Equity (SAFE): A term sheet that provides a right to future equity in the company without setting a specific valuation at the time of investment.

How to complete Venture Capital Term Sheet

Completing a Venture Capital Term Sheet requires careful consideration of various factors to ensure a mutually beneficial agreement. Here are some steps to follow:

01

Identify the key terms: Determine the amount of funding required, valuation of the company, investor rights, and any specific provisions.

02

Negotiate and draft the terms: Discuss the terms with the venture capitalists and legal advisors, and draft the term sheet accordingly.

03

Review and revise: Carefully review the term sheet for any inconsistencies or ambiguous clauses, and make revisions if necessary.

04

Seek legal advice: It is recommended to seek legal advice to ensure that the term sheet aligns with the interests of both parties and complies with applicable laws.

05

Sign and execute: Once both parties are satisfied with the terms, sign the term sheet to make it legally binding.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.