Free University Budget Word Templates - Page 2

What are University Budget Templates?

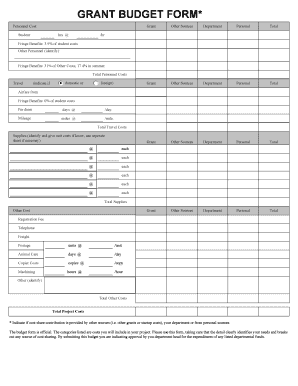

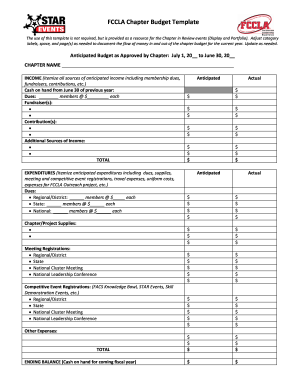

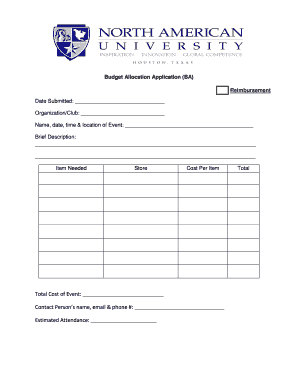

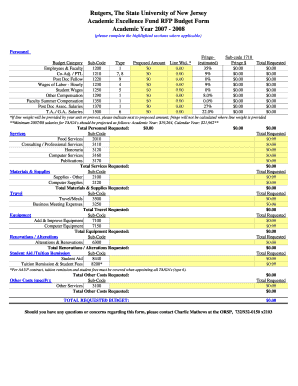

University Budget Templates are pre-designed financial planning tools specifically tailored for universities and higher education institutions. These templates assist in organizing and tracking income, expenses, and overall financial resources related to academic and administrative activities within the university.

What are the types of University Budget Templates?

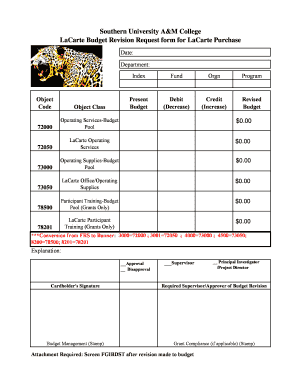

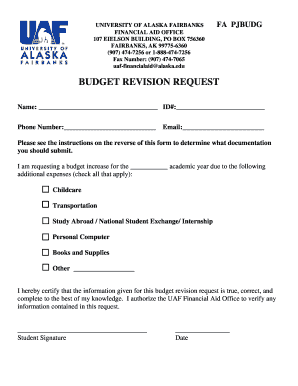

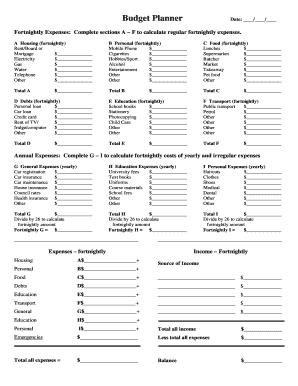

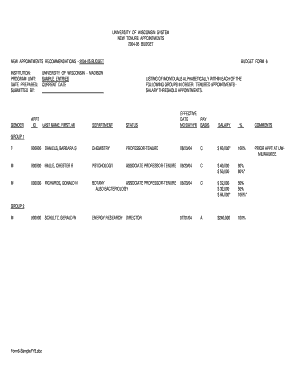

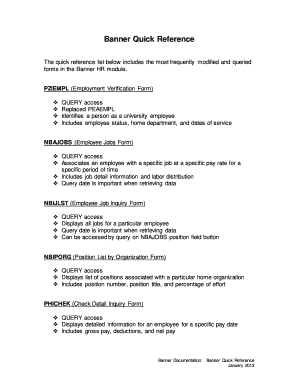

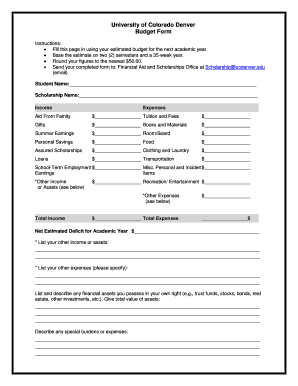

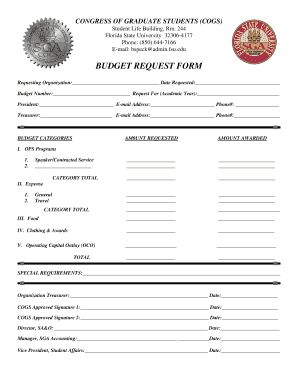

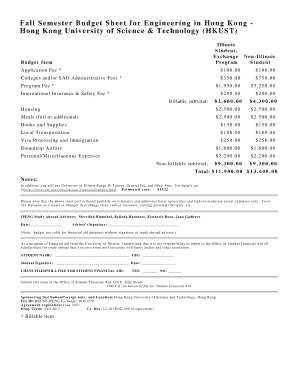

There are various types of University Budget Templates available to address specific financial needs and functions within a university setting. Some common types include:

How to complete University Budget Templates

Completing University Budget Templates is a straightforward process that involves the following steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.