Free Weekly Budget Word Templates - Page 2

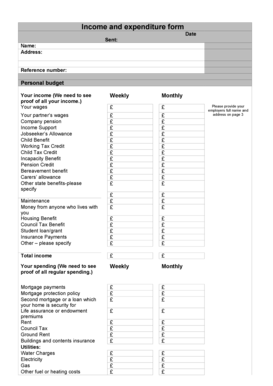

What are Weekly Budget Templates?

Weekly Budget Templates are pre-designed spreadsheets or documents that help individuals or families track their income and expenses on a weekly basis. These templates are a useful tool for managing finances efficiently and staying on top of budget goals.

What are the types of Weekly Budget Templates?

There are several types of Weekly Budget Templates available, including:

Basic Weekly Budget Template

Detailed Weekly Budget Template

Expense Tracking Weekly Budget Template

Savings Goal Weekly Budget Template

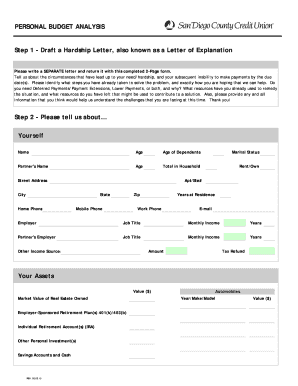

How to complete Weekly Budget Templates

Completing a Weekly Budget Template is simple and essential for effective budget management. Here are some steps to help you complete your Weekly Budget Template:

01

Gather all your financial documents, including pay stubs, bills, and receipts.

02

Enter your income sources and amounts in the designated section of the template.

03

List all your weekly expenses, categorizing them into fixed and variable costs.

04

Subtract your total expenses from your total income to calculate your weekly budget surplus or deficit.

05

Adjust your spending habits as needed to achieve your financial goals.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Weekly Budget Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Is the 50 30 20 rule good?

A lot of money experts recommend the 50/30/20 budget, where 50% of your income goes to needs, 30% goes to wants, and 20% goes to savings and debt.

What is the 50 40 10 budgeting rule and how is it broken down?

that doesn't involve detailed budgeting categories. Instead, you spend 50% of your after-tax pay on needs, 40% on wants, and 10% on savings or paying off debt.

What should a weekly budget include?

Creating a weekly budget How much do you earn? How much are you spending? Split your outgoings into mandatory and lifestyle. Remove your outgoings from your income, and look for ways to cut spending. Think about the future. Choose goals you can meet. Schedule monthly check-ins.

How to budget $500 a week?

9 Tips for Saving Money When You Only Earn $500 a Week Cut the TV or internet cable cord. Get basic phone service. Skip the Internet. Get to know the library better. Buy used clothes, furniture, and other items. Barter your skills, goods, and services. Buy groceries and other items in bulk.

Can you live off $1,000 a month after bills?

If you're trying to live on a $1,000-a-month budget, all of it can't go to housing. Unfortunately, the national average fair market rent for a one-bedroom apartment or home is $1,105 per month. So even if you cut your budget in half to account for housing, you'll still fall way short.

How do I budget my weekly income?

The best way to budget weekly is to work out your total outgoings for the year (e.g. multiplying monthly bills by 12) and then dividing by 52. Then you'll know how much you need to put away each week to cover your bills and expenses.