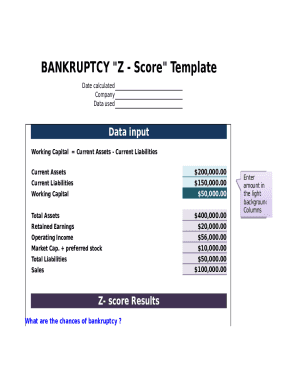

What is Bankruptcy Z-score Template?

The Bankruptcy Z-score Template is a financial formula designed to predict the likelihood of a company going bankrupt within the next two years. It takes into account various financial ratios to assess the overall financial health and stability of a business.

What are the types of Bankruptcy Z-score Template?

There are two main types of Bankruptcy Z-score Template: the original formula developed by Edward Altman for public manufacturing companies and an adjusted version for privately held firms. Each type uses different components and weightings to calculate the Z-score.

How to complete Bankruptcy Z-score Template

Completing the Bankruptcy Z-score Template involves gathering the necessary financial data from a company's balance sheet and income statement. Follow these steps to calculate the Z-score:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.