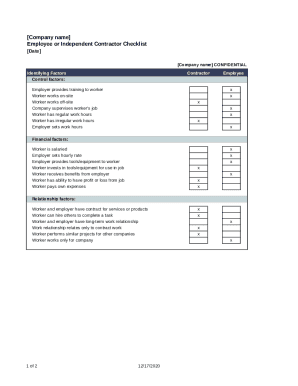

Independent Contractor Checklist

What is Independent Contractor Checklist?

An Independent Contractor Checklist is a document used to ensure that independent contractors are properly classified and are compliant with the necessary legal requirements. It helps businesses mitigate risks associated with misclassification and ensures that independent contractors are treated correctly under the law.

What are the types of Independent Contractor Checklist?

There are various types of Independent Contractor Checklists based on the specific industry or nature of work. Some common types include:

How to complete Independent Contractor Checklist

Completing an Independent Contractor Checklist is essential for both businesses and contractors to establish a clear understanding of their working relationship. Here are the steps to complete the checklist:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.