Editable Loan Application Form

What is Editable loan application form?

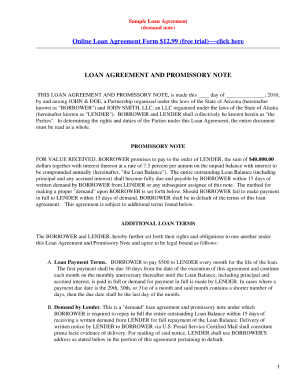

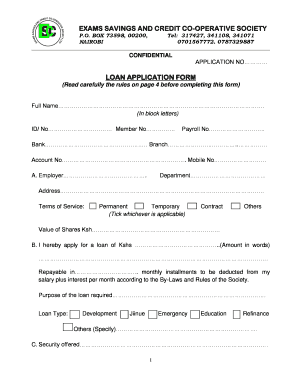

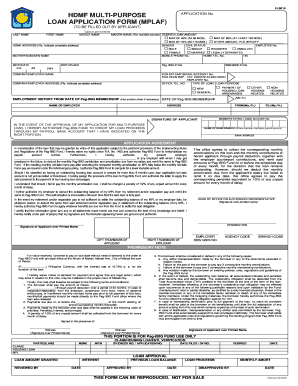

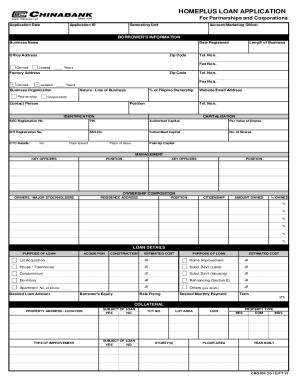

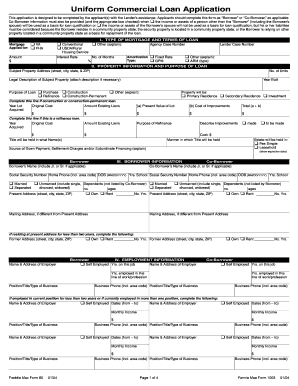

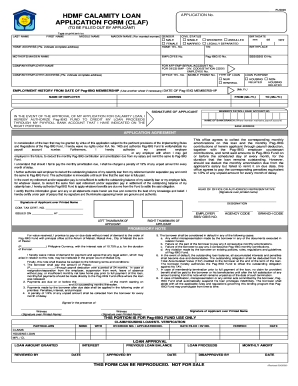

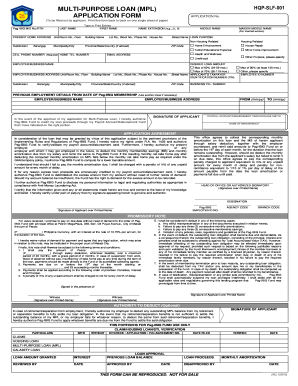

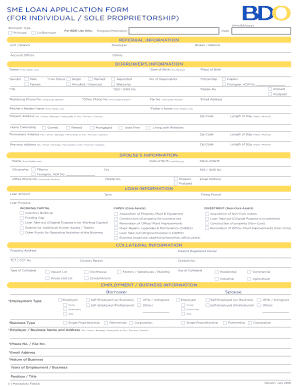

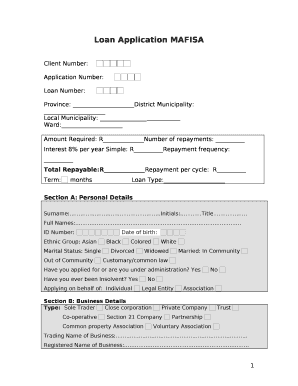

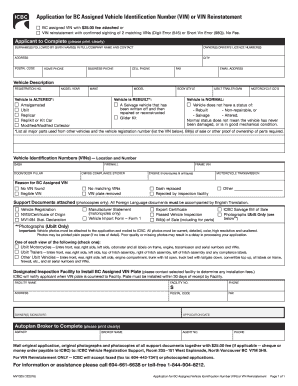

An Editable loan application form is a digital document that allows users to input their personal and financial information in order to apply for a loan. It can be easily filled out online, edited as needed, and shared with lenders or financial institutions.

What are the types of Editable loan application form?

There are several types of Editable loan application forms depending on the type of loan being applied for. Some common types include: - Personal loan application form - Mortgage loan application form - Business loan application form - Student loan application form - Auto loan application form

How to complete Editable loan application form

Completing an Editable loan application form is a straightforward process that can be done in a few simple steps: 1. Open the loan application form on your device 2. Fill in your personal information including name, address, and contact details 3. Provide details about your employment, income, and financial status 4. Input the loan amount requested and desired terms 5. Review the completed form for accuracy and completeness before submitting

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.