Small Business Financial Statements Examples Pdf

What is Small business financial statements examples pdf?

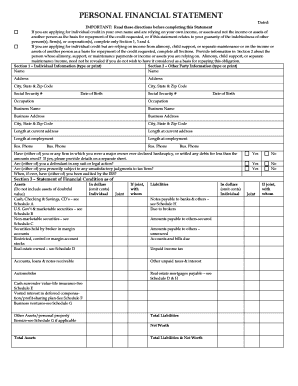

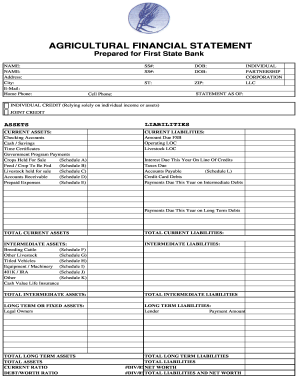

Small business financial statements examples pdf are documents that provide a snapshot of a company's financial situation at a specific point in time. These statements include information on the business's assets, liabilities, and equity.

What are the types of Small business financial statements examples pdf?

There are three main types of small business financial statements examples pdf:

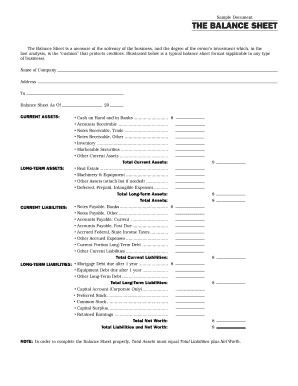

Balance Sheet

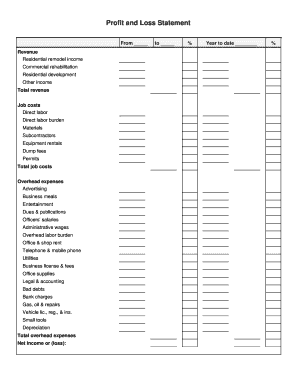

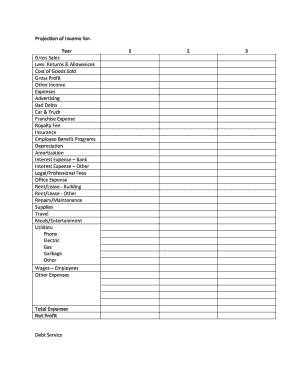

Income Statement

Cash Flow Statement

How to complete Small business financial statements examples pdf

Completing small business financial statements examples pdf can seem overwhelming, but with the right tools and guidance, it can be done efficiently. Here are some steps to help you complete your financial statements:

01

Gather all necessary financial data and documents.

02

Organize the information into the appropriate sections (balance sheet, income statement, cash flow statement).

03

Input the data accurately into the template provided.

04

Review the completed financial statements for accuracy and completeness before finalizing them.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Small business financial statements examples pdf

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What does a income statement look like for a small business?

1:39 4:40 A guide to income statements for small business owners - YouTube YouTube Start of suggested clip End of suggested clip Basically what the business is worth on the other hand the income statement is taken over a periodMoreBasically what the business is worth on the other hand the income statement is taken over a period of time. So it's more dynamic. It shows how much profit or loss a business makes.

What is the best financial statement for a small business?

The three essential financial statements to run your small business are your balance sheet, your income statement and your cash flow statement.

What is the easiest financial statement to prepare?

Perhaps the most useful financial statement, and easiest to understand, is the income statement. The income statement has a separate section for both revenue and expenses, including sales, cost of goods sold, operating expenses, and net profit. And most importantly, it provides you with your net income.

What is the basic financial statement for small business?

There are three basic financial statements: balance sheets, income statements (or profit and loss statements), and cash flow statements. Business owners use other financial reports, such as the statement of retained earnings, less frequently.

How do you prepare financial statements for beginners?

How to Prepare Financial Statements Step 1: Verify Receipt of Supplier Invoices. Step 2: Verify Issuance of Customer Invoices. Step 3: Accrue Unpaid Wages. Step 4: Calculate Depreciation. Step 5: Value Inventory. Step 6: Reconcile Bank Accounts. Step 7: Post Account Balances. Step 8: Review Accounts.

What are the 4 basic financial statements and examples?

For-profit businesses use four primary types of financial statement: the balance sheet, the income statement, the statement of cash flow, and the statement of retained earnings. Read on to explore each one and the information it conveys.

Related templates