Guarantor Form For Loan Pdf

What is Guarantor form for loan pdf?

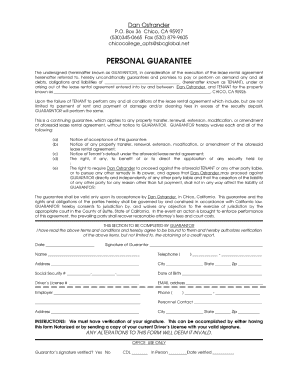

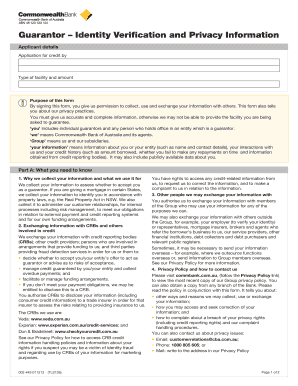

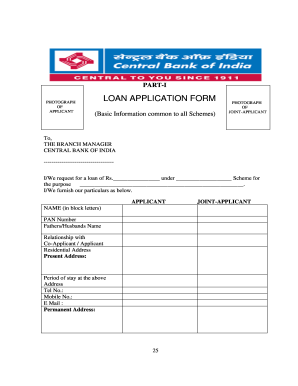

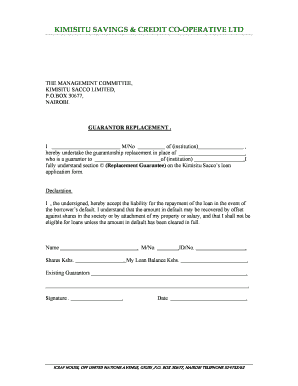

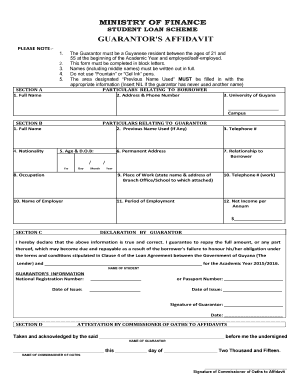

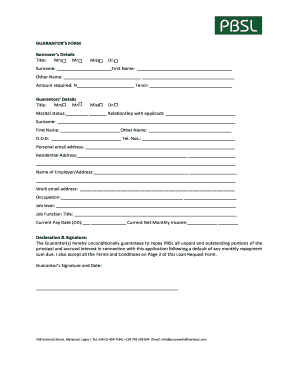

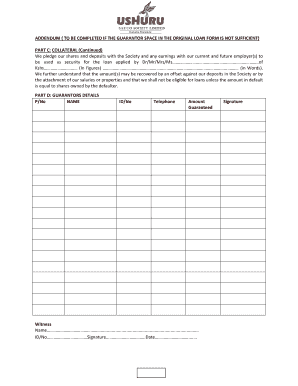

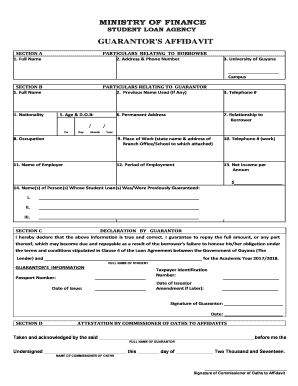

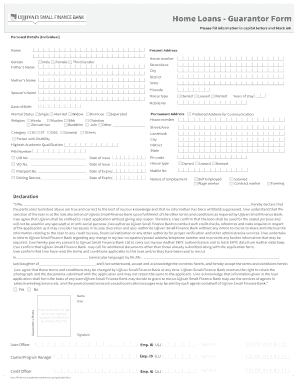

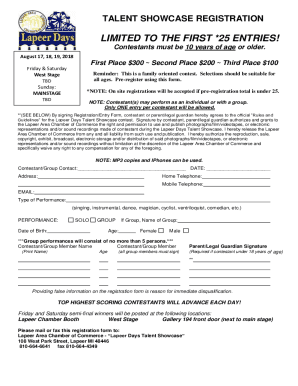

A Guarantor form for a loan in PDF format is a legal document that outlines the responsibilities of a guarantor who guarantees the repayment of a loan in case the borrower defaults. This form protects the lender in case the borrower is unable to fulfill their obligations.

What are the types of Guarantor form for loan pdf?

There are several types of Guarantor forms for loans in PDF format, including Personal Guaranty Forms, Corporate Guaranty Forms, Joint Guaranty Forms, and Continuing Guaranty Forms. Each type serves a specific purpose and has unique requirements.

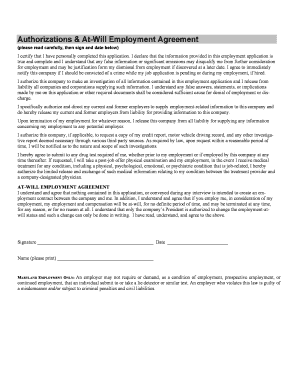

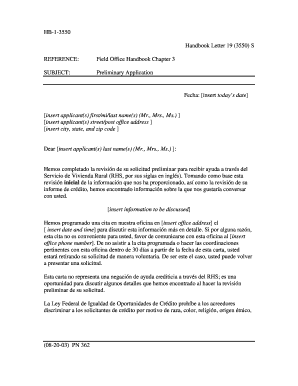

How to complete Guarantor form for loan pdf

Completing a Guarantor form for a loan in PDF format is a straightforward process. Simply fill in the required information accurately, including your personal details, contact information, and signature. Make sure to review the form carefully before submitting it to ensure all information is correct.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.