Tuition Reimbursement Policy And Procedure

What is Tuition reimbursement policy and procedure?

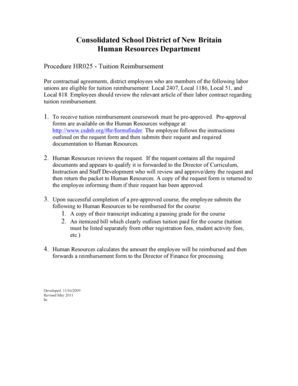

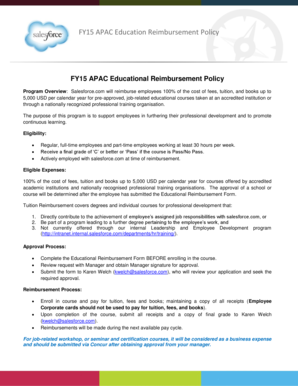

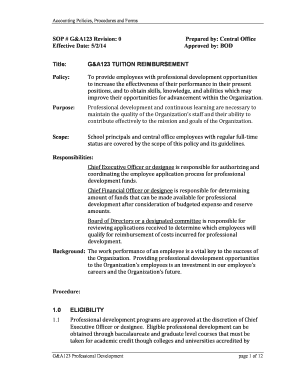

Tuition reimbursement policy and procedure refers to the guidelines and steps put in place by an organization to support employees who wish to pursue further education. These policies outline the eligibility criteria, reimbursement limits, and submission requirements for educational expenses.

What are the types of Tuition reimbursement policy and procedure?

Types of tuition reimbursement policies and procedures include:

Full reimbursement for approved courses related to the employee's current role

Partial reimbursement for courses that may enhance the employee's skills or knowledge within the organization

Reimbursement for degrees or certifications that directly benefit the employee's performance at work

How to complete Tuition reimbursement policy and procedure

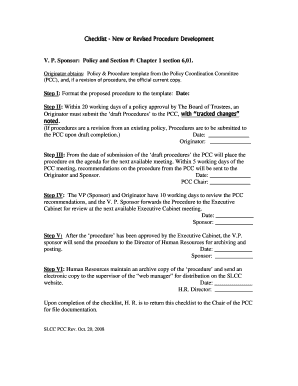

To successfully complete the tuition reimbursement policy and procedure, follow these steps:

01

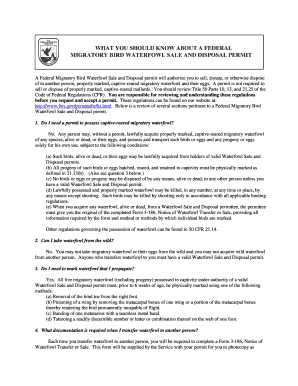

Review the organization's tuition reimbursement policy to understand the requirements and limitations

02

Select an eligible course or program that aligns with your career goals and the company's guidelines

03

Obtain approval from your supervisor or HR department before enrolling in the course

04

Keep detailed records of expenses and completion certificates for reimbursement submission

05

Submit reimbursement requests according to the specified deadlines and documentation requirements

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Tuition reimbursement policy and procedure

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you record tuition reimbursement in payroll?

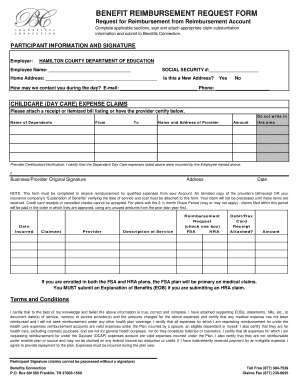

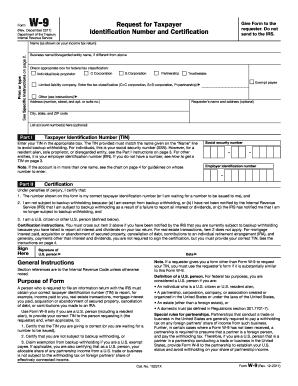

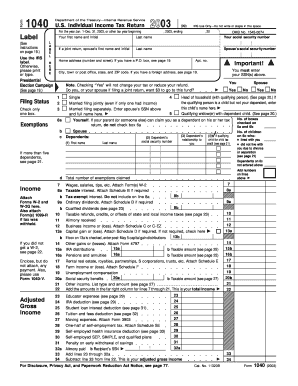

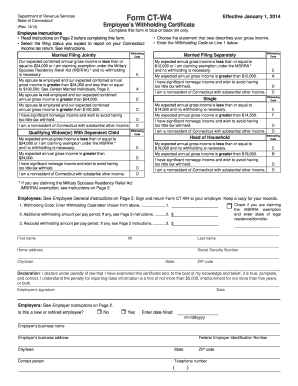

These amounts should be included in your wages in Box 1 of Form W-2. However, if the payments over $5,250 qualify as a fringe benefit, your employer does not need to include them in your wages. A fringe benefit is a benefit you could deduct as an employee business expense had you paid for it.

What is the 127 tuition reimbursement plan?

Existing federal law, (IRC section 127) provides an exclusion of up to $5,250 per year from gross income of an employee, for educational assistance furnished pursuant to an educational assistance program by an employer, for expenses incurred by, or on behalf of, an employee for education of the employee.

What are the federal guidelines for tuition reimbursement?

IRS regulations limit tuition reimbursement programs to $5,250 per year for tax-free benefits. If your company reimburses you less than that amount, you should not have any benefits to report on your annual tax return. Tuition benefits paid beyond that amount would be subject to taxation.

What is Section 127 of the student loan Repayment Cares Act?

127 of the Internal Revenue Code, which addresses employer-paid tuition benefits. The Cares Act stipulated that the $5,250 amount that employers can annually contribute tax-free for tuition assistance can be extended to student loan repayment assistance.

What is a Section 127 tuition reimbursement plan?

Federal Law. Existing federal law, (IRC section 127) provides an exclusion of up to $5,250 per year from gross income of an employee, for educational assistance furnished pursuant to an educational assistance program by an employer, for expenses incurred by, or on behalf of, an employee for education of the employee.

Do companies actually make you pay back tuition reimbursement?

Employers require tuition reimbursement payback agreements to avoid training employees who use their education to get a new job working elsewhere. Companies legally protect themselves by making employees pay back reimbursements if the employee leaves the company within a specific time frame of completing the education.