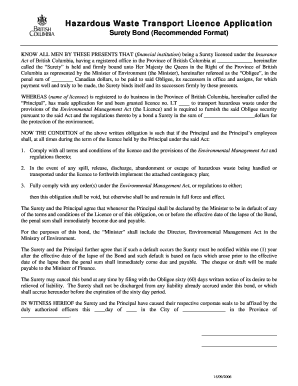

Application For Furnishing Surety

What is Application for furnishing surety?

An Application for furnishing surety is a document used to provide a guarantee or assurance to another party regarding financial liability or performance.

What are the types of Application for furnishing surety?

There are several types of Applications for furnishing surety, including:

Bid Bond: Ensures that the bidder will enter into a contract if awarded.

Performance Bond: Guarantees satisfactory completion of a project.

Payment Bond: Secures payment to subcontractors and suppliers.

Advance Payment Bond: Protects against misuse of advanced funds.

Retention Money Bond: Releases retention money held as security.

How to complete Application for furnishing surety

To complete an Application for furnishing surety, follow these steps:

01

Gather all necessary information and supporting documents.

02

Fill out the required fields accurately.

03

Review the document for completeness and accuracy.

04

Sign the Application and provide any additional requested information.

05

Submit the completed form to the relevant party.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Application for furnishing surety

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How much is a surety bond in Tennessee?

Tennessee certificate of title bond costs start at $100 for the state-required 3-year term. Exact costs vary depending on the surety bond amount required by the Department of Revenue. Bond amounts less than $10,000 cost $100. Bond amounts from $10,001 to $25,000 cost $10 for every $1,000 of coverage, starting at $100.

How do I get a surety bond in TN?

You can obtain a corporate surety through many insurance providers. If your insurance provider does not write corporate surety bonds, there are third-party companies available that can assist you with finding a company to write your corporate surety bond for you.

How much does a surety bond cost in Tennessee?

Tennessee certificate of title bond costs start at $100 for the state-required 3-year term. Exact costs vary depending on the surety bond amount required by the Department of Revenue. Bond amounts less than $10,000 cost $100. Bond amounts from $10,001 to $25,000 cost $10 for every $1,000 of coverage, starting at $100.

What is the difference between a surety bond and a security bond?

In many surety bond cases, there is not any collateral required. Thus, the surety will simply issue the bond, like a performance bond or payment bond, based on the financial standing of the underlying entity being bonded. However, in a security bond, there is collateral that is required.

What do you need for a surety bond in Tennessee?

You must furnish the complete name and physical mailing address of your two sureties on the Surety Bond Application. You must also furnish General Tax Certification (“GTC”) (tax cards) (i.e. a copy of their most recent property tax bill showing their property tax information).

How long does it take to get a surety bond in TN?

Most bonds purchased in Tennessee are emailed 24-48 business hours after placing an order or 24-48 business hours after sending the NNA your commission letter (depending on your county), but not more than 120 days prior to your expiration date. If you did not receive your bond, please contact us.