2013 Form 1040

What is 2013 form 1040?

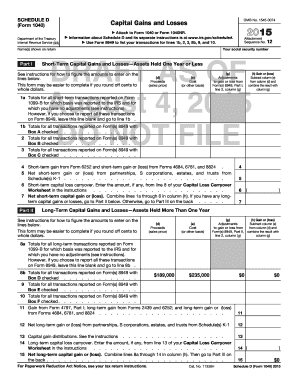

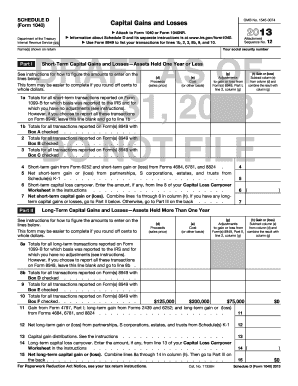

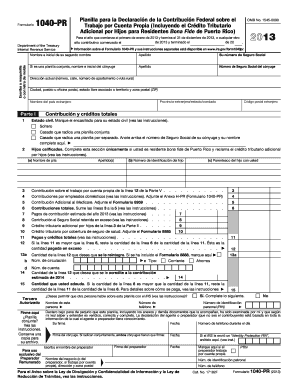

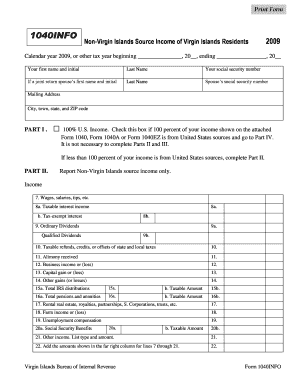

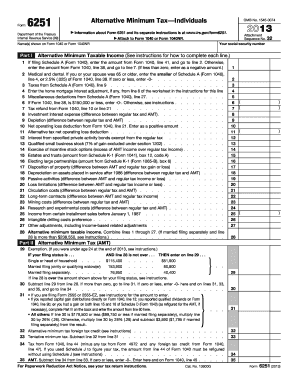

The 2013 form 1040 is the U.S. Individual Income Tax Return for the tax year 2013. It is the main tax form used by individuals to report their income, calculate their tax liability, and claim tax credits and deductions for that year. The form is issued by the Internal Revenue Service (IRS) and is used by millions of taxpayers in the United States.

What are the types of 2013 form 1040?

There are several types of 2013 form 1040, each designed for different types of taxpayers. The most common types include: 1. Form 1040: This is the standard form used by most individual taxpayers who have a straightforward tax situation. 2. Form 1040A: This form is a shorter version of Form 1040 and is used by taxpayers who have less complex tax situations and meet certain criteria. 3. Form 1040EZ: This is the simplest form, used by individuals with very basic tax situations and who meet specific requirements, such as having only income from wages, salaries, tips, and taxable scholarship or fellowship grants. It's important to choose the right form based on your individual circumstances to ensure accurate reporting of your income and deductions.

How to complete 2013 form 1040

Completing the 2013 form 1040 can seem daunting, but with the right information, it can be a straightforward process. Here are the steps to complete the form:

By following these steps, you can accurately complete the 2013 form 1040 and ensure that your tax return is filed correctly. Remember, if you have any questions or need assistance, pdfFiller offers a user-friendly platform that empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done efficiently.