What is Blank Mileage Form?

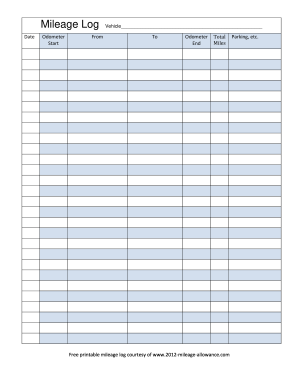

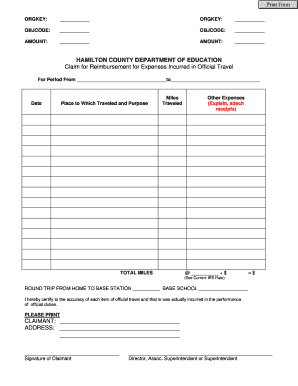

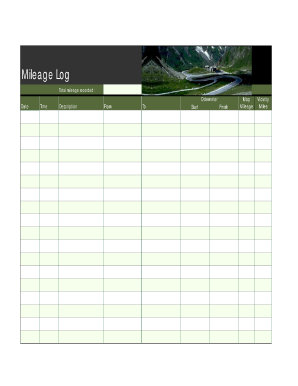

A Blank Mileage Form is a document used to record the distance traveled by a vehicle for business purposes. It is an essential tool for tracking mileage and calculating expenses related to business travel.

What are the types of Blank Mileage Form?

Blank Mileage Forms come in different formats and layouts to suit various business needs. Some common types of Blank Mileage Forms include:

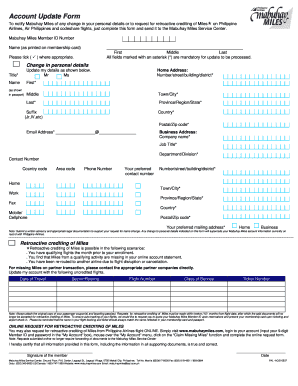

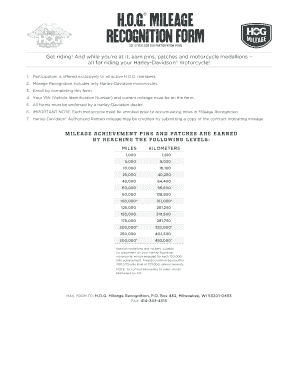

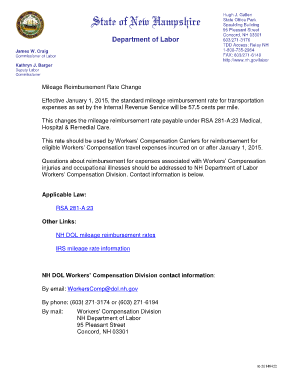

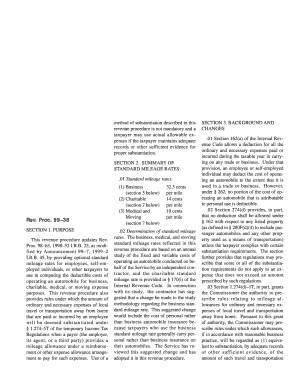

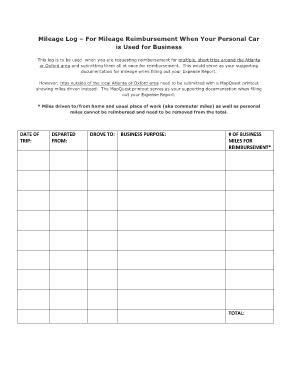

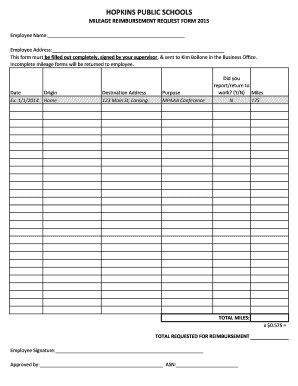

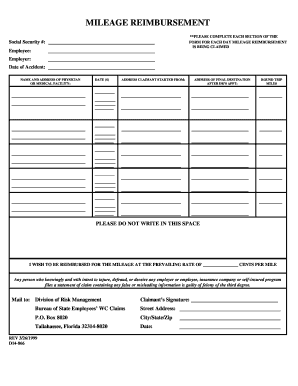

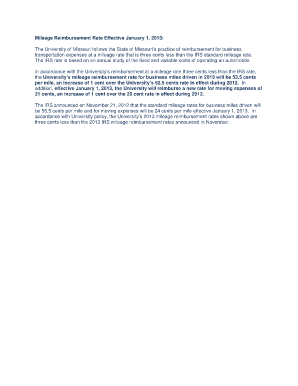

Standard Mileage Form: This is the most common type of Mileage Form that allows you to record the starting and ending odometer readings, destination, purpose of the trip, and other relevant details.

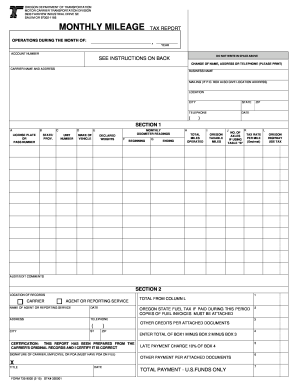

Detailed Mileage Form: This type of form includes additional fields to track more detailed information, such as tolls, parking fees, and other expenses incurred during the trip.

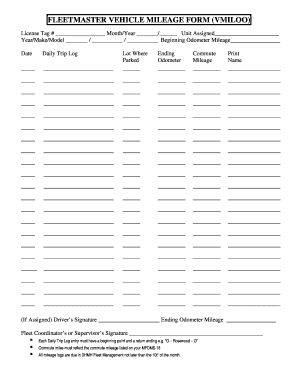

Fleet Mileage Form: Designed for businesses with multiple vehicles, this form allows you to record the mileage for each vehicle separately, making it easier to track and manage the mileage data.

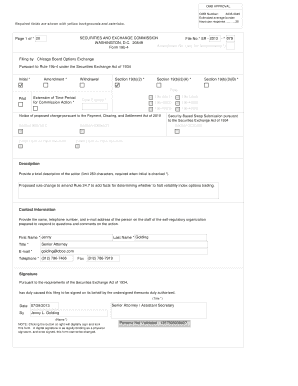

Electronic Mileage Form: With the advancement of technology, electronic mileage forms are becoming more popular. These forms can be filled digitally, eliminating the need for manual data entry.

How to complete Blank Mileage Form

Completing a Blank Mileage Form is a straightforward process. Here are the steps to follow:

01

Start by filling in the date of the trip and your name or the driver's name.

02

Record the starting and ending odometer readings for the trip.

03

Indicate the purpose of the trip, whether it was for business or personal use.

04

Enter the destination or locations visited during the trip.

05

If applicable, record any additional expenses such as tolls, parking fees, or other related costs.

06

Review the completed form for any errors or missing information.

07

Once reviewed, sign the form to certify its accuracy.

08

Keep a copy of the completed form for your records.

With pdfFiller, you can easily create and customize your own Blank Mileage Form. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to efficiently manage your mileage forms and get your documents done.