What is personal financial statement worksheet?

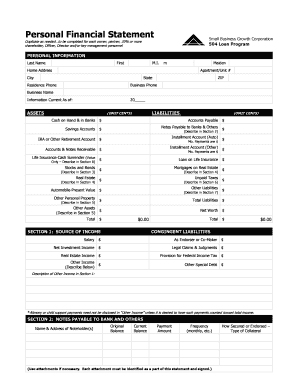

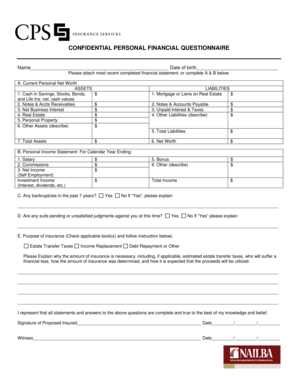

A personal financial statement worksheet is a document that allows individuals to assess their financial situation. It provides a detailed overview of their assets, liabilities, income, and expenses. By filling out this worksheet, individuals can gain a better understanding of their financial health and make informed decisions about their finances.

What are the types of personal financial statement worksheet?

There are several types of personal financial statement worksheets available, each tailored to different needs and goals. Some common types include:

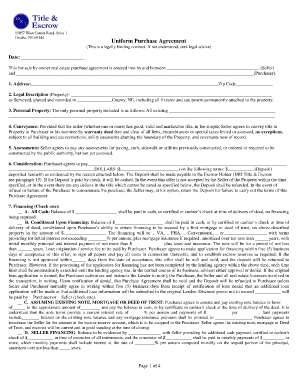

Balance Sheet: This type of worksheet focuses on an individual's assets, liabilities, and net worth.

Income Statement: This worksheet focuses on an individual's income, expenses, and net income.

Cash Flow Statement: This worksheet tracks the flow of cash in and out of an individual's accounts, providing insights into their spending and saving habits.

Budget Worksheet: This type of worksheet helps individuals create and manage their budgets, encompassing all income and expenses.

How to complete personal financial statement worksheet

Completing a personal financial statement worksheet is straightforward and can be done in a few steps. Here's how to do it:

01

Gather necessary financial documents such as bank statements, credit card statements, loan statements, and income records.

02

List all your assets, including cash, investments, real estate, vehicles, and other valuables.

03

List all your liabilities, including mortgages, loans, credit card debt, and other outstanding debts.

04

Calculate your net worth by subtracting your liabilities from your assets.

05

Track your income from all sources, including salaries, dividends, rental income, or any other form of income.

06

List all your monthly expenses, including housing, transportation, utilities, groceries, insurance, and entertainment.

07

Calculate your net income by subtracting your expenses from your income.

08

Review your financial statement and analyze the results to gain insights about your financial situation.

09

Make necessary adjustments to your budget and financial goals based on the information obtained.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.