Balance Sheet Template

Purpose of balance sheet

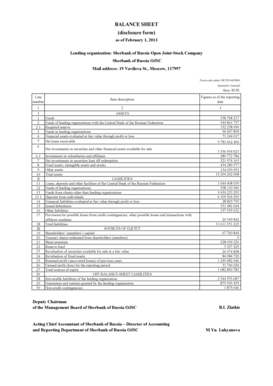

Creating a balance sheet is quite a complicated procedure requiring much attention, but you are not required to be a professional accountant to manage. What you need is to make a use of a balance sheet template. If you have a good mind to succeed in commercial activities, such a document will be integral part of it. Managing business without calculating profit and expenses is just impossible. By the means of such document an individual is always aware of his/her financial situation and affairs. Such instrument usually closes a certain fiscal period.

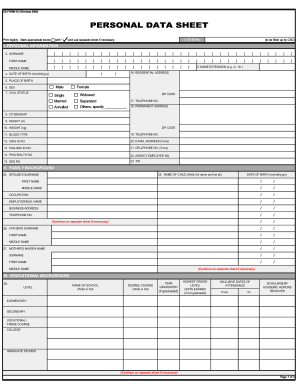

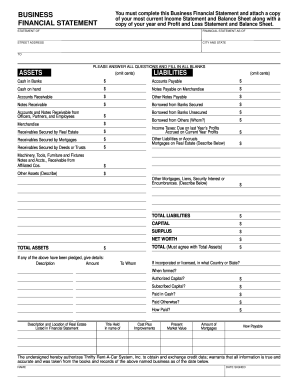

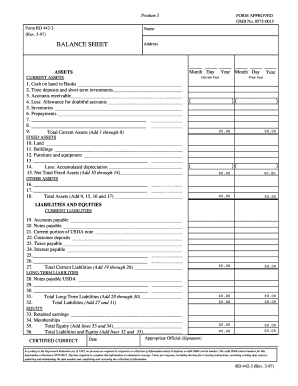

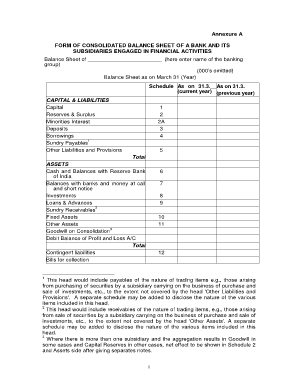

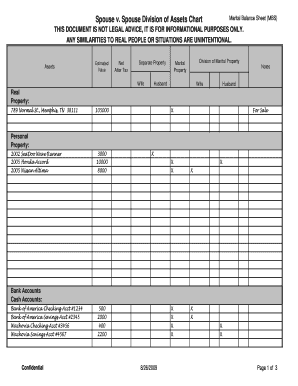

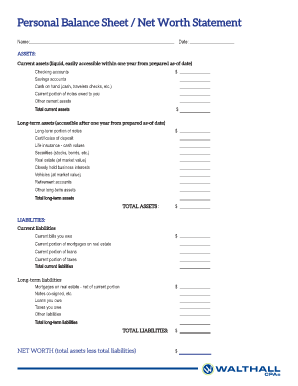

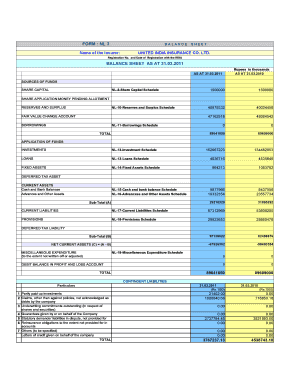

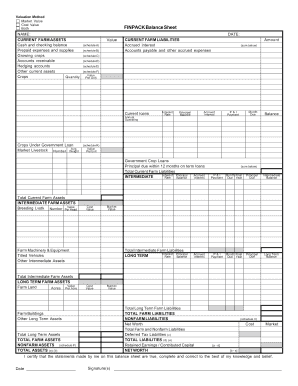

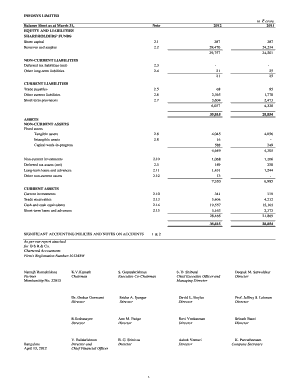

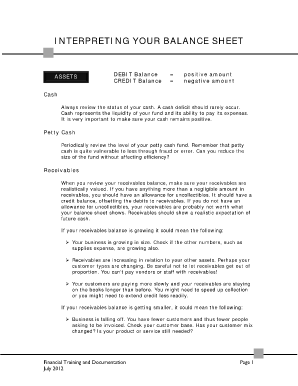

To prepare a document you need to chose an appropriate balance sheet template and to pull together all necessary details concerning funds. All information you possess must be put in a table where you clearly list all sources of income and purposes of expenses providing accurate figures in front of a certain item, as specified in a personal balance sheet template. A document is separated in two parts - assets and liabilities.

Part 1 of an instrument (assets) comprises person`s available financial means such as cash deposits, investments (including personal securities and shares if any), real estate, land etc. with their values stated. This part shows person`s revenue for a specified fiscal period.

Part 2 includes detailed information about liabilities showing a full amount of your expenses. Section “Liabilities” represents various loans, mortgages, pledges, liens etc. Each section summarizes full amount of return and losses.

The difference between person`s income and expenditures reflects a net worth. Being not satisfied with amount of net worth and willing to increase it - start putting down expenditures. Keep in mind to update s document regularly. Remember that you can download a simple balance sheet template on a computer or print a blank balance sheet template.