Direct Credit - Page 2

What is direct credit?

Direct credit is a convenient electronic payment method that allows funds to be transferred directly from one bank account to another. With direct credit, you can easily receive payments from individuals or businesses without the need for physical checks or cash.

What are the types of direct credit?

There are several types of direct credit available:

Regular Direct Credit: This is the most common form of direct credit, where funds are transferred on a regular basis, such as monthly or weekly.

Same-Day Direct Credit: This type of direct credit allows for immediate fund transfers, usually within the same business day.

Advance Notice Direct Credit: With this type of direct credit, the payer needs to provide advance notice before transferring funds to your account.

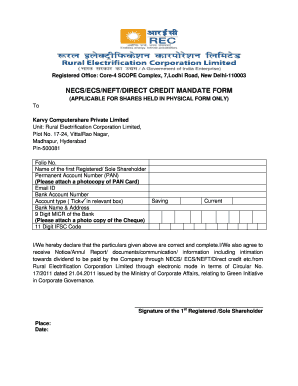

How to complete direct credit

To complete a direct credit, follow these simple steps:

01

Gather the necessary information: You will need the recipient's bank account details, including their account number and bank's routing number.

02

Initiate the transfer: Use your online banking platform or contact your bank directly to initiate the direct credit transfer.

03

Enter the recipient's details: Provide the recipient's name, account number, and bank's routing number accurately to ensure the funds are transferred to the correct account.

04

Confirm the transaction: Review the details of the transfer and confirm the transaction. Double-check all the information provided.

05

Verify funds transfer: Once the transfer is initiated, verify that the funds have been successfully transferred to the recipient's account.

With pdfFiller, you can easily create, edit, and share documents online. As the leading PDF editor, pdfFiller provides unlimited fillable templates and powerful editing tools to streamline your document workflow. Empower yourself to get your documents done quickly and efficiently with pdfFiller.

Video Tutorial How to Fill Out direct credit

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is a payment template?

A payment template is a defined set of instructions that you can use for repeated payments or collections. Templates make it easy to set up and use repetitive payments, including: Payments to vendors and suppliers. Collections from customers.

What is a template in banking?

A: Templates are a useful tool for payments and transfers that you make on a regular basis. They offer greater control as the beneficiary's details are fixed and the payment amount can be capped. The first time you set up a payment, you have the option to 'Save as Template'.

What are the 4 types of payment methods?

Payment Options Cash. Checks. Debit cards. Credit cards. Mobile payments. Electronic bank transfers.

What is direct credit payment method?

A direct credit is an electronic transfer of funds through the ACH (Automated Clearing House) system. The payment is initiated by the payer, which sends funds directly into the bank account of the payee. Settlement usually occurs within one or two business days.

How do I create a payment form?

Designing the Perfect Payment Form in 9 Steps Step 1: Keep Them on Your Site. Step 2: Offer Multiple Payment Methods. Step 3: Don't Require an Account. Step 4: Assure Customers Their Data Is Safe. Step 5: Ask Simple, Logical Questions. Step 6: Remove Unnecessary Fields. Step 7: Identify Customers' Errors.

What is direct credit with example?

When you have funds paid directly into any of your Credit Union SA accounts from an external source, this facility is called a 'direct credit'. This could be your salary, for example, or a tax refund, share dividend, superannuation payment, social security payment or a pension.

Related templates