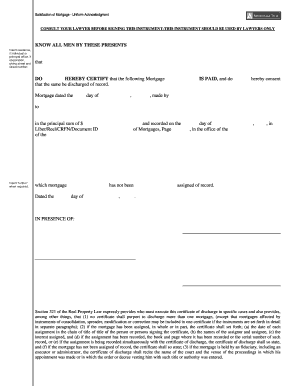

Satisfaction Of Mortgage Form - Page 2

What is Satisfaction Of Mortgage Form?

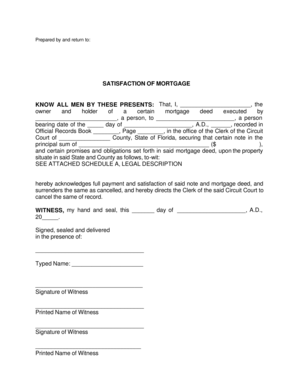

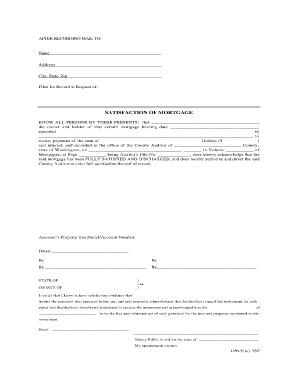

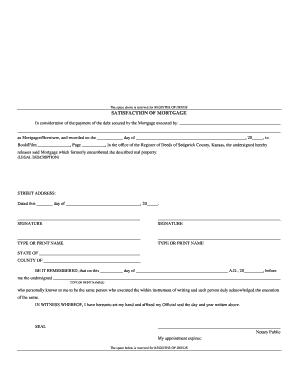

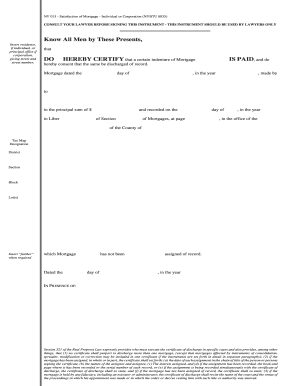

A Satisfaction of Mortgage Form is a legal document that indicates that a mortgage has been paid in full. It serves as proof and releases the lien on the property. It is important to file this form with the appropriate parties and government agencies to ensure that the mortgage is officially satisfied.

What are the types of Satisfaction Of Mortgage Form?

There are various types of Satisfaction of Mortgage Forms that may be used depending on the specific jurisdiction and requirements. Some common types include:

How to complete Satisfaction Of Mortgage Form

Completing a Satisfaction of Mortgage Form is a simple process. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.