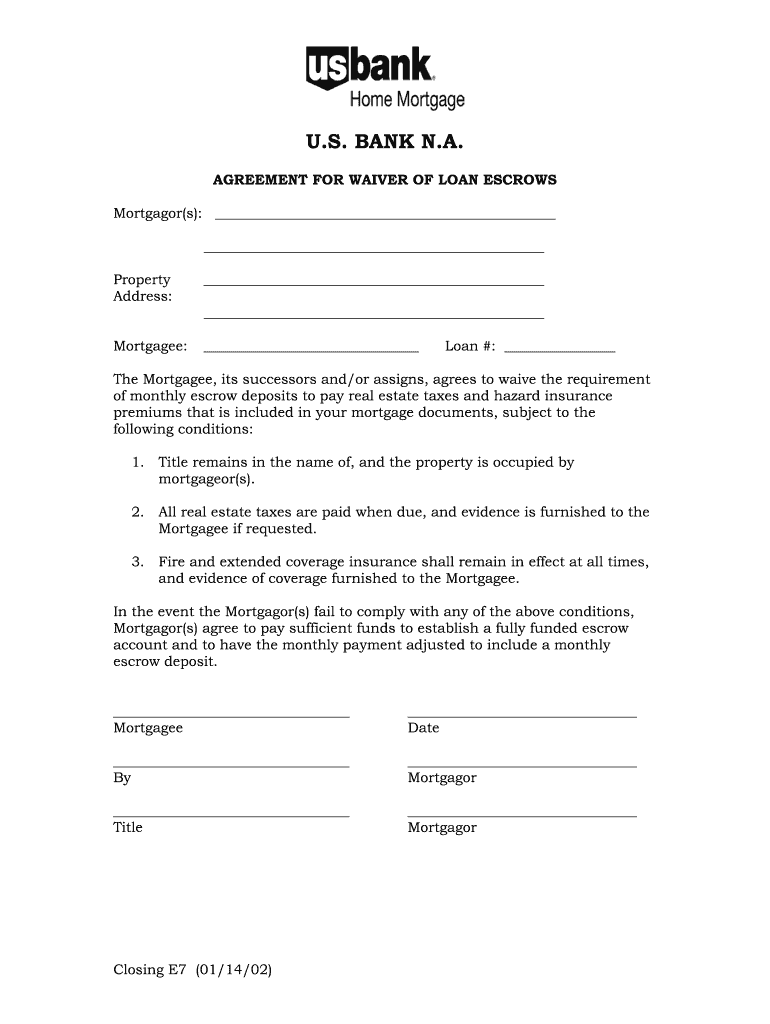

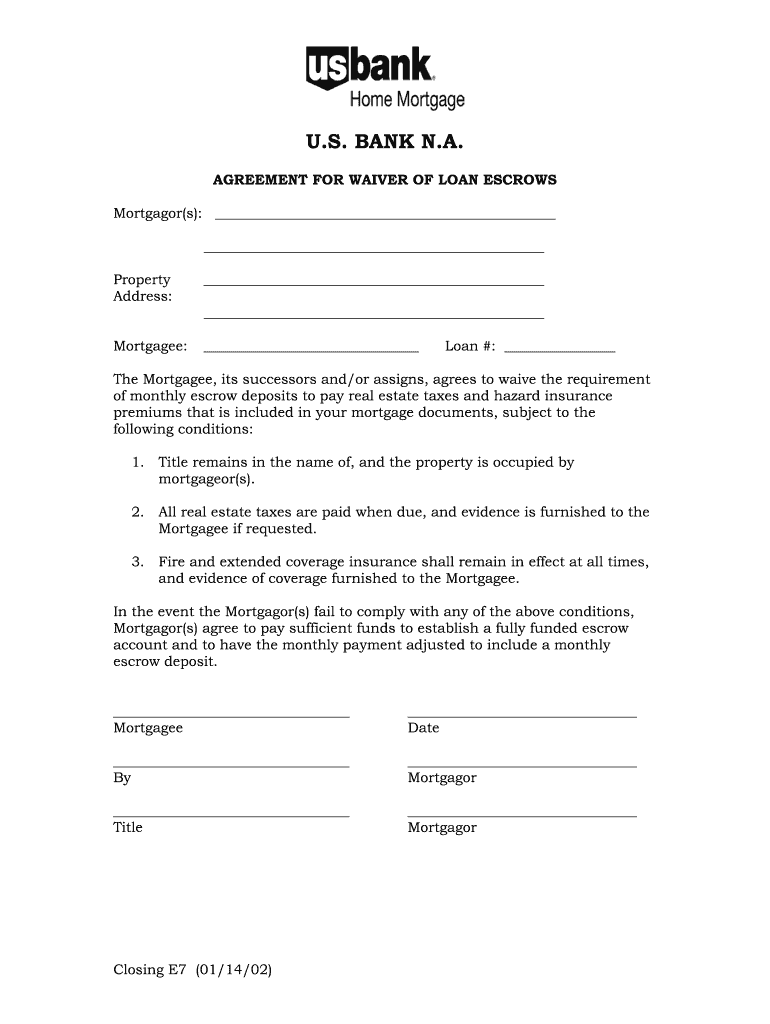

US Bank Closing E7 2002-2024 free printable template

Get, Create, Make and Sign

Editing escrow waiver agreement online

How to fill out escrow waiver agreement form

How to fill out mortgagor's escrow:

Who needs mortgagor's escrow:

Video instructions and help with filling out and completing escrow waiver agreement

Instructions and Help about waiver agreement fillable template form

So today we're going to be talking about waivers and release forms these are crucial if you're doing anything commercial and even YouTube getting to the point where you have to have these on a lot of the shoots that you're doing we deal with a lot of dangerous stunts, and we deal with commercial work where we have to have written permission by the athletes and the people that are in our videos, so Carter is a producer is the person often deals with that while we're on set so have him talk about the logistics of that first I just want to say that we're going to have a link to download the waiver that we use you can see exactly what we do that covers us well you know we hope it covers us in court if anything were to happen but pretty many things that the waiver does how it protects you as a filmmaker is 1 it says that anybody that's in your video that they give you the right to use their image or their face or likeness as it says in your video so then after that you can post it on YouTube, and they can't come and say hey you need to take this down the second thing that the waiver does is that it protects you in case anybody gets hurt we do a lot of stunts for our videos, and it's always a question of safety we have a lot of people watching taking part in the video people we don't know we ask our fans to come out and the biggest thing is what would happen if they get hurt doing the slip and slide that we've set up for them, so we have them sign a waiver first saying that knowingly participate in the stunt even though they know it could be dangerous and that they could get hurt and that they can't sue us for getting her in that video saying hey I did the slip and slide I broke my arm, and now you owe me 500 million dollars because I'm sure that happens right anyway, so the third thing is that in our waivers in the case of our waivers they say that even though you can't sue us we do have to have production company insurance you know we when we're working with big brands that's something that they do force you to have, so we have production company insurance that if anyone does get hurt we can't with they're covered under our insurance, so they can't sue us, but we do try and take care of them we don't want anybody to get hurt knock on wood we haven't had huge serious injuries but so that's the waiver in a nutshell and those are the three areas where it can protect you we're going to have that link in the bottom, and we suggest you go look at it, you can change it however you want it to be I know it might not make a lot of sense maybe as a young filmmaker starting out but as things start to grow you never know, and it's good to start that practice especially if you're putting footage on YouTube and then people come by years later and say hey this is an awesome video you made I want to buy some footage and put it in a commercial do you have the releases for the people or the locations in it that's the first question I get asked when people want stock...

Fill escrow payments : Try Risk Free

People Also Ask about escrow waiver agreement

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your escrow waiver agreement form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.