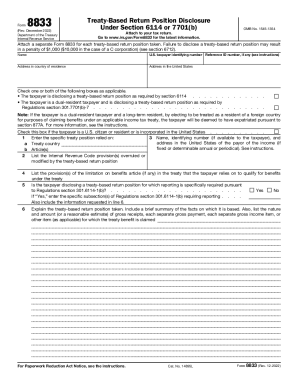

IRS 8833 2013 free printable template

Show details

Cat. No. 14895L Rev. 12-2013 This page left blank intentionally Form 8833 Rev. 12-2013 Section references are to the Internal Revenue Code unless otherwise noted. Future Developments For the latest information about developments related to Form 8833 and its instructions such as legislation enacted after they were published go to www.irs.gov/form8833. Form Rev. December 2013 Department of the Treasury Internal Revenue Service Treaty-Based Return Position Disclosure Under Section 6114 or 7701 b...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign

Edit your irs form 8833 2013 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs form 8833 2013 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irs form 8833 2013 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit irs form 8833 2013. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

IRS 8833 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out irs form 8833 2013

How to fill out IRS form 8833 2013:

01

Obtain the necessary form. You can download IRS Form 8833 (2013 version) from the official IRS website or request a physical copy from the IRS.

02

Begin by filling out your personal information. Enter your name, Social Security Number or Taxpayer Identification Number, address, and other required details in the designated fields.

03

Fill out Part I - Treaty-Based Return Position Disclosure. Provide the specific treaty article or paragraph number, and a detailed explanation of the treaty position you are taking on your tax return.

04

If you have multiple treaty-based positions, use additional forms or the continuation sheets provided to disclose each position separately.

05

Complete Part II - Information on Tax Treaty Benefits Claimed. Provide the country for which the treaty benefits are claimed, the article or paragraph number of the treaty, and a brief description of the treaty benefits you are claiming.

06

If you are a nonresident alien or a dual-status alien, complete Part III - Explanation of Treaty Benefits Claimed and Facts Supporting Eligibility for Benefits.

07

Review your completed form for accuracy and ensure all necessary information is provided. Double-check that your explanations are clear and concise.

Who needs IRS form 8833 2013:

01

Individuals who are claiming benefits under a tax treaty between the United States and another country may need to fill out Form 8833.

02

Taxpayers who have taken a treaty-based return position and are required to disclose it on their tax return should use this form.

03

Nonresident aliens, dual-status aliens, or individuals who are eligible for tax treaty benefits and are required to provide documentation supporting their eligibility should consider using this form.

Instructions and Help about irs form 8833 2013

Fill form : Try Risk Free

People Also Ask about irs form 8833 2013

Who is required to file form 8833?

What are the exceptions to filing form 8833?

Who must file IRS form 8833?

What is IRS form 8833 used for?

What is the penalty for not filing 8833?

What is a 8833 treaty-based return position?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is irs form 8833?

IRS Form 8833 is a form used to claim a tax treaty benefit and to disclose information about certain foreign tax matters.

Who is required to file irs form 8833?

Individuals and entities who are eligible for tax treaty benefits or who have certain foreign tax matters to report are required to file IRS Form 8833.

How to fill out irs form 8833?

To fill out IRS Form 8833, you need to provide your personal information, details about the tax treaty benefit being claimed, and any other relevant information about foreign tax matters. The form should be completed following the instructions provided by the IRS.

What is the purpose of irs form 8833?

The purpose of IRS Form 8833 is to ensure compliance with tax treaties and to disclose information related to certain foreign tax matters.

What information must be reported on irs form 8833?

IRS Form 8833 requires reporting of personal information, tax treaty details, and any other relevant information about foreign tax matters, as specified by the IRS.

When is the deadline to file irs form 8833 in 2023?

The deadline to file IRS Form 8833 in 2023 is typically April 15th for individuals and the 15th day of the 4th month following the end of the organization's tax year for entities. However, it is recommended to check with the IRS or a tax professional for specific deadlines in a given year.

What is the penalty for the late filing of irs form 8833?

The penalty for the late filing of IRS Form 8833 is determined by the IRS and may vary depending on the circumstances. It is advisable to consult the IRS guidelines or seek professional tax advice to understand the specific penalties and consequences of late filing.

How can I edit irs form 8833 2013 from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including irs form 8833 2013, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I send irs form 8833 2013 for eSignature?

To distribute your irs form 8833 2013, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I execute irs form 8833 2013 online?

pdfFiller has made it simple to fill out and eSign irs form 8833 2013. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Fill out your irs form 8833 2013 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.