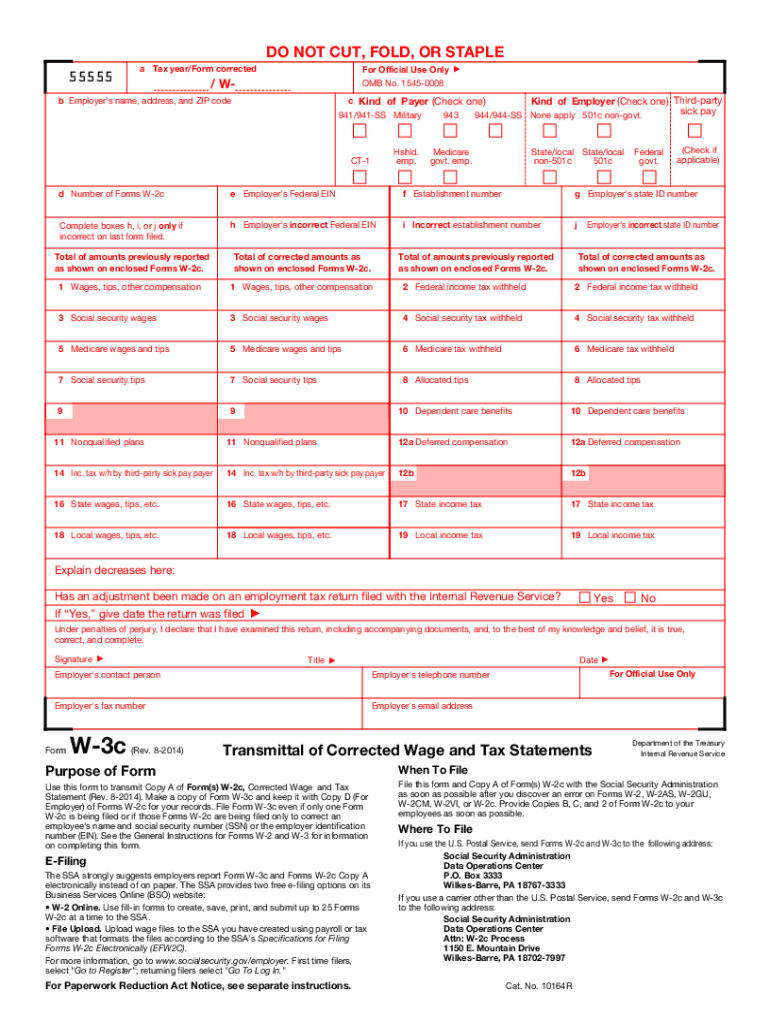

What is W-3c Form 2014?

Form W-3c (Transmittal of Corrected Wage and Tax Statement) is used to correct mistakes on previously filed W-3 forms. If you made corrections on Form W-3, you must fix the same errors on Form W-2 with a copy of the form W-2c along with Form W-3c.

Who needs an IRS form W3c 2014?

Employers file forms W-2 and W-3 to report wages, tips, and other compensations paid to their employees during the tax year. An employer who made an error in filing their original W-3 or W-2 forms must file both a W-2c and W-3c. The IRS will not accept a return of the W 3c series with corrections on the printed copy. You must provide correct information on separate returns.

Is Form W-3c accompanied by other forms?

File Form W-3c when you file Form W-2c to the SSA.

When is W 3c Form due?

W-3C Form, Transmittal of Corrected Wage and Tax Statement, should be submitted as soon as you discover an error. Also, provide a Form W-2c to the employee as quickly as possible.

What information do I need to fill out a Form W-3c?

In your W-3c, write the employee's name and address, and define which taxpayer and employer want to make changes. Then indicate in the columns the amounts previously reported and the corrected amounts of wages, tips, compensations, social security and Medicare wages, social security tips, federal income tax withheld, etc. If you report a decrease of any amount, explain in the table below.

How do I fill out W-3c Form in 2015?

You can fill out and file Form W 3c on paper or electronically. If you want to fill it out online, use a trusted service like pdfFiller.

Here’s how you can complete Form W-3c with ease.

- Click Get Form to open W 3c Form in the editor.

- Once opened, start filling out the document.

- Use various annotation and editing tools to add text, checkmarks, and dates.

- Click on the signature box to sign the document.

- Click DONE once you’ve completed your W-3c.

Where do I send Form W-3c?

You can choose one of the following options to file the form W-3C: eFile, send via US Postal Service, send via other postal services, or IRS-designated private services. The list of services and their addresses are available on this page.