Canada RC1 2005 free printable template

Show details

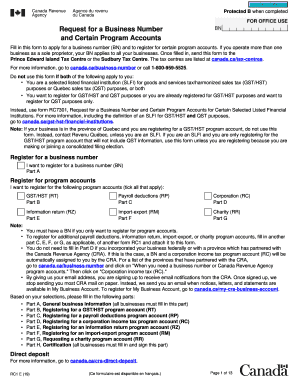

Restore Help IN REQUEST FOR A BUSINESS NUMBER (IN) FOR OFFICE USE ONLY Complete this form to apply for a Business Number (IN). If you are a sole proprietor with more than one business, your IN will

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your rc1 e form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rc1 e form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rc1 e form online

Follow the steps below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit rc1 e form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Canada RC1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out rc1 e form

How to fill out rc1 e form:

01

Obtain the RC1 e form from the appropriate website or office.

02

Carefully read the instructions provided on the form to understand the information required.

03

Fill in your personal details such as your name, address, and contact information.

04

Provide any relevant identification numbers or references required.

05

Fill in the details of your income, including any deductions or credits you may be eligible for.

06

Double-check all the information filled in to ensure accuracy.

07

Sign the form and submit it according to the instructions provided.

Who needs rc1 e form:

01

Individuals who earn income and are required to file taxes in their jurisdiction.

02

Anyone who wishes to claim deductions or credits on their income tax return.

03

Self-employed individuals or sole proprietors who need to report their income and expenses.

Note: It is advisable to consult with a tax professional or refer to the specific guidelines provided by the tax authority in your jurisdiction for accurate and up-to-date information.

Fill form : Try Risk Free

People Also Ask about rc1 e form

Where do I get Canadian tax forms?

Which tax forms do I need Canada?

Which tax form do I use Canada?

What is RC1 in Canada?

What is an RC number in Canada?

What is the difference between T1 and T4 tax form Canada?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is rc1 e form?

RC1 E form refers to the Application for Relief at Source from Canadian Income Tax form. It is a form used by individuals who are residents of a country that has a tax treaty with Canada and who are eligible for a reduced rate or exemption from Canadian income tax. This form allows these individuals to apply for relief from Canadian withholding tax on certain types of income, such as dividends, interest, royalties, and pension payments.

Who is required to file rc1 e form?

The RC1(E) form is required to be filed by individuals who are applying for an extension of their Individual Tax Identification Number (ITIN) or by individuals who are required to renew their ITIN.

How to fill out rc1 e form?

To fill out an RC1 E form, follow these steps:

1. Visit the official website of the Canada Revenue Agency (CRA).

2. Go to the "Forms and publications" page.

3. Search for "RC1 E" in the search bar or locate it in the list of forms.

4. Click on the link to download the RC1 E form in PDF format.

5. Open the downloaded form using a PDF reader program.

6. Review the instructions and requirements outlined in the form.

7. Fill in the necessary information in each section of the form.

- Provide your name, address, and contact details in the appropriate fields.

- Enter your business or organization information, such as the official name, business number, and tax period.

- Complete any additional sections relevant to your situation, such as amendments or cessation of activities.

8. Make sure to double-check all the information you have provided for accuracy and completeness.

9. Save a copy of the filled-out form on your device.

10. If required, print the completed form for your records or for submission to the CRA.

11. Submit the form to the CRA as per their instructions. This can be done either electronically or by mail, depending on the method accepted by the CRA.

Note: It's always recommended to consult with a tax professional or contact the CRA directly if you have any specific questions or require further clarification while filling out the RC1 E form.

What is the purpose of rc1 e form?

The purpose of the RC1 E form is to apply for a business number (BN) and certain program accounts with the Canada Revenue Agency (CRA). The BN serves as a unique identifier for businesses in Canada and is required for various tax-related obligations, such as filing tax returns, collecting and remitting GST/HST, and participating in other CRA programs. The RC1 E form is specifically used by enterprises located outside of Canada that need a BN and program accounts to conduct business in Canada.

What information must be reported on rc1 e form?

RC1 E is a form used by Canadian residents to report their income earned outside of Canada. The information that must be reported on RC1 E includes:

1. Personal Information: Name, Social Insurance Number (SIN), address, and contact details of the taxpayer.

2. Dates of Departure and Return: The dates when the taxpayer left Canada and returned, or if the taxpayer is deemed to have emigrated or immigrated.

3. Country of Residence: The name of the country where the taxpayer was residing during the period.

4. Income Earned Outside Canada: Details of all income earned outside Canada during the period, including employment income, self-employment income, rental income, capital gains, dividends, interests, pensions, and any other types of income.

5. Canadian Pensions or Annuities: Information about any Canadian pensions or annuities received during the period.

6. Deductions and Credits: Any deductions and credits that the taxpayer wants to claim related to the income earned outside Canada.

7. Treaty Exemption Claimed: If the taxpayer is claiming an exemption under a tax treaty between Canada and the country of residence, details of the treaty provisions and the income being claimed for exemption.

8. Other Information: Any other relevant information that may affect the taxpayer's tax liability.

It's important to note that the specific requirements may vary depending on the taxpayer's situation and the country of residence. Therefore, it is recommended to refer to the official Canada Revenue Agency (CRA) guidelines and seek professional tax advice if needed.

What is the penalty for the late filing of rc1 e form?

The penalty for the late filing of RC1-E form can vary depending on the jurisdiction and tax regulations in a particular country. It is best to consult the tax authority or a tax professional in your jurisdiction to get accurate information on the penalties associated with late filing of this form.

Where do I find rc1 e form?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the rc1 e form. Open it immediately and start altering it with sophisticated capabilities.

How do I edit rc1 e form straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit rc1 e form.

Can I edit rc1 e form on an Android device?

With the pdfFiller Android app, you can edit, sign, and share rc1 e form on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your rc1 e form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.