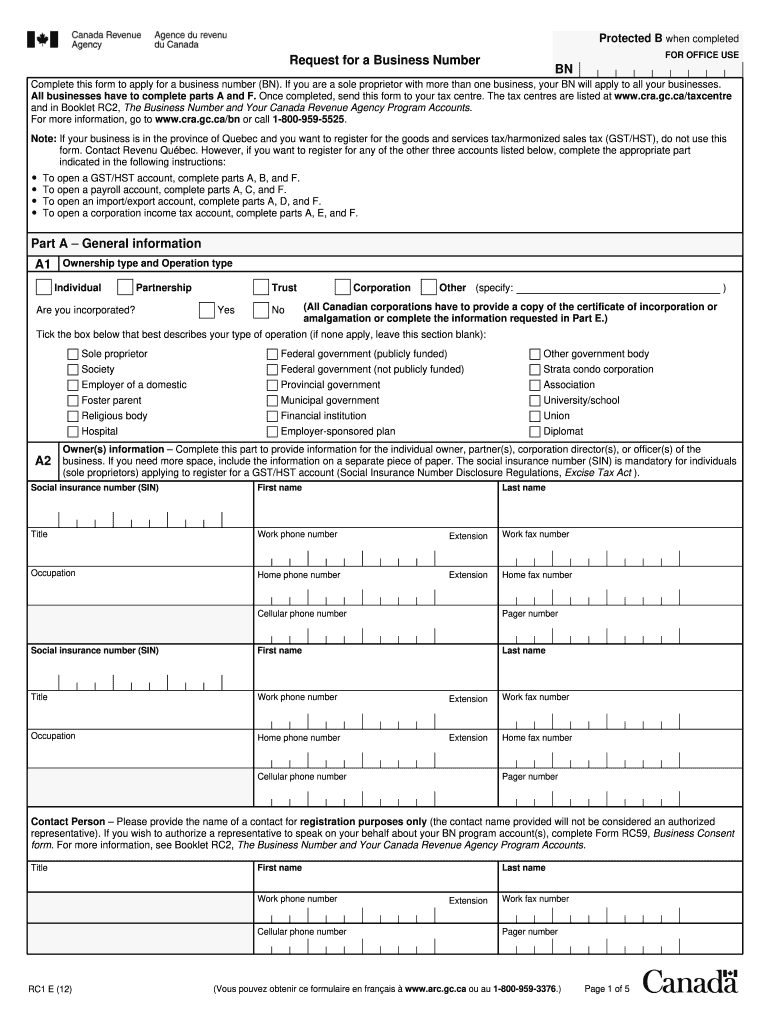

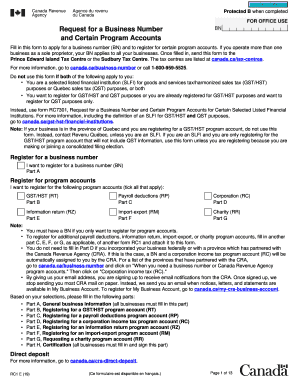

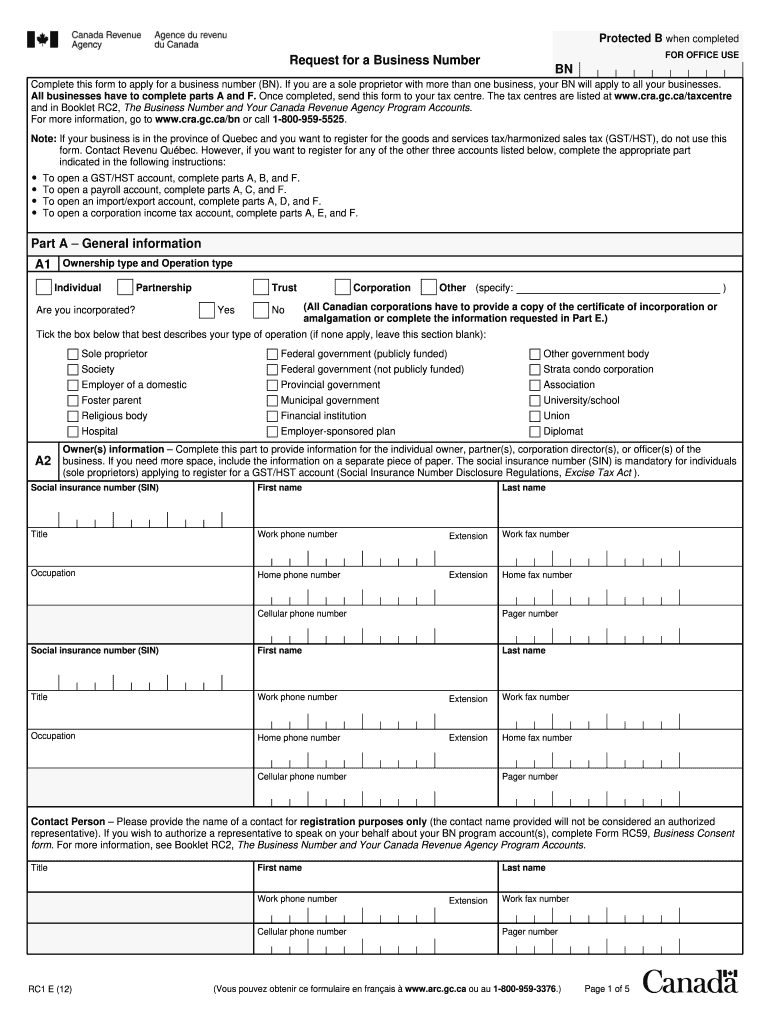

Canada RC1 2012 free printable template

Get, Create, Make and Sign

How to edit canada ca rc1 online

Canada RC1 Form Versions

How to fill out canada ca rc1 2012

How to fill out Canada CA RC1:

Who needs Canada CA RC1:

Video instructions and help with filling out and completing canada ca rc1

Instructions and Help about cra rc1 form

What's up guys my name is Aaron, and we're back with a new screen cost, so the angular team recently announced the fifth release candidates and the new big thing here is something called NG modules which we'll take a look at and build our app module in my NG 2 repo at GitHub I'm going to link to it in the description, and you're going to see it throughout this screencast also we're going to revisit angular 2 forms which I did a rant on I think a couple of month months ago so if you missed it I'm going to try to link to it up here and a couple of things has happened anger forms now doesn't live in the common barrel any more it's moved to its own it's called angular forms, and they are up at version o 3.0, and we're going to see a, and we're actually going to see that they've addressed the issues that I tried to raise, and we're going to upgrade our repo to leverage these new features, so before we being let me start by reading from the angular site what angular modules are so angular modules also known as NG modules are a powerful new way to organize and bootstrap your angular application anyways let's try to upgrade our NG to repo to the latest release candidate, so I'm going to link to two documents in the description one of them is this announcement I on their official blog which is a perfect read they talk about the compiler, and it gives you a little more depth to knowing what the compiler does the just-in-time compiler and ahead of time compiler which is perfect read not too complicated even though if you maybe don't care about the compiler, and then we're going to try to use this document which will help us to migrate to the latest release candidate, so there seems to be five simple steps here simply just update to our c5, and they are telling you that your application won't break from our c4, but we're not even going to try this because to be honest I doubt if we are using an angular material and in the alpha 7 release which we're going to upgrade to now they have introduced NG modules, and we want all that to come together perfectly, so we can just upgrade the router and material components along with Angle latest release candidate and hopefully after these things won't be moving as much because really this is kind of a big thing to do between two release candidates if you ask me, so we update to our c5 will create an EM module to bootstrap our application, so we won't be creating separate modules for each component set we're just going to create one app module, but I'm guessing that's enough for our repo, and then we're going to update our bootstrapping of the application and after the third part libraries that's where we're going to load up forms and HTTP mod module along with the material modules, and then we're going to try to do some cleanup to see how our code to see how our code can be simplified and hopefully not as repetitive as it may seem in some components right now we're going to try to get rid of some boilerplate code by...

Fill form rc145 fillable : Try Risk Free

People Also Ask about canada ca rc1

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your canada ca rc1 2012 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.