What is a certified pay stub?

What is a certified payroll report? A CPR is an official compliance document that is required on local-, state-, and/or federal-funded projects. It details the worker's information, type of work performed, wages, benefits, and hours worked.

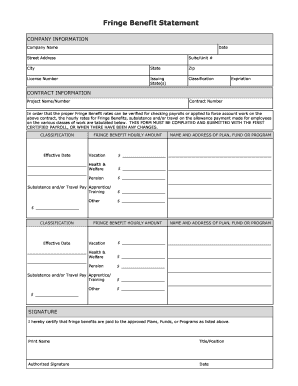

What does rate in lieu of fringes mean?

Wages Paid-in-Lieu of Fringes – The amount paid to the employee instead of fringe benefits paid to a plan, fund or program. This amount is sometimes included in the Gross Employee Pay this Project depending on the accounting system and the agency reporting requirements.

What is a certified payroll report QuickBooks?

Certified payroll is a federal payroll report. Government contractors submit federal Form WH-347 weekly to the agency overseeing the government contract. The form lists every employee, their wages, their benefits, the type of work they did, and the hours they worked.

What is certified payroll in Texas?

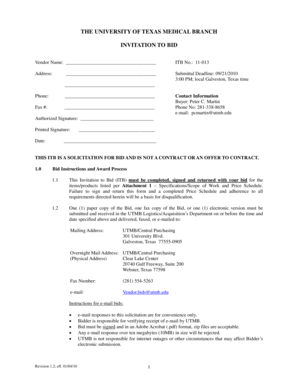

Certified payroll is a special weekly payroll report used by contractors who are working on federally funded projects. To meet your certified payroll requirements, you'll need to submit Form WH-347 to the Department of Labor every week.

How to fill out Massachusetts weekly certified payroll report form?

How to Complete the Certified Payroll Form in Massachusetts Enter the company's name, address, phone number and payroll number in the equivalent fields. Sign the form and enter your title, contract number, tax payer ID number and the work week ending date in the correct fields.

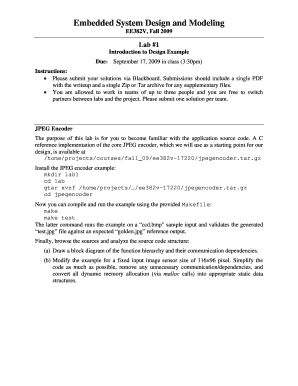

How to do certified payroll with QuickBooks Online?

Create a report Select Reports menu. Select Employees & Payroll. Select More Payroll Reports in Excel. Select Certified Payroll Report. For all excel based reports, you must Enable Macros. Select Continue then enter the Pay Date needed for the report. Select Get QuickBooks Data.

Which law requires a company with federal contracts to use certified payroll for any contract size?

The Davis-Bacon Act states that you must follow certified payroll criteria if your company works on a government contract worth more than $2,000. The guidelines cover a worker's hourly rate of compensation as well as fringe benefits.

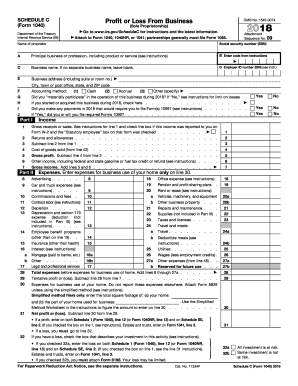

How do I run certified payroll?

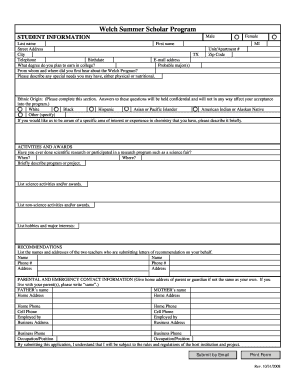

Certified payroll reports require the following information for employees working on covered federal projects: Full name and identifying number of the worker. Work classification. Hours worked daily, including the day, date and straight time and overtime hours. Total hours. Rate of pay. Gross amount earned.

Can QuickBooks do certified payroll?

Direct integration with QuickBooks Online allows for employee data, hours by day, project information, paycheck values, and more to flow seamlessly from QuickBooks into Certified Payroll Reporting each pay period, and then directly onto any required prevailing wage reports.

What is the purpose of certified payroll?

What is certified payroll reporting? Certified payroll reports confirm that contractors and subcontractors working on federally-funded projects are paying their employees prevailing wages in ance with the Davis-Bacon and Related Acts.

What is certified payroll Quickbooks?

Certified payroll is a federal payroll report. Government contractors submit federal Form WH-347 weekly to the agency overseeing the government contract. The form lists every employee, their wages, their benefits, the type of work they did, and the hours they worked.

Can QuickBooks payroll Do certified payroll?

If you use QuickBooks Online Payroll, we don't support prevailing wages or certified payroll reports. If you use QuickBooks Desktop Payroll Enhanced or QuickBooks Desktop Payroll Assisted, see Certified Payroll on how to create a certified payroll report.

What is a certified payroll report Quickbooks?

Certified payroll is a federal payroll report. Government contractors submit federal Form WH-347 weekly to the agency overseeing the government contract. The form lists every employee, their wages, their benefits, the type of work they did, and the hours they worked.

How do I run a certified payroll?

To complete your certified payroll requirements, you'll submit Form WH-347 to the Department of Labor. This form includes information about your employees, their wages and the total number of hours worked.

Does ADP handle certified payroll?

Certified Payroll Reporting is fully integrated with RUN Powered by ADP (RUN). Employee data and paycheck information flows directly from payroll onto prevailing wage reports.

How do I run certified payroll?

To complete your certified payroll requirements, you'll submit Form WH-347 to the Department of Labor. This form includes information about your employees, their wages and the total number of hours worked.

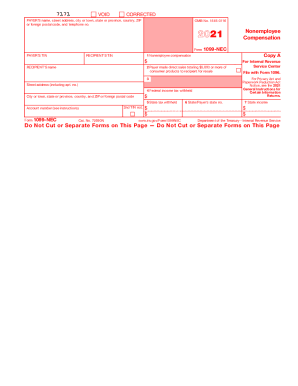

What is a statement of non performance?

In the event there has been no work performed during a given week on the project, the Statement of Non-Performance (“SNP”) can be filled out for that week. A subcontractor must submit a SNP or Certified Payroll Report for each week on the job until their scope of work is complete.

What is the difference between a certified payroll and regular payroll?

Certified Payroll is a company's accounting of everything paid out under a contract performed for a government client, while Wrap-Up Payroll is what a company has to report to their Workers Compensation Carrier for the state in which they are doing the work.

Why is certified payroll important?

Certified payroll is a requirement stemming from the Davis-Bacon Act. In 1931, Congress passed the Davis-Bacon Act to protect workers from low hourly pay. If your business works on a federal contract over $2,000, you're required to comply with certified payroll requirements.

What does certified payroll mean?

What is certified payroll reporting? Certified payroll reports confirm that contractors and subcontractors working on federally-funded projects are paying their employees prevailing wages in ance with the Davis-Bacon and Related Acts.