Get the free local tax form

Show details

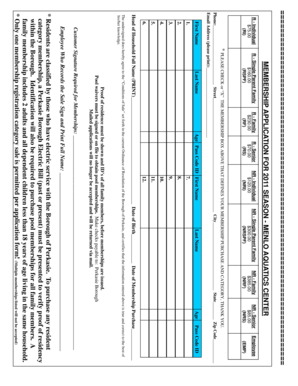

TAX YEAR F1 092311 LOCAL EARNED INCOME TAX RETURN *BTA* RESIDENT JURISDICTION: CHECK HERE IF EXTENSION FILED AND MAIL THIS FORM. IF YOU MOVED during the tax year printed above, please complete below.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your local tax form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your local tax form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing local tax form online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit how to fill out f1 berkheimer form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out local tax form

How to fill out local tax form?

01

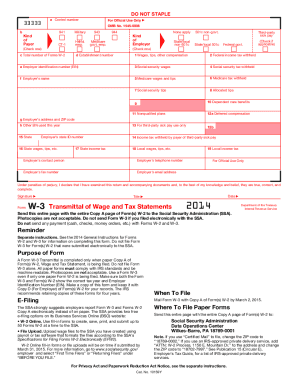

Gather all necessary documents such as W-2 forms, 1099 forms, and any other income or deduction records.

02

Carefully read through the instructions provided with the tax form to understand the requirements and procedures.

03

Begin by entering your personal information, such as your name, address, and social security number, in the designated spaces.

04

Report your income accurately by following the instructions provided for each type of income you have earned.

05

Deduct any eligible expenses or credits by carefully reviewing the provided guidelines and entering the necessary information.

06

Double-check your calculations and review all the information you have entered to ensure accuracy.

07

Sign and date the form to certify that the information provided is true and complete.

08

Make copies of all the documents and the completed tax form for your records.

09

File the tax form by mailing it to the appropriate tax agency or by electronically submitting it online, depending on the requirements.

Who needs local tax form?

01

Individuals who are residents of a specific locality and are subject to the local tax laws may need to fill out a local tax form.

02

Self-employed individuals or freelancers who conduct business within a particular locality may also need to complete a local tax form.

03

Some employers may require their employees to fill out local tax forms if they work within a particular locality and are subject to local taxes.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What information must be reported on local tax form?

The specific information reported on a local tax form may vary depending on the jurisdiction and tax laws in place. However, some common information that is typically required to be reported on local tax forms includes:

1. Personal information: This includes the taxpayer's name, address, Social Security number or taxpayer identification number.

2. Income details: The taxpayer must report all sources of income earned during the tax year. This may include employment income, self-employment income, rental income, investment income, and any other form of taxable income.

3. Deductions and credits: Taxpayers may be required to report deductions and credits that are available on the local level. This could include deductions for mortgage interest, property taxes, education expenses, medical expenses, or specific local tax credits.

4. Property ownership and assessment: For local property taxes, taxpayers may need to provide information regarding property ownership, such as property address, assessed value, and any changes in property ownership during the year.

5. Estimated tax payments: If taxpayers are required to make estimated tax payments throughout the year, they may need to report the amounts paid and the dates of payment on their local tax form.

6. Additional information: Depending on the local tax laws, there might be additional information required to be reported. This might involve details about business activities, sales tax collected, use tax owed, and any other local-specific tax requirements.

It is important to consult the specific local tax authorities or tax professionals to ensure compliance with the local tax laws and to obtain accurate information regarding the applicable reporting requirements for a particular jurisdiction.

What is local tax form?

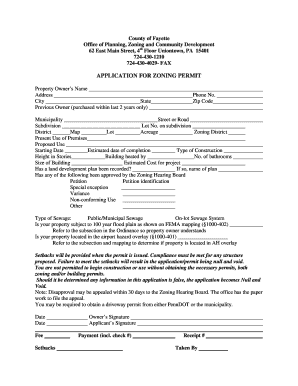

A local tax form, also known as a municipal tax form, is a document used to report and pay taxes to a local government or municipality. These forms are separate from federal or state tax forms, and they usually cover taxes related to property, sales, business operations, or other specific local taxes imposed by the local jurisdiction. The specific requirements for local tax forms can vary based on the location and the type of tax being reported.

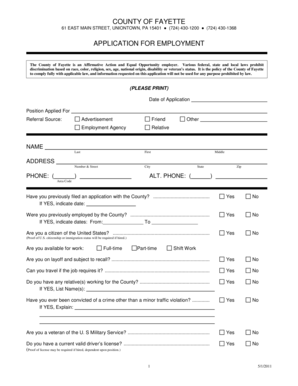

Who is required to file local tax form?

The individuals required to file a local tax form vary depending on the specific locality and its regulations. Generally, residents and non-residents who earn income within a particular jurisdiction may be required to file a local tax form. Some common examples include individuals who live or work in a specific city, town, or county that imposes local taxes. Additionally, individuals who own property or conduct business activities within a jurisdiction may also be obligated to file a local tax form. It is important to consult the specific local tax laws and guidelines applicable to a particular area to determine who is required to file a local tax form.

How to fill out local tax form?

Filling out a local tax form can vary depending on the specific requirements and regulations of your jurisdiction. However, here is a general step-by-step guide on how to fill out a local tax form:

1. Obtain the necessary tax form: Visit your local government's website, tax office, or request a form by mail. Alternatively, you might be able to find an online version that can be filled out electronically.

2. Read the instructions: Carefully review the instructions provided with the tax form to understand the specific requirements and any special considerations.

3. Gather required documents: Collect all the necessary documents such as W-2 forms, 1099 forms, and any other income or deduction statements you received during the tax year.

4. Start with your personal information: Fill in your personal details accurately, including your name, address, social security number or taxpayer identification number, and any other requested information.

5. Report your income: Follow the instructions to report your income from all sources. This typically includes wages, self-employment income, rental income, and any other taxable income.

6. Report deductions and exemptions: Deductions and exemptions can include items such as mortgage interest, education expenses, medical expenses, and qualified deductions that may reduce your taxable income. Consult the instructions and provide the required information accordingly.

7. Calculate your local tax liability: Use the provided tax tables, rates, or formulas to calculate the amount you owe in local taxes or the refund you are entitled to. Some forms may require you to perform specific calculations for this purpose.

8. Make payments if applicable: If you owe local taxes, there usually will be a section on the form to indicate how you want to make the payment. Most jurisdictions offer various payment methods such as electronic payment, check, or money order.

9. Review and sign the form: Double-check all the information you provided to ensure accuracy. Sign and date the tax form where required. If you are filing jointly, your spouse may also need to sign.

10. Make copies and submit: Before submitting your tax form, make copies for your records. Then, send the original form to the appropriate local tax office by mail or electronically, adhering to the specified deadlines.

It's important to note that local tax forms can vary significantly based on where you live. Always consult the specific instructions provided by your local tax authority to ensure you complete the form accurately and comply with all local regulations.

What is the purpose of local tax form?

The purpose of a local tax form is to collect information and calculate the amount of local taxes that individuals or businesses owe to their local government. This form is used to report income, expenses, deductions, and other relevant financial information that determines the local tax liability. By filling out and submitting the local tax form, individuals and businesses fulfill their obligation to contribute financially to the local government for services such as public education, emergency services, infrastructure development, local government operations, and other community programs.

What is the penalty for the late filing of local tax form?

The penalty for the late filing of a local tax form can vary depending on the specific jurisdiction and tax regulations in place. Generally, penalties can include fines or interest charges on the unpaid taxes. It is advisable to consult the local tax authority or review the specific regulations applicable to the jurisdiction in question to get accurate information on the penalties associated with late filing of local tax forms.

How can I edit local tax form from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including how to fill out f1 berkheimer form, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I edit pa local income tax form printable on an Android device?

You can make any changes to PDF files, like part year local income tax return, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

How do I fill out local tax form on an Android device?

On an Android device, use the pdfFiller mobile app to finish your how to fill out f1 berkheimer form. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your local tax form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pa Local Income Tax Form Printable is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.