Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

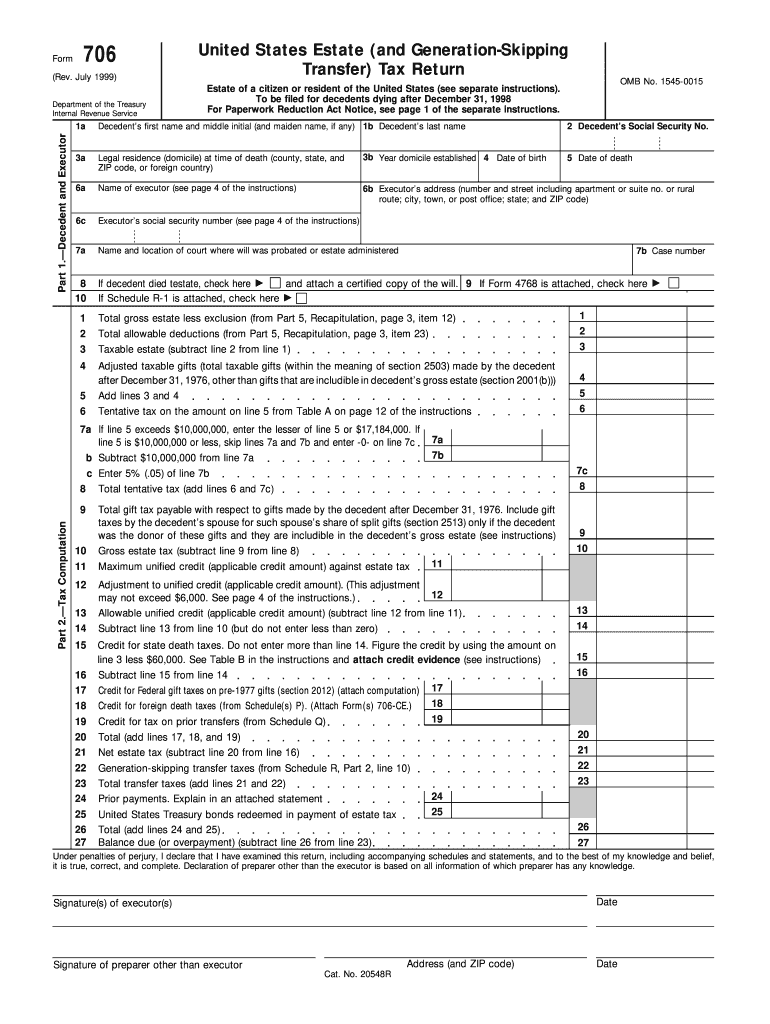

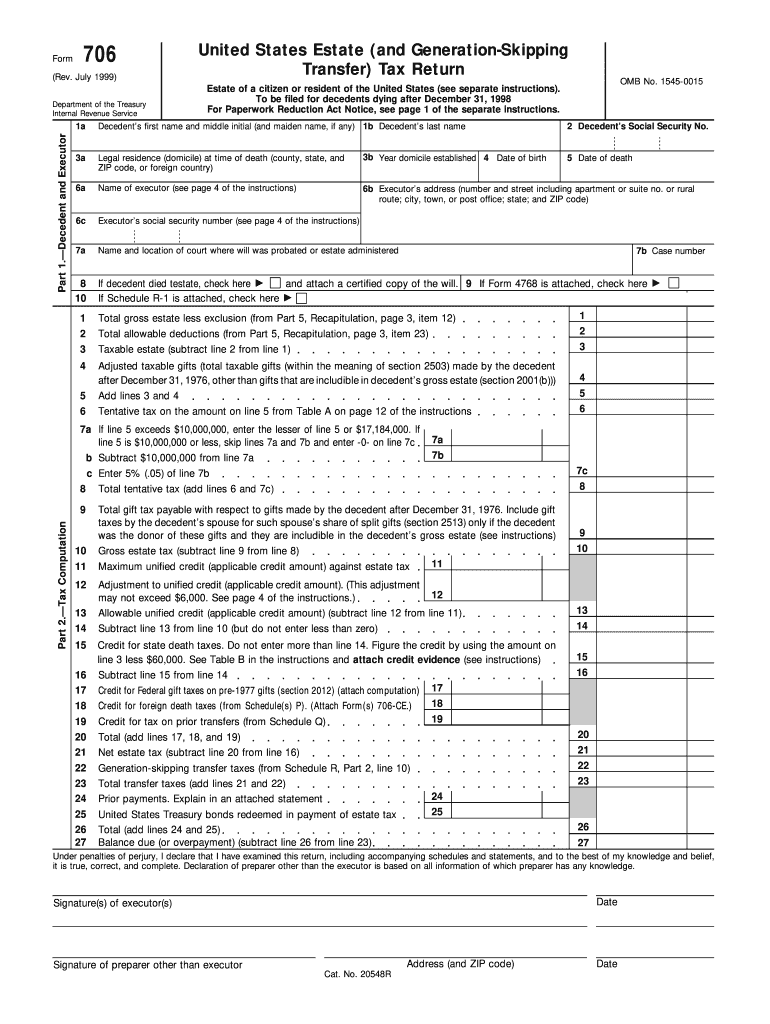

The 706 form is a federal tax form, officially known as Form 706: United States Estate (and Generation-Skipping Transfer) Tax Return. It is used by the executors of a deceased individual's estate to report the transfer of assets and determine any estate tax liability. This form must be filed within nine months after the decedent's death, and it provides information about the assets, debts, and beneficiaries of the estate.

Who is required to file 706 form?

The 706 form, also known as the United States Estate (and Generation-Skipping Transfer) Tax Return, is required to be filed by the executor or administrator of the estate of a deceased person. This form is used to report the estate's assets, calculate any estate tax owed, and determine if any generation-skipping transfer tax applies.

What is the purpose of 706 form?

Form 706, also known as the United States Estate (and Generation-Skipping Transfer) Tax Return, is a tax form used to calculate and report federal estate taxes owed on the estate of a deceased individual. Its purpose is to determine the value of the estate, calculate the estate tax liability, and report the transfer of property to beneficiaries or other parties. The form must be filed by the executor or administrator of the estate for any US citizen or resident whose estate, combined with any lifetime taxable gifts, exceeds the applicable threshold set by the Internal Revenue Service (IRS).

When is the deadline to file 706 form in 2023?

The deadline to file a 706 form, also known as the United States Estate (and Generation-Skipping Transfer) Tax Return, in 2023 is typically nine months after the date of the individual's death. However, it's essential to note that tax laws are subject to change, so it is advisable to consult with a tax professional or refer to the Internal Revenue Service (IRS) website for the most accurate and up-to-date information.

What is the penalty for the late filing of 706 form?

The penalty for the late filing of Form 706, which is the United States Estate (and Generation-Skipping Transfer) Tax Return, can vary depending on the circumstances. The penalty is typically calculated based on the amount of tax owed that is not paid by the original due date of the return. The penalty can be up to 25% of the unpaid tax amount, and it may accrue interest as well. Additionally, if there is reasonable cause for the delay in filing, the penalty may be waived or reduced. It is important to consult with a tax professional or review the specific instructions and guidelines provided by the Internal Revenue Service (IRS) for accurate and up-to-date information on penalties for late filing of Form 706.

How to fill out 706 form?

Filling out Form 706, also known as the United States Estate (and Generation-Skipping Transfer) Tax Return, can be a complex process. Here is a general guide on how to fill out the form:

1. Understand the purpose of Form 706: Form 706 is used to calculate and report any estate taxes owed after someone's death. It includes information about the decedent, their assets, debts, and distribution of their estate.

2. Gather the necessary information and documentation: Collect all relevant information, including the decedent's personal details (such as name, Social Security number, date of death), their will, and any other legal documentation related to the estate. Also, gather information about the decedent's assets and liabilities, including bank accounts, real estate, investments, debts, etc.

3. Complete the header section: Provide the decedent's personal details, including name and Social Security number. Fill in the date of death as well, as this will determine the applicable tax laws.

4. Determine the filing status and election: Determine the filing status based on whether the estate is required to file Form 706. Additionally, choose whether the estate makes an election to allow the surviving spouse to use any unused portion of the decedent's estate tax exemption (known as the "portability election").

5. Calculate the gross estate: Determine the total value of the decedent's assets using fair market values as of the date of death. This includes real estate, stocks, bonds, personal property, etc. Subtract any allowable deductions (e.g., mortgages, debts, and administrative expenses) to arrive at the value of the gross estate.

6. Determine the taxable estate: Make adjustments to the gross estate by subtracting allowable deductions, such as funeral expenses, debts, qualifying charitable bequests, and marital deduction if applicable. This will arrive at the taxable estate value.

7. Calculate and pay estate tax: Use the taxable estate value to determine the estate tax owed. Refer to the appropriate tax tables and instructions provided by the IRS to calculate the tax liability accurately. Pay any tax due with the submission of the form.

8. Complete the remainder of the form: Provide detailed schedules and supporting documents as requested in Form 706. These schedules will depend on the specifics of the decedent's estate.

9. Sign and submit the form: Sign the completed Form 706 and attach any required schedules and supporting documents. Send the form to the appropriate IRS processing center as indicated in the instructions.

It is crucial to note that the information provided here is only a basic overview. Form 706 can be complex, and it is recommended to consult with a tax professional or estate attorney for guidance to ensure accurate completion before submission.

What information must be reported on 706 form?

Form 706 is the United States Estate (and Generation-Skipping Transfer) Tax Return. It must be filed by the executor of a deceased person's estate and reports the value of their taxable estate and any generation-skipping transfers.

The following information must be reported on Form 706:

1. Decedent Information: This includes the name, Social Security number, date of birth, date of death, and address of the deceased person.

2. Executor Information: The name, address, and Social Security number of the person responsible for administering the estate.

3. Estate Assets: The value of all assets owned by the decedent at the time of death must be reported. This includes real estate, bank accounts, investments, life insurance proceeds, business interests, and personal belongings.

4. Estate Liabilities: Any debts, mortgages, loans, or other obligations of the decedent that are owed at the time of death are reported.

5. Funeral Expenses: The cost of the decedent's funeral and burial expenses must be reported.

6. Debts and Administrative Expenses: Any expenses related to the administration of the estate, such as attorney fees, court costs, and appraiser fees, must be reported.

7. Charitable Bequests: If the decedent included any charitable donations in their will or estate plan, these must be reported.

8. Generation-Skipping Transfers: If the decedent made any transfers to grandchildren or others that skipped a generation, these must be reported separately.

9. Estate Tax Computation: This section calculates the amount of federal estate tax owed based on the value of the taxable estate and applicable tax rates.

10. Signature and Verification: The executor signs the form under penalty of perjury, confirming that the information provided is true, accurate, and complete.

It is important to consult with a qualified tax professional or attorney for specific guidance and to ensure accurate completion of Form 706.

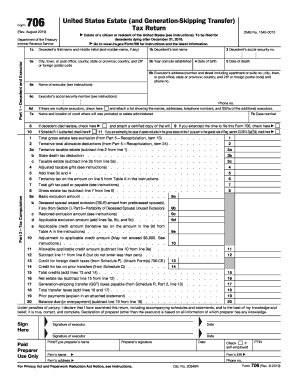

How do I make changes in 1999 706 form?

The editing procedure is simple with pdfFiller. Open your 1999 706 form in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit 1999 706 form in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing 1999 706 form and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I complete 1999 706 form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your 1999 706 form. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.