India ITD Form No. 49AA 2011 free printable template

Show details

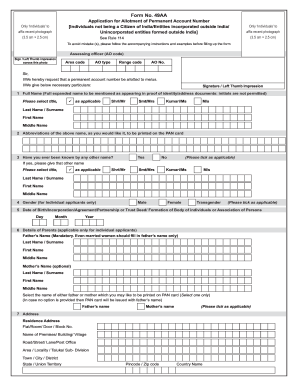

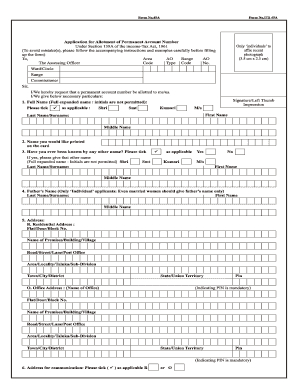

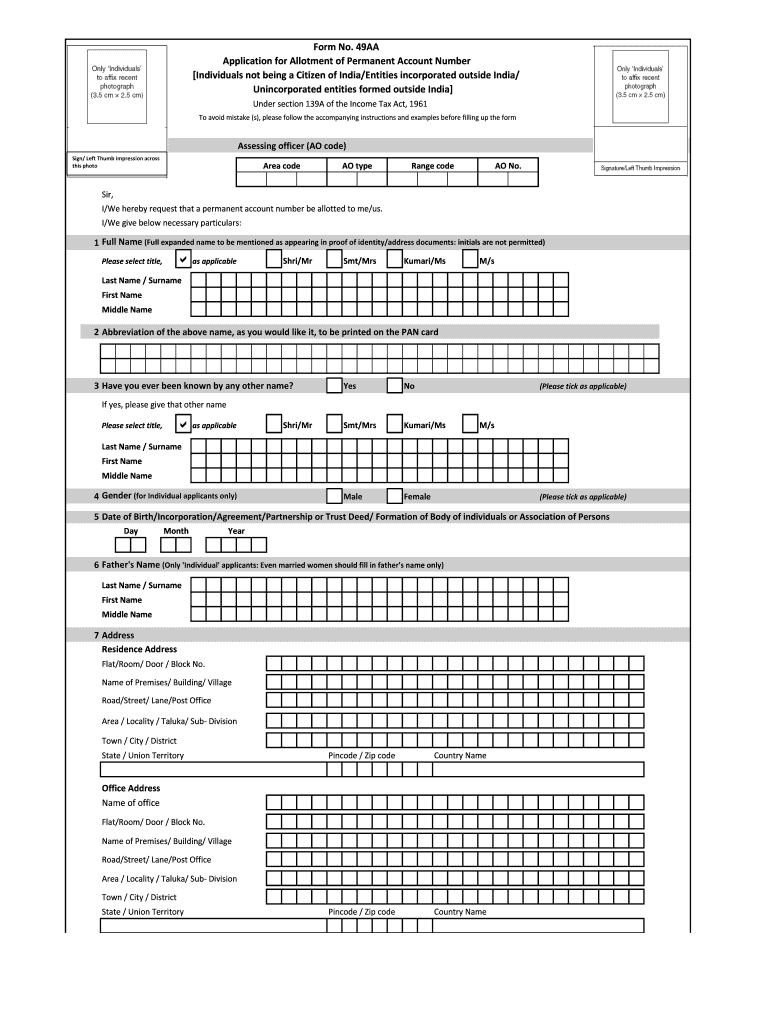

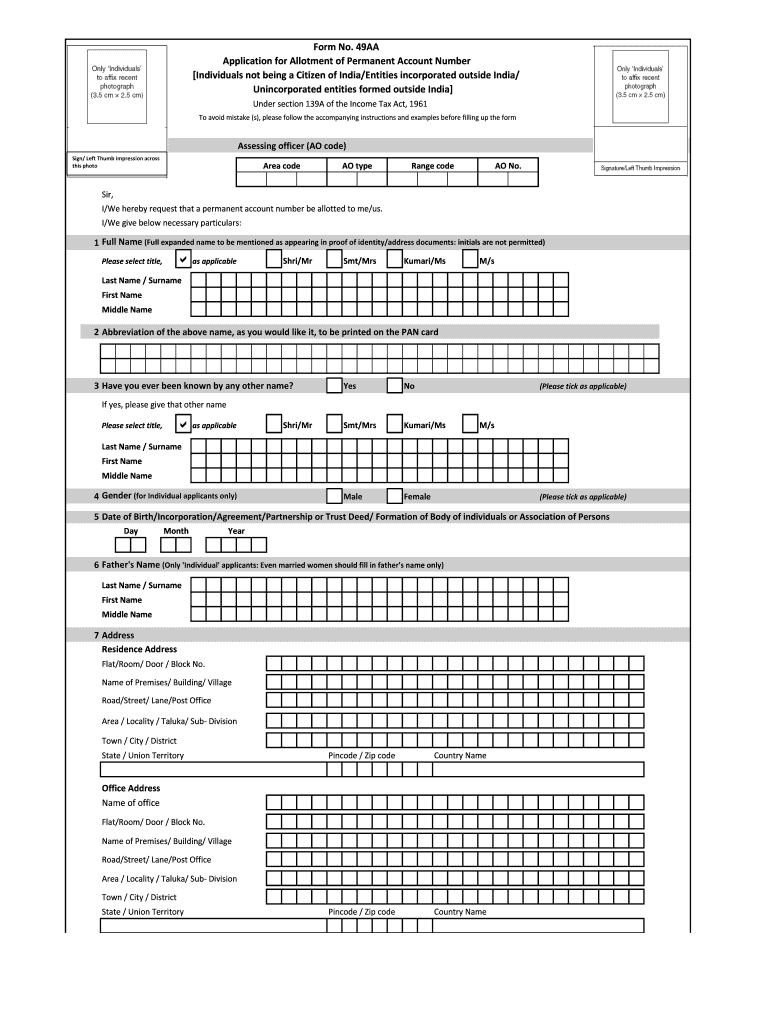

Form No. 49AA Application for Allotment of Permanent Account Number Individuals not being a Citizen of India/Entities incorporated outside India/ Unincorporated entities formed outside India Under section 139A of the Income Tax Act 1961 To avoid mistake s please follow the accompanying instructions and examples before filling up the form Assessing officer AO code Sign/ Left Thumb impression across this photo Area code AO type Range code AO No. Sir I/We hereby request that a permanent account...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your pan card 49aa form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pan card 49aa form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pan card 49aa form online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 49aa. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

India ITD Form No. 49AA Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out pan card 49aa form

How to fill out PAN card 49AA form:

01

Gather all the necessary documents such as proof of address, proof of identity, and proof of date of birth.

02

Visit the official website of the Income Tax Department of India.

03

Download the PAN card 49AA form from the website.

04

Fill in all the required details accurately, provide your personal information, and attach the necessary documents.

05

Double-check the form for any errors or missing information.

06

Once you have filled out the form completely, submit it either online or offline, as per the instructions provided on the website.

Who needs PAN card 49AA form:

01

Individuals who are not citizens of India but wish to apply for a PAN card.

02

Foreign nationals who engage in financial transactions in India and need a PAN card for taxation purposes.

03

People who belong to a foreign jurisdiction that requires them to have a PAN number as per the regulations laid down by the Government of India.

Note: It is always recommended to consult the guidelines and instructions provided by the Income Tax Department or seek professional advice while filling out the PAN card 49AA form.

Video instructions and help with filling out and completing pan card 49aa form

Instructions and Help about form 49aa download

Fill form 49aa pan card application : Try Risk Free

People Also Ask about pan card 49aa form

Is form 49AA to be filled by foreign citizens?

Can foreigners apply for PAN card in India?

How can I download PAN card 49A form?

Can a US citizen get a PAN card?

How to fill PAN card form online for NRI?

How to fill form 49A for PAN card online?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is pan card 49aa form?

A PAN (Permanent Account Number) Card 49AA Form is an application form for obtaining a PAN card issued by the Indian Income Tax Department. It is used by individuals and entities who are not citizens of India, or entities not incorporated or established in India. This form is used for the purpose of providing an identity proof for tax purposes.

Who is required to file pan card 49aa form?

The 49AA form is used for individuals and entities who do not fall under the category of citizens of India, entities incorporated in India, and unincorporated entities formed in India. The form is used to obtain a Permanent Account Number (PAN) for these individuals and entities.

How to fill out pan card 49aa form?

The PAN Card 49AA form is an application form for obtaining a Permanent Account Number (PAN). To fill out the form, you must first select the option that applies to you: individual, Hindu Undivided Family, company, trust, or association of persons. Then, you must provide the following information:

1. Name

2. Father's/Husband's Name

3. Date of Birth

4. Gender

5. Address

6. Contact Details

7. Email ID

8. Proof of Identity

9. Proof of Address

10. Signature

Once you have provided all the required information, you can submit the form along with the documents and the required fees. The PAN Card will be issued to you within 15 working days.

What is the purpose of pan card 49aa form?

The PAN Card 49AA Form is used by individuals who are not citizens of India or entities incorporated outside India to apply for a Permanent Account Number (PAN) from the Indian Income Tax Department. This form is also used to make changes or corrections to existing PAN details.

What information must be reported on pan card 49aa form?

The information required on a PAN Card 49AA Form includes:

-Full Name

-Date of Birth

-Gender

-Father’s Full Name

-Address

-State

-Country

-Mobile Number

-Email ID

-Aadhaar Card Number (if available)

When is the deadline to file pan card 49aa form in 2023?

The deadline to file PAN card 49AA form in 2023 is March 31, 2023.

What is the penalty for the late filing of pan card 49aa form?

The penalty for the late filing of PAN Card 49AA form is a fine of up to Rs. 10,000.

How do I edit pan card 49aa form on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign form 49aa on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I edit pan card correction form pdf 49aa on an Android device?

You can make any changes to PDF files, like pan 49aa form, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

How do I complete form 49aa pdf on an Android device?

Use the pdfFiller mobile app and complete your pan card form filable and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

Fill out your pan card 49aa form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pan Card Correction Form Pdf 49aa is not the form you're looking for?Search for another form here.

Keywords relevant to 49aa form

Related to form 49aa fillable pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.