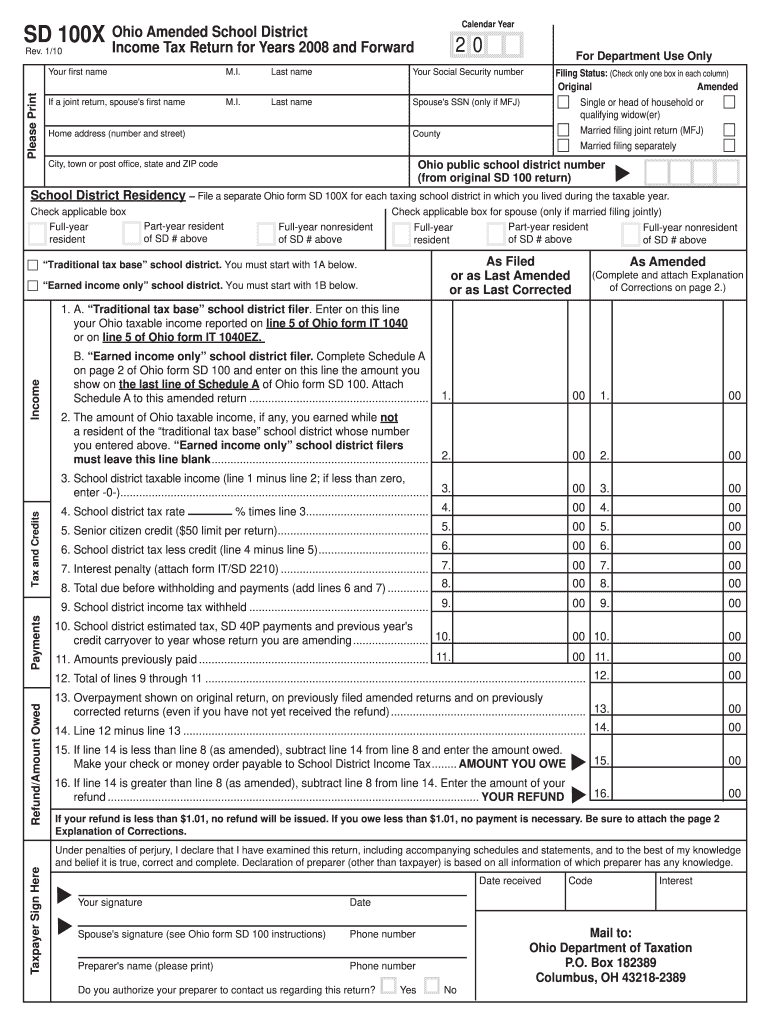

OH SD 100 (Formerly SD 100X) 2010 free printable template

Instructions and Help about OH SD 100 Formerly SD 100X

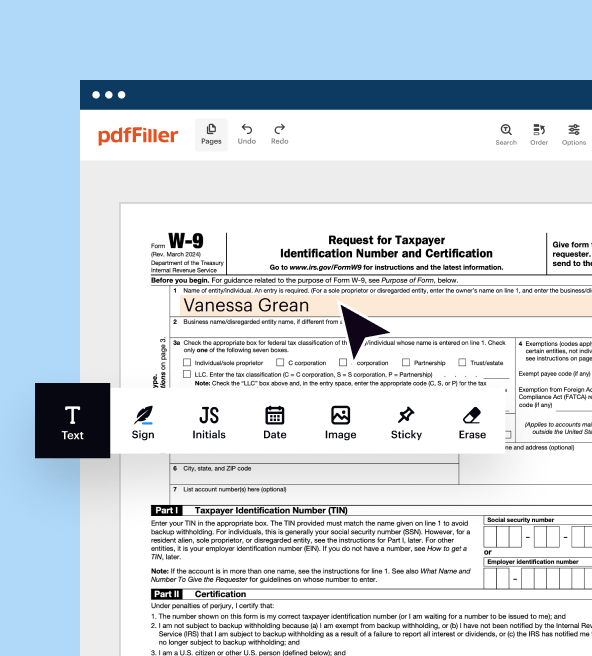

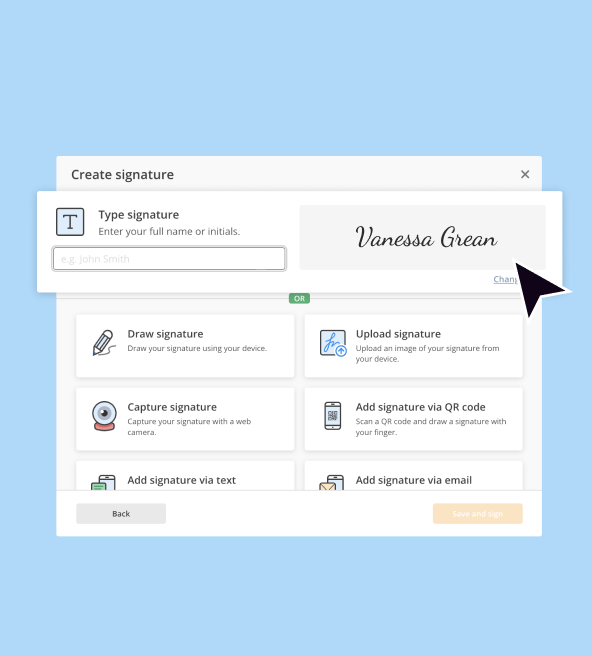

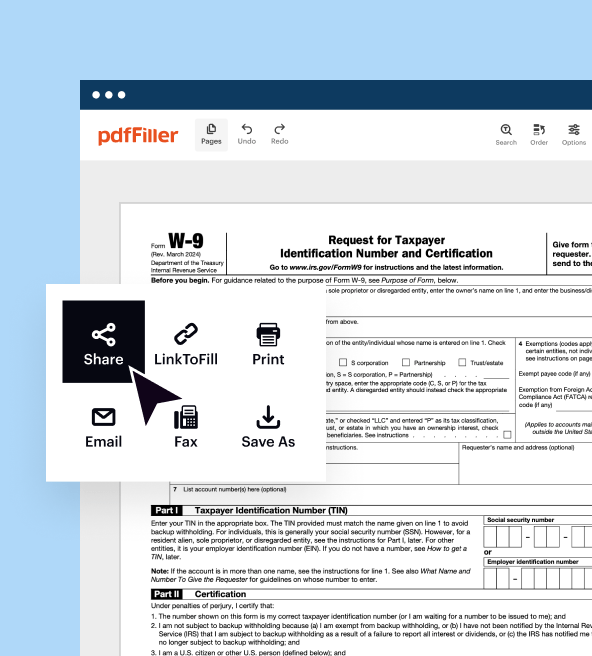

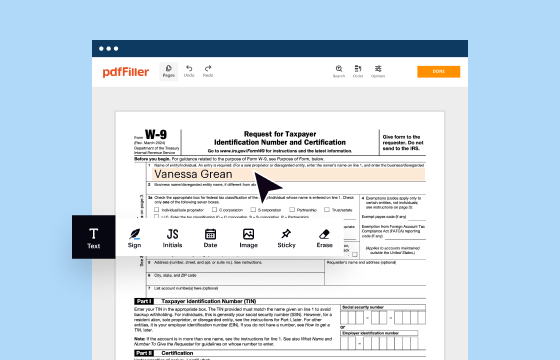

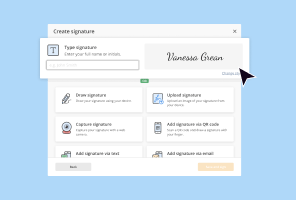

How to edit OH SD 100 Formerly SD 100X

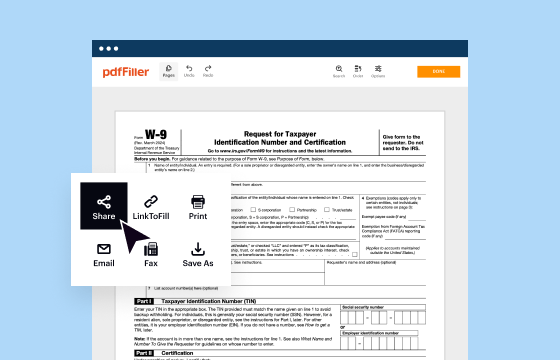

How to fill out OH SD 100 Formerly SD 100X

About OH SD 100 Formerly SD 100X 2010 previous version

What is OH SD 100 Formerly SD 100X?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

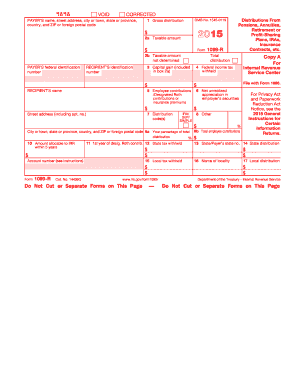

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about OH SD 100 Formerly SD 100X

What should I do if I realize I've made a mistake after filing?

If you notice any errors after filing, you should submit an amended return to correct the mistakes. It's important to do this as soon as possible to avoid potential penalties. The amended return will follow specific instructions for making changes to previously submitted information, ensuring you properly address all discrepancies.

How can I confirm that my e-filed form was received?

To verify the receipt of your e-filed form, you can check your email for a confirmation notification or log into the e-filing system used for submission. Many systems provide a status update feature that allows you to track the processing stages of your filing.

What kind of common errors should I look out for?

Common errors include mismatched identification numbers, incorrect dollar amounts, and failure to include required signatures. Reviewing your information against guidance materials and utilizing error-check features in e-filing software can help you avoid these mistakes.

Are there any special considerations for submitting on behalf of someone else?

When filing on behalf of another individual, it's vital to ensure you have the proper authorization, often through a Power of Attorney (POA) document. This is particularly important for non-residents or foreign payees, as specific rules and regulations might apply.

What should I do if my e-filing submission is rejected?

If your e-filing submission is rejected, the system will typically provide a reason for the rejection. Review this information carefully and make the necessary corrections before resubmitting your form. You may also want to check for common e-file rejection codes to understand the issues better.

See what our users say