OH SD 100 (Formerly SD 100X) 2011 free printable template

Show details

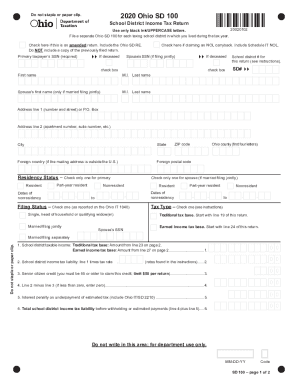

Taxable year beginning in 11020101 Please use only black ink. School District Income Tax Return File a separate Ohio form SD 100 for each taxing school district in which you lived during the taxable year. The amount of Ohio taxable income if any you earned while not a resident of the traditional tax base school district whose number you entered above. NO Payment Enclosed Mail to P. O. Box 182197 Columbus OH 43218-2197 2011 SD 100 If you have a federal extension of time to le please include a...copy or the con rmation number of the extension. pg. Taxpayer Social Security no. required If deceased Rev. 9/11 SD 100 Spouse s Social Security no. only if joint return If deceased Enter school district for this return see pages SD 7-8. SD O. R.C. 5748 O. R.C. 5703. 057 A check box Use UPPERCASE letters. Your rst name M. I. Last name Spouse s rst name only if married ling jointly O. R.C. 5747. 08 Mailing address for faster processing please use a street address City State ZIP code County rst...four letters Home address if different from mailing address please do NOT show city or state Foreign country please provide this information if your mailing address is outside the U.S. Foreign postal code Check applicable box Full-year Full-year nonresident Part-year resident resident of SD above Enter date of nonresidency to Filing Status Check one must match Ohio income tax return Single or head of household or qualifying widow er Married ling jointly Married ling separately enter spouse s SS... check payable to School District Income Tax and Ohio form SD 40P on top of your return. Include forms W-2G and 1099-R if tax was withheld. Due Date O. R*C. 5747. 08 G O. R*C. 5748. 01 D Record Retention O. R*C. 5747. 17 Please do not use staples. Taxpayer Social Security no. required If deceased Rev* 9/11 SD 100 Spouse s Social Security no. only if joint return If deceased Enter school district for this return see pages SD 7-8. SD O. R*C. 5748 O. R*C. 5703. 057 A check box Use UPPERCASE...letters. Your rst name M. I. Last name Spouse s rst name only if married ling jointly O. R*C. 5747. 08 Mailing address for faster processing please use a street address City State ZIP code County rst four letters Home address if different from mailing address please do NOT show city or state Foreign country please provide this information if your mailing address is outside the U*S* Foreign postal code Check applicable box Full-year Full-year nonresident Part-year resident resident of SD above...Enter date of nonresidency to Filing Status Check one must match Ohio income tax return Single or head of household or qualifying widow er Married ling jointly Married ling separately enter spouse s SS check payable to School District Income Tax and Ohio form SD 40P on top of your return* Include forms W-2G and 1099-R if tax was withheld. Place any other supporting documents or statements after the last page of your return* Go paperless. It s FREE Visit tax. ohio. gov to try Ohio I-File. Tax...Type Check one for an explanation see page SD 4 of the instructions I am ling this return because during the taxable year I lived in a n Traditional tax base school district.

pdfFiller is not affiliated with any government organization

Instructions and Help about OH SD 100 Formerly SD 100X

How to edit OH SD 100 Formerly SD 100X

How to fill out OH SD 100 Formerly SD 100X

Instructions and Help about OH SD 100 Formerly SD 100X

How to edit OH SD 100 Formerly SD 100X

Editing the OH SD 100 Formerly SD 100X is straightforward with pdfFiller. First, upload the form from your computer or select it from your stored documents. Utilize the editing tools to modify text or add information as needed. Once the necessary changes are made, save the document for future use or submission.

How to fill out OH SD 100 Formerly SD 100X

Filling out the OH SD 100 Formerly SD 100X requires specific information about the tax situation. Start by entering your identifying information at the top of the form. Make sure to provide details such as your name, address, and tax identification number. Follow the instructions carefully for each section, ensuring accuracy in reporting. Lastly, review the completed form before submission to confirm that all entries are correct.

About OH SD 100 Formerly SD 100X 2011 previous version

What is OH SD 100 Formerly SD 100X?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About OH SD 100 Formerly SD 100X 2011 previous version

What is OH SD 100 Formerly SD 100X?

OH SD 100 Formerly SD 100X is a tax form used primarily in Ohio for reporting certain tax-related information. This form is specifically utilized by businesses to report various types of payments made during the tax year. By submitting this form, taxpayers ensure compliance with state tax regulations.

What is the purpose of this form?

The purpose of the OH SD 100 Formerly SD 100X is to report specific payments to the state of Ohio. This includes payments made to contractors, interest, dividends, and other miscellaneous payments. Accurate reporting through this form helps to maintain the integrity of the tax system and ensures proper tax collection.

Who needs the form?

Any business or entity that makes reportable payments to individuals or other businesses in Ohio must file the OH SD 100 Formerly SD 100X. This includes, but is not limited to, contractors, service providers, and other payees receiving specific types of payments. Compliance is crucial for avoiding penalties and ensuring accurate tax reporting.

When am I exempt from filling out this form?

You may be exempt from filing the OH SD 100 Formerly SD 100X if your payments do not meet the threshold amounts set by the state or if the payments are made to exempt organizations. Additionally, if your business is not making any reportable payments during the tax year, you would not be required to complete this form.

Components of the form

The OH SD 100 Formerly SD 100X includes sections for entering payer information, recipient information, and details of the payments made. The form also typically requires signatures and dates to verify accuracy. It is essential to ensure that each component is filled out completely and correctly to avoid delays or issues with processing.

What are the penalties for not issuing the form?

Failure to issue the OH SD 100 Formerly SD 100X accurately and on time can result in significant penalties. The Ohio Department of Taxation may impose fines for late submissions or for failing to file altogether. Businesses should also be aware that incorrect reporting can trigger audits or additional scrutiny from tax authorities.

What information do you need when you file the form?

When filing the OH SD 100 Formerly SD 100X, you will need detailed information about the payer and the recipient, including names, addresses, and tax identification numbers. You will also need a summary of the payments made during the reporting period, along with any applicable amounts that need to be reported. Ensuring all information is accurate is crucial for compliance.

Is the form accompanied by other forms?

The OH SD 100 Formerly SD 100X may need to be submitted alongside other related tax forms, depending on the specific circumstances of the taxpayer. This could include forms that report federal income taxes or other state-required documents. Always check Ohio tax guidelines for specific filing requirements.

Where do I send the form?

Completed OH SD 100 Formerly SD 100X forms should be sent to the Ohio Department of Taxation. The submission can typically be made via mail or electronic methods, depending on current state regulations. Ensure to confirm the correct address or electronic submission link for your specific filing year.

See what our users say