Seterus Uniform Borrower Assistance Form 2012 free printable template

Show details

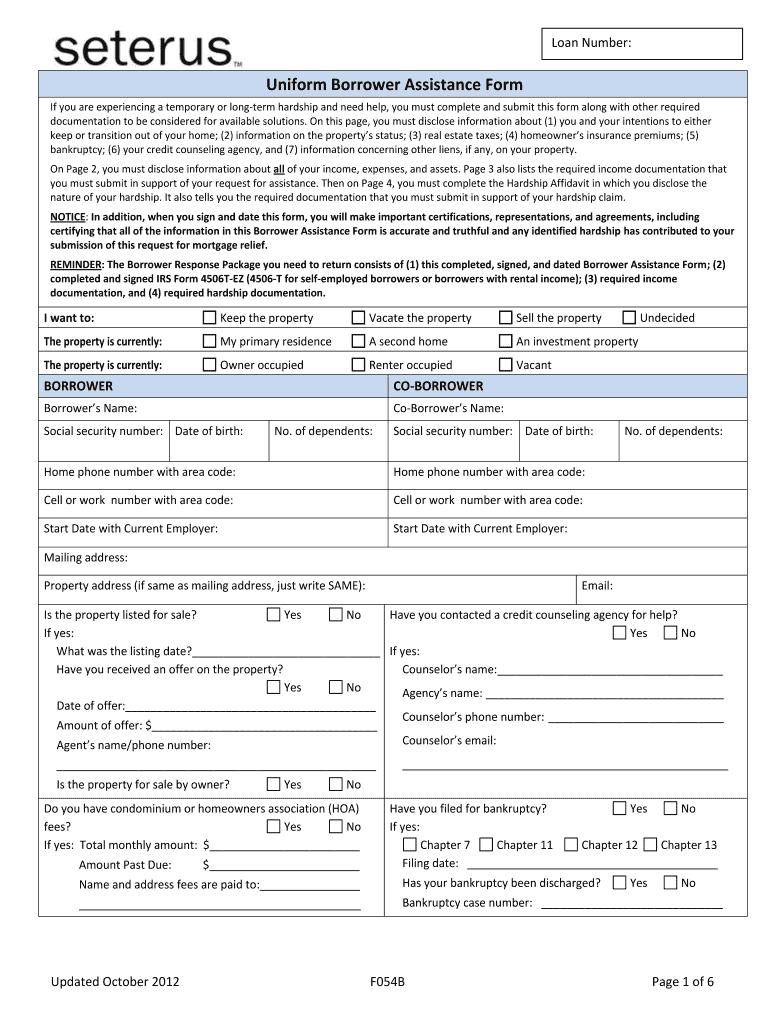

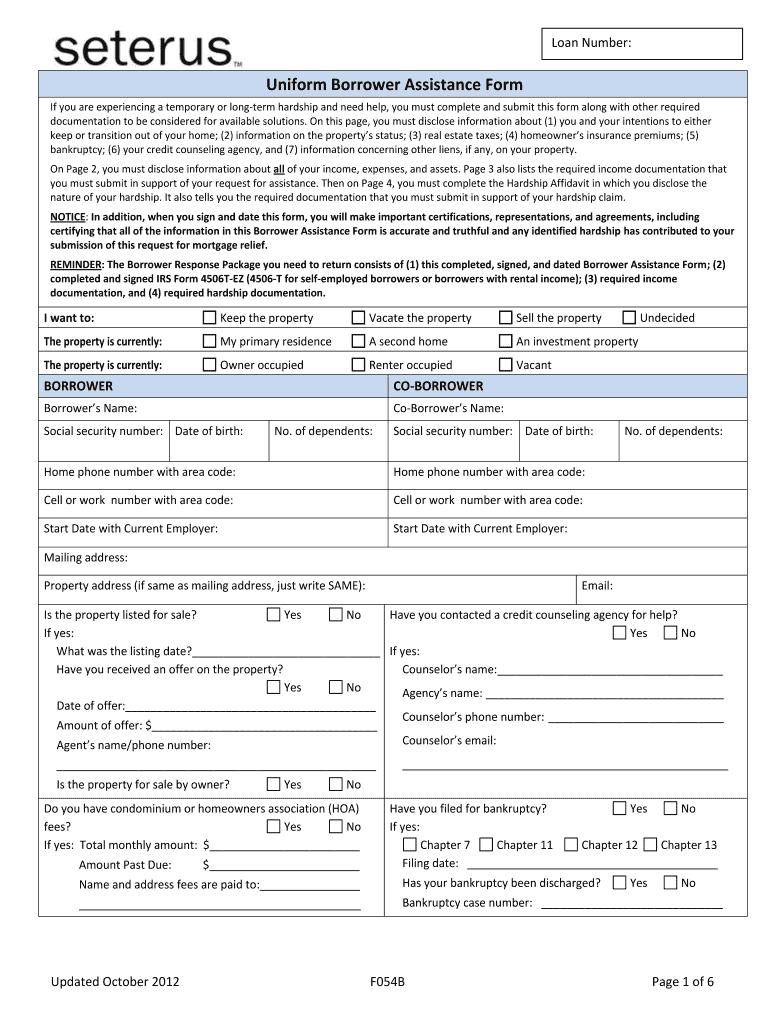

Loan Number Uniform Borrower Assistance Form If you are experiencing a temporary or long term hardship and need help you must complete and submit this form along with other required documentation to be considered for available solutions.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your uniform borrower assistance form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your uniform borrower assistance form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit uniform borrower assistance form 2020 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit f054 freddie download form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Seterus Uniform Borrower Assistance Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out uniform borrower assistance form

01

To fill out the uniform borrower assistance form, start by gathering all the necessary documents such as pay stubs, tax returns, bank statements, and any other financial information that may be required.

02

Carefully read through the instructions and guidelines provided with the form to ensure a complete and accurate completion.

03

Begin filling out the form by providing your personal information, including your name, address, contact details, and social security number.

04

Next, detail your current employment status, including your employer's name, address, and contact information.

05

Indicate the type of assistance you are seeking, such as loan modification, forbearance, or another form of borrower assistance.

06

Provide a detailed explanation of your financial hardship or the reason why you require assistance. Include any supporting documentation or evidence to strengthen your case.

07

Fill out the sections related to your income and expenses, including details of your monthly income, expenses, and debts.

08

If applicable, include information about any other assets you may have, such as property or investments.

09

Review your completed form for any errors or omissions before signing and dating it.

10

Finally, submit the completed form to the appropriate entity, such as your loan servicer or mortgage lender.

11

The uniform borrower assistance form is typically needed by individuals who are facing financial hardship and are seeking assistance with their mortgage payments or loan terms. This may include homeowners who are struggling to make their mortgage payments due to job loss, income reduction, medical expenses, or other unforeseen circumstances. The form allows borrowers to formally request assistance and provide necessary financial information for review and evaluation.

Video instructions and help with filling out and completing uniform borrower assistance form 2020

Instructions and Help about uniform borrower from

Fill you f054b bank online : Try Risk Free

People Also Ask about uniform borrower assistance form 2020

What is proof of residency letter for SNAP benefits near New York NY?

What documents do you need to apply for food stamps in NYC?

How to apply for NY Public Assistance?

What is NYS OTDA State Supplement Program?

How do I get approved for food stamps in NYC?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is uniform borrower assistance form?

Uniform Borrower Assistance Forms (UBAs) are standardized forms used by borrowers to apply for financial assistance from lenders or loan servicers. The UBA is designed to help borrowers provide necessary information to lenders and loan servicers quickly and accurately. UBAs can be used to apply for a variety of loan modification programs, loan forbearance, short sales, deed-in-lieu of foreclosure, and other types of loan assistance.

What information must be reported on uniform borrower assistance form?

The information required on a Uniform Borrower Assistance Form typically includes the borrower’s name, contact information, loan information, income and expenses, financial hardship details, and a request for assistance.

Who is required to file uniform borrower assistance form?

Borrowers who are seeking assistance or loan modifications through their mortgage companies are required to file a Uniform Borrower Assistance Form. This form is typically used in the United States and is required by many mortgage lenders and loan servicers as part of the application process for loan modification programs.

How to fill out uniform borrower assistance form?

To effectively fill out a uniform borrower assistance form, follow the steps below:

1. Obtain the form: Obtain a copy of the borrower assistance form from your lender. Ensure that you have the most recent version to avoid any discrepancies.

2. Read instructions: Start by carefully reading the instructions provided at the beginning of the form. Understand the purpose of the form, its sections, and any additional documents that may be required.

3. Personal information: Provide your personal information, such as your name, address, phone number, and email address. Include any other details that may be requested, such as your social security number or loan account number.

4. Employment information: Enter your current employment information, including your employer's name, address, and phone number. Indicate your job title, the number of years you have been with the company, and your monthly income.

5. Financial information: Fill in the section that focuses on your financial situation. This includes information on your household income, any additional sources of income, and your monthly expenses. Be as accurate and detailed as possible to ensure a comprehensive evaluation of your financial circumstances.

6. Hardship explanation: Explain the specific hardship you are facing, leading to your inability to meet your loan obligations. Provide a detailed account and any supporting documentation, such as medical bills, termination letters, or pay stubs reflecting a decrease in income. Be honest and clear in your explanation.

7. Additional assistance: If you are seeking specific assistance or modification options, check the appropriate box and provide details. This could include requesting a loan forbearance, loan modification, or any other available alternatives.

8. Supporting documents: Review the required supporting documentation section and gather all the necessary paperwork. This might include recent bank statements, tax returns, proof of income, or any other documents specified by your lender.

9. Signature: Sign and date the form, certifying that all the information provided is accurate and complete to the best of your knowledge.

10. Submission: Follow the instructions provided by your lender on how to submit the form. This can typically be done either electronically or by mailing a physical copy. Ensure you make copies of all documents for your records.

Remember, the process may vary depending on the lender and specific circumstances, so it's always essential to carefully review the provided instructions and seek any necessary clarification from your lender.

What is the purpose of uniform borrower assistance form?

The purpose of the uniform borrower assistance form is to provide a standardized and comprehensive document that borrowers can use to apply for various types of assistance and loan modifications. This form is typically used by borrowers who are facing financial hardship or struggling to make their loan payments, such as those with mortgages, student loans, or other types of loans. By consolidating all the necessary information into one form, it makes the application process more streamlined for borrowers and allows lenders to efficiently evaluate and process the requests for assistance.

What is the penalty for the late filing of uniform borrower assistance form?

The penalty for the late filing of a uniform borrower assistance form may vary depending on the specific situation and the lender involved. In general, late filing may result in delays in processing the borrower's request for assistance or modifications to their loan terms. It is important for borrowers to check with their specific lender or loan servicer to understand the potential consequences and penalties for late filing.

Can I create an eSignature for the uniform borrower assistance form 2020 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your f054 freddie download form and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit seterus form pdf straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing uniform borrower asistance form right away.

How do I fill out the uniform asistance from form on my smartphone?

Use the pdfFiller mobile app to fill out and sign uniform asistance from form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Fill out your uniform borrower assistance form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Seterus Form Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to uniform assistance form

Related to form fannie f054 fillable

If you believe that this page should be taken down, please follow our DMCA take down process

here

.