Get the free irs mileage log template form

Get, Create, Make and Sign

Editing irs mileage log template online

How to fill out irs mileage log template

How to fill out printable mileage log:

Who needs printable mileage log:

Video instructions and help with filling out and completing irs mileage log template

Instructions and Help about mileage log form

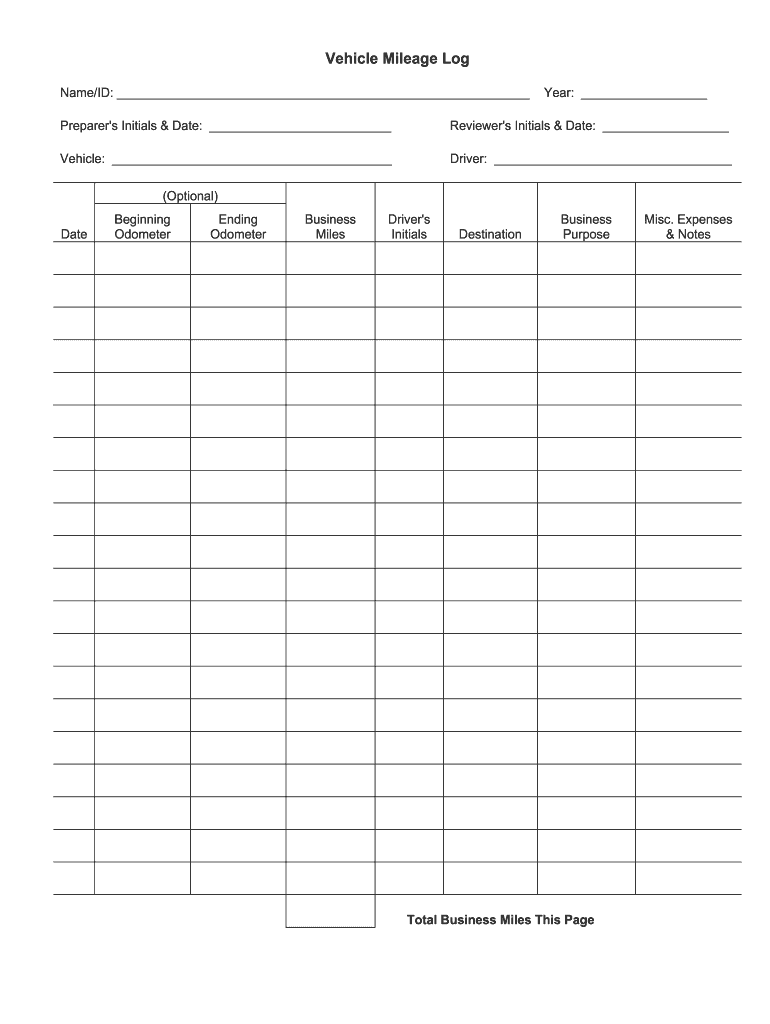

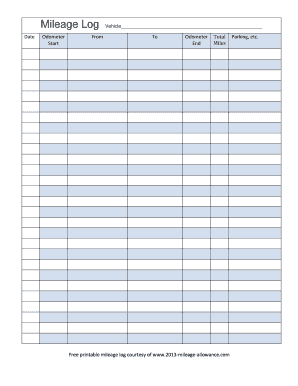

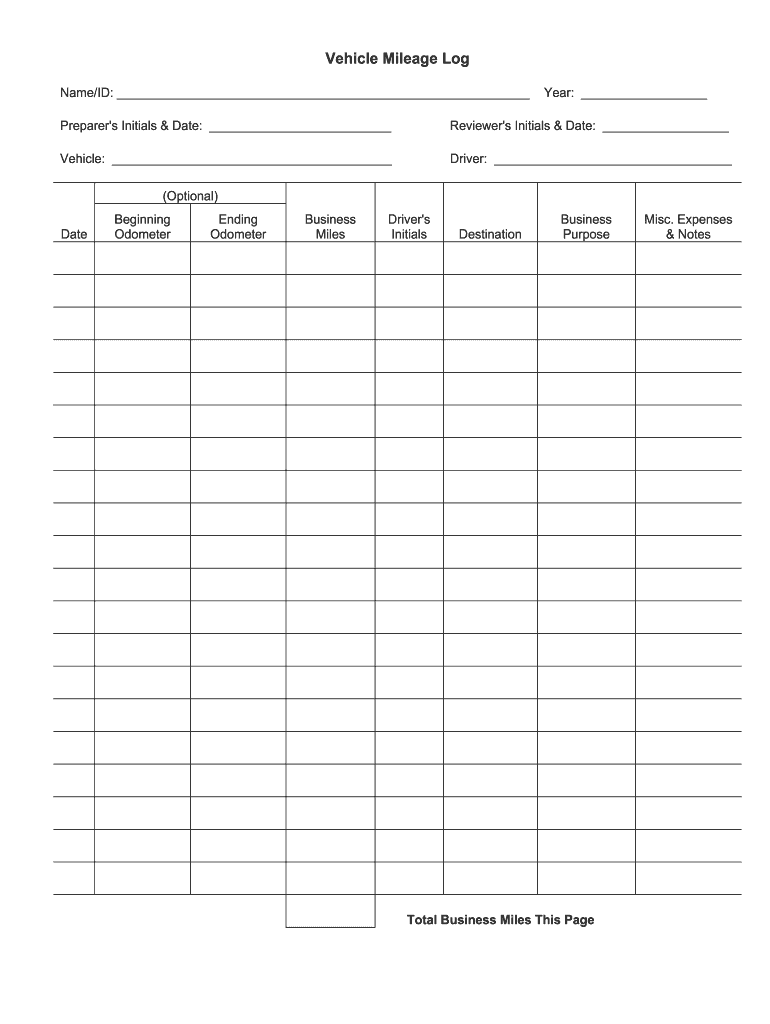

Music welcome to the GTA accounting YouTube channel where we have the latest accounting and tax tips watch our videos and feel free to ask questions in the comment section below click here to subscribe to our channel keep a mileage log to support your vehicle expenses in tax return do you often use your vehicle for business if you use your personal car to earn some form of business income you can claim the money you've used as a business expense in your income tax filing you'll need a mileage log in order to claim this expense this log is simply a way of substantiating your claim we will share with you details below on how to keep a mileage log and the kind of motor vehicle expenses that you can claim how to keep your mileage log the CRA will require you to keep a mileage log for at least one year which is evidence for your car expense claims this logbook should have the following information the date in which the vehicle is used for business the starting point and destination the purpose of the trip the cars starting and ending mileage the total miles covered for that trip you can get a mileage log book at the local office supply store the other option would be to find a template online which you can copy into Word or Excel if you don't like the idea of manually entering the trip information in a logbook a good option would be to use a tracking application on your smartphone there are apps that have been designed to keep track of miles driven for business purposes this is especially useful if you make so many business trips the app can even calculate and provide your mileage summary on your tax return how to avoid your claim being rejected the CRA is very keen to ensure that taxpayers do not claim all their car mileage for business use if you do this it will raise a red flag and attract a lot of scrutiny from the tax authorities therefore take it upon yourself to find out how many miles or kilometers you drove that are not related to your business you can figure this out by checking the miles you've driven over the course of a year and at the very beginning the simplified logbook the CRA has come up with a way to help small businesses simplify the record-keeping process when they want to clean via Kodak Spence's in tax return for you to use this you will need to have maintained a mileage log for at least one year in 2009 or later also you must have used the car for business at least 10 for the year which you will be using this simplified logbook once you have fulfilled all the requirements to use a simplified logbook the CRA will allow you to keep a logbook for only 3 months and after that calculate your business use using the following calculation sample year period base year period base year annual percent equals calculated annual business use there's information that you'll need in order to use this formula such as your business used for that three-month period for the base year you'll need this to compare with your sample year period Music...

Fill mileage log template : Try Risk Free

People Also Ask about irs mileage log template

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your irs mileage log template online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.