What is Mileage Log Template?

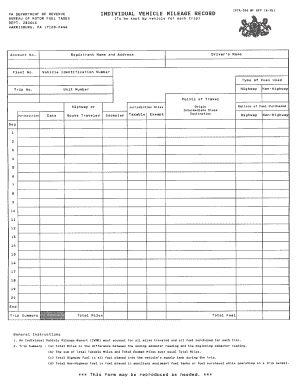

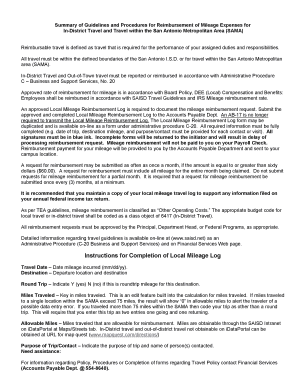

A Mileage Log Template is a document that helps individuals keep track of their mileage for business or personal purposes. It serves as a record of the distance traveled during specific trips, including the starting and ending locations, the purpose of the trip, and the total mileage covered. This template can be used by employees, entrepreneurs, and self-employed individuals to accurately track their business mileage and calculate potential tax deductions.

What are the types of Mileage Log Template?

There are various types of Mileage Log Templates available to cater to different needs and preferences. Some common types include:

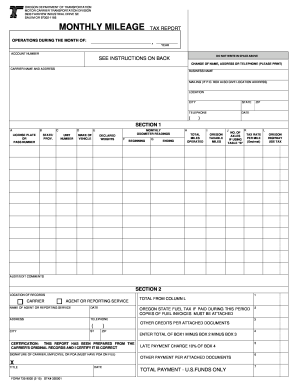

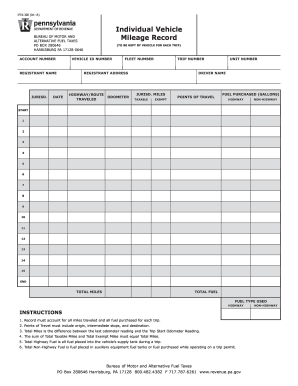

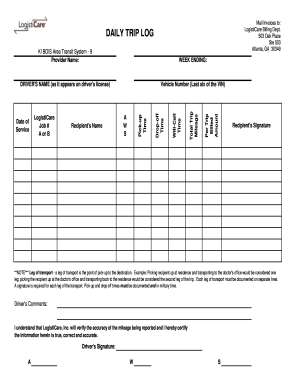

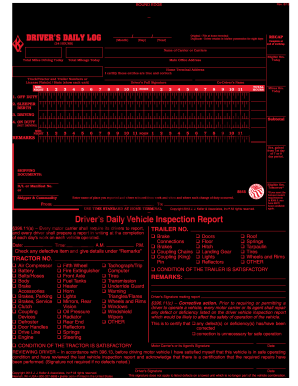

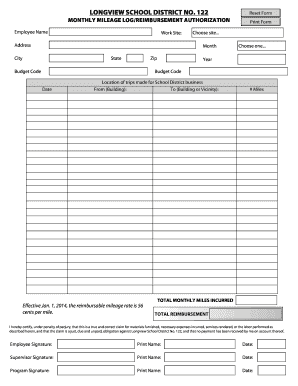

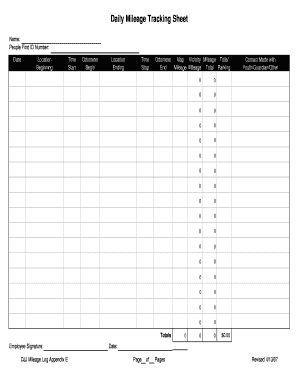

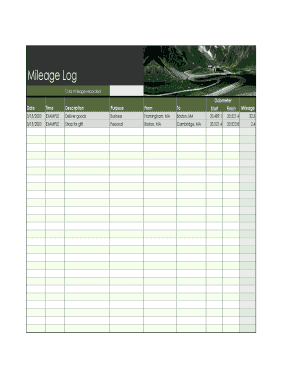

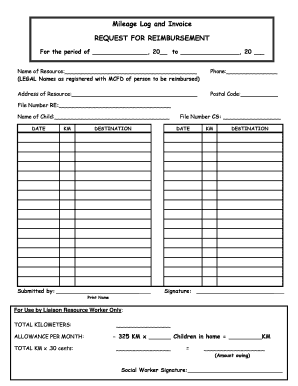

Basic Mileage Log Template: This template provides a simple layout for recording mileage details such as trip dates, starting and ending locations, and total miles traveled.

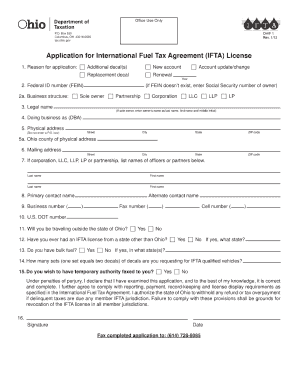

Detailed Mileage Log Template: This template includes additional fields to capture more detailed information such as the purpose of the trip, client or project details, and any additional expenses incurred.

Electronic Mileage Log Template: This template is designed to be used in electronic formats, allowing users to conveniently input and calculate mileage data using digital tools or apps.

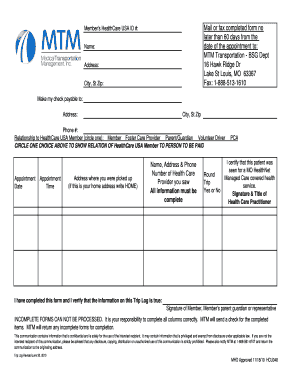

Printable Mileage Log Template: This template can be printed and filled in manually, making it suitable for those who prefer a physical copy or need to keep a hard copy of their mileage records.

Customizable Mileage Log Template: This template allows users to modify and adapt it according to their specific requirements, adding or removing fields as needed.

How to complete Mileage Log Template

Completing a Mileage Log Template is a straightforward process. Follow these steps to accurately fill in the required information:

01

Open the selected Mileage Log Template on pdfFiller or any other PDF editor.

02

Fill in the necessary details such as the date of the trip, starting and ending locations, purpose of the trip, and total mileage.

03

If applicable, include additional information such as the client or project details, any expenses incurred during the trip, or any notes related to the mileage.

04

Save the completed template for future reference or print a physical copy if required.

05

Regularly update and maintain the mileage log whenever a new trip is made, ensuring accurate and up-to-date records.

By using pdfFiller, users can conveniently create, edit, and share their Mileage Log Templates online. With access to unlimited fillable templates and powerful editing tools, pdfFiller is the perfect PDF editor for efficiently managing and organizing your mileage records.