Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ifta mileage sheet?

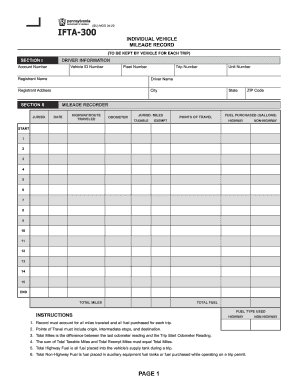

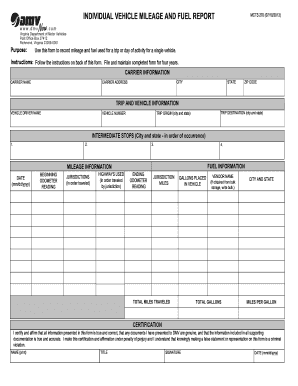

IFTA, or the International Fuel Tax Agreement, is an agreement among the 48 contiguous states of the United States and the ten Canadian provinces, which simplifies the reporting and payment of fuel taxes by interstate and international motor carriers. An IFTA mileage sheet is a document that is used to track and record the distance traveled by a commercial vehicle in each jurisdiction for which fuel taxes are due. It typically includes information such as the date, starting and ending odometer readings, total miles driven, and the jurisdictions traveled in. This sheet is important for accurately calculating and reporting the fuel taxes owed by motor carriers.

Who is required to file ifta mileage sheet?

IFTA mileage sheets are required to be filed by commercial motor carriers that operate vehicles in multiple jurisdictions (states or provinces) within the International Fuel Tax Agreement (IFTA) network. These carriers must file an IFTA quarterly fuel tax return, which includes the reporting of miles traveled in each jurisdiction, gallons of fuel consumed, and taxes owed or refunds due.

How to fill out ifta mileage sheet?

To fill out an International Fuel Tax Agreement (IFTA) mileage sheet, follow these steps:

1. Start by entering your company name, address, and IFTA license number at the top of the form.

2. Enter the reporting period for which you are completing the mileage sheet. This is typically a three-month period (quarterly).

3. List the vehicle information for each qualified motor vehicle (QMV) that your company owns or operates. This includes the vehicle identification number (VIN), license plate number, and the state or jurisdiction in which the vehicle is registered.

4. For each QMV, record the total miles driven during the reporting period. You should separate miles driven in each member jurisdiction (states or provinces).

5. Calculate the total taxable miles for each jurisdiction. These are the miles driven in member jurisdictions where you have a fuel tax obligation. It is important to differentiate between interstate (crossing state lines) and intrastate (within a state) mileage.

6. Determine the total non-taxable miles for each jurisdiction. These are the miles driven in member jurisdictions where you are exempt from paying fuel taxes. Examples of non-taxable mileage include out-of-route miles and miles driven on Indian reservations.

7. Calculate the total miles for each jurisdiction by adding the taxable and non-taxable miles for that jurisdiction.

8. Using the jurisdiction tax rates, calculate the total miles subject to tax for each jurisdiction. Multiply the total taxable miles by the appropriate tax rate for that jurisdiction.

9. Calculate the total tax for each jurisdiction by multiplying the total taxable miles by the jurisdiction tax rate. Sum up the taxable miles, taxes due, and non-taxable miles for all jurisdictions to get the total for the reporting period.

10. Finally, sign and date the mileage sheet, certifying that the information provided is accurate and complete.

It is crucial to maintain accurate records of mileage and supporting documentation, such as trip logs or electronic logging device (ELD) data, to back up the reported mileage.

What is the purpose of ifta mileage sheet?

The purpose of an International Fuel Tax Agreement (IFTA) mileage sheet is to record and track the distance traveled by a commercial motor vehicle (CMV) in each jurisdiction or state for the purpose of calculating and reporting fuel taxes. It is used by trucking companies and motor carriers to ensure accurate reporting and payment of fuel taxes to the respective jurisdictions in which they operate. The sheet includes details such as the date, starting and ending location, distance traveled, and the jurisdiction crossed.

What information must be reported on ifta mileage sheet?

On an IFTA (International Fuel Tax Agreement) mileage sheet, the following information must be reported:

1. Trip Information: Date of trip, trip number, beginning and ending odometer readings, and total trip miles.

2. Unit Information: Vehicle identification number (VIN), license plate number, state/province, and carrier identification number (if applicable).

3. Jurisdiction Information: Indicate the states/provinces traveled through during the trip and the miles traveled in each jurisdiction.

4. Fuel Information: Fuel purchase date, fuel vendor name, invoice/receipt number, fuel type (diesel, gasoline, etc.), total gallons/liters purchased, and fuel cost.

5. Distance Information: Total miles traveled in each jurisdiction during the reporting period, broken down by individual trips.

6. Calculation Information: Calculate and report taxable and non-taxable miles, fuel consumed in each jurisdiction, and the fuel tax due/credit for each jurisdiction.

7. Authorized Signature: The sheet must be signed by an authorized individual representing the motor carrier.

It is important to note that the specific requirements for an IFTA mileage sheet may vary slightly depending on the jurisdiction. It is advisable to consult the IFTA regulations and guidelines of the respective jurisdiction for accurate and up-to-date reporting requirements.

What is the penalty for the late filing of ifta mileage sheet?

The penalty for late filing of an IFTA (International Fuel Tax Agreement) mileage sheet can vary depending on the jurisdiction. However, typically, a late filing penalty may range from a fixed amount per month, such as $50, to a percentage of the owed taxes. It's important to note that these penalties can accrue over time until the filing and payment is made. To determine the exact penalty for late filing, it is recommended to consult the specific regulations and guidelines established by the relevant state or jurisdiction's tax authority.

How can I edit ifta mileage sheet from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your ifta trip sheets template form into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I edit ifta spreadsheet online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your ifta trip sheets to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I fill out the ifta mileage spreadsheet form on my smartphone?

Use the pdfFiller mobile app to fill out and sign ifta form pennsylvania. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.