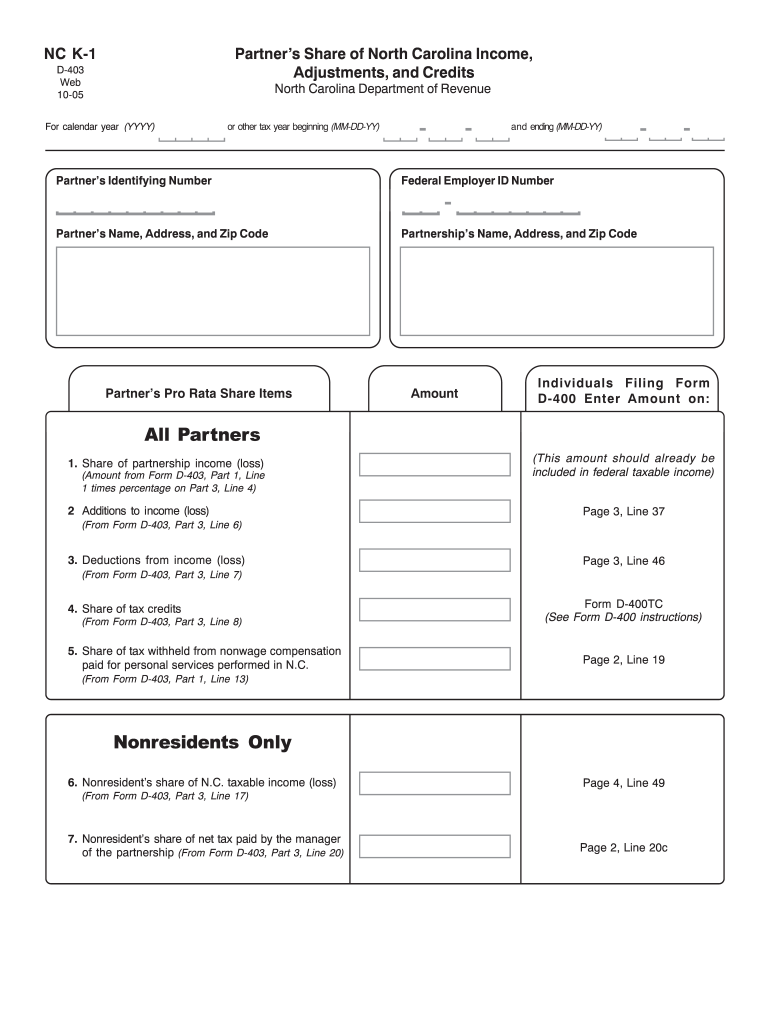

NC DoR D-403 K-1 2005 free printable template

Show details

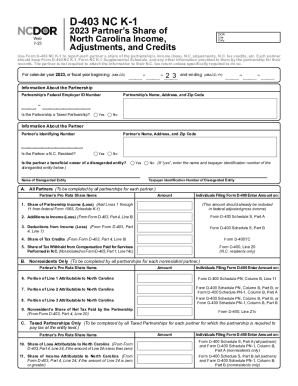

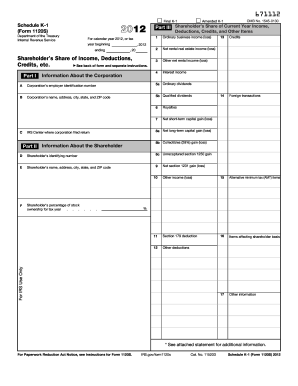

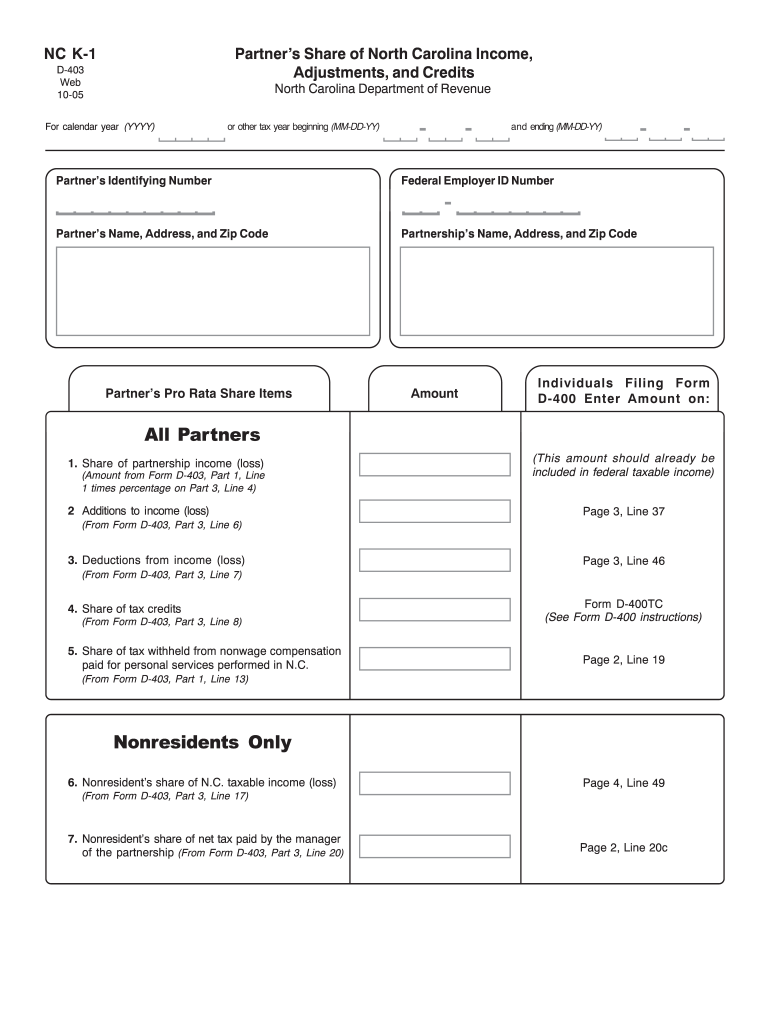

NC K-1 Partner s Share of North Carolina Income Adjustments and Credits D-403 Web 10-05 North Carolina Department of Revenue For calendar year YYYY or other tax year beginning MM-DD-YY and ending MM-DD-YY Partner s Identifying Number Federal Employer ID Number Partner s Name Address and Zip Code Partnership s Name Address and Zip Code Partner s Pro Rata Share Items Amount Individuals Filing Form D-400 Enter Amount on All Partners 1. Share of part...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your nc k 1 2005 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nc k 1 2005 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nc k 1 2005 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit nc k 1 2005. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

NC DoR D-403 K-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out nc k 1 2005

How to fill out NC K-1 2005:

01

Begin by gathering all the necessary information and documents needed to complete the form. This may include tax return forms, financial statements, and partnership agreements.

02

Read through the instructions provided with the NC K-1 2005 form. Familiarize yourself with the requirements and any specific guidelines or provisions.

03

Start by entering the name and identification number of the partnership or S corporation for which you are preparing the NC K-1 2005 form.

04

Provide the personal information of the partner or shareholder for whom the form is being prepared. This includes their name, address, and social security number.

05

Complete the income section of the form by reporting the partner's or shareholder's share of the partnership's or S corporation's income, deductions, gains, and losses. Ensure all necessary calculations are accurate.

06

Include any additional information required for specific items on the form, such as supplemental tax information or specific partnership activities.

07

Review the completed NC K-1 2005 form for accuracy and completeness. Make sure there are no errors or missing information.

08

Submit the form according to the instructions provided, whether it is by mail, electronically, or through another approved method.

Who needs NC K-1 2005?

01

Individuals who are partners in a partnership that files a North Carolina tax return.

02

Shareholders of an S corporation that operates in North Carolina and files a North Carolina tax return.

03

Anyone who receives income, deductions, gains, or losses from a partnership or S corporation that is required to file a North Carolina tax return and issues the NC K-1 2005 form to report such information.

Note: It is always recommended to consult with a tax professional or refer to the specific instructions provided by the North Carolina Department of Revenue when filling out any tax-related forms.

Instructions and Help about nc k 1 2005

Fill form : Try Risk Free

People Also Ask about nc k 1 2005

What is form E-588 NC sales tax refund?

What form do I use for sales tax reimbursement in NC?

What is D 403 NC k1?

Can I get tax forms mailed to me?

Is there an eFile form for North Carolina?

What is a E 595E form?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is nc k 1 form?

NC k 1 form is a form from the North Carolina Department of Revenue. It is used to report North Carolina withholding taxes for an employee.

Who is required to file nc k 1 form?

NC K-1 forms must be filed by any individual or business that is a partner in a North Carolina partnership.

How to fill out nc k 1 form?

To fill out an NC K-1 form, you will need the following information:

1. Your name, address, and Social Security Number

2. Your employer's name and Federal Employer Identification Number (FEIN)

3. Your North Carolina withholding tax account number

4. Your total wages subject to North Carolina withholding

5. Your total North Carolina withholding taxes withheld

6. The period for which you are filing the form (monthly, quarterly, etc)

7. Your signature and date

Once you have all of the required information, you can fill out the form by completing each of the sections. The sections include your personal information, wages subject to withholding, and your withholding taxes. Once you have completed the form, you can submit it to the North Carolina Department of Revenue.

What information must be reported on nc k 1 form?

The NC K-1 form requires taxpayers to report their share of income, deductions, credits, and other items from a partnership, S corporation, estate, or trust. This includes items such as income, deductions, credits, non-dividend distributions, and basis information.

What is the penalty for the late filing of nc k 1 form?

The penalty for late filing of Form NC K-1 varies depending on the specific circumstances and the state regulations. In general, if the Form NC K-1 is filed late, the taxpayer may be subject to penalties and interest charges. These penalties can range from a percentage of the tax owed to a flat fee per day of delay. It is crucial to check the specific instructions and guidelines provided by the North Carolina Department of Revenue or consult a tax professional for accurate information regarding penalties for late filing of Form NC K-1.

How do I modify my nc k 1 2005 in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your nc k 1 2005 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I modify nc k 1 2005 without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your nc k 1 2005 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I edit nc k 1 2005 on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing nc k 1 2005.

Fill out your nc k 1 2005 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.