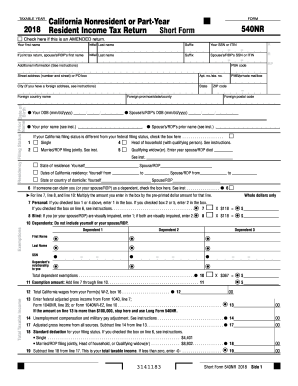

CA FTB 540NR Short 2013 free printable template

Show details

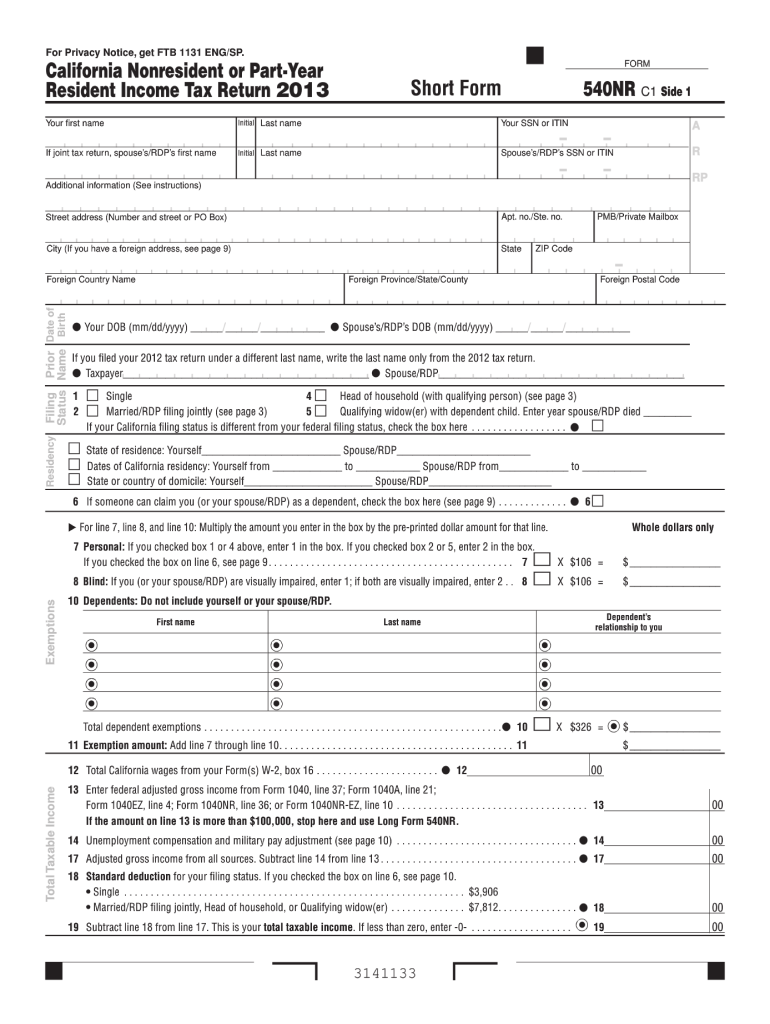

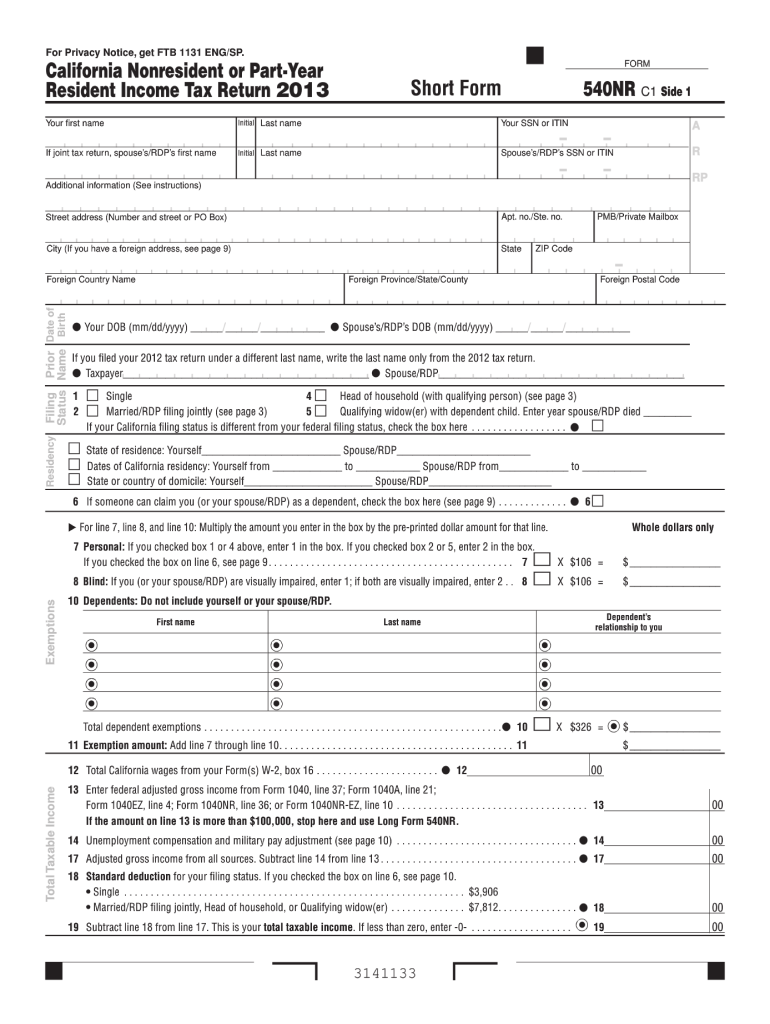

424 Keep Arts in Schools Fund. 425 American Red Cross California Chapters Fund. 426 120 Add code 401 through code 426. This is your total contribution. Side 2 Short Form 540NR C1 2013 You Owe 121 AMOUNT YOU OWE. Add line 104 and line 120 see page 10. Get instructions for 540NR Short Form For Privacy Notice get FTB 1131 ENG/SP. California Nonresident or Part-Year Resident Income Tax Return 2013 FORM 540NR C1 Side 1 Short Form Your first name Initial Last name Your SSN or ITIN A If joint tax...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your california 540nr transcript 2013 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your california 540nr transcript 2013 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit california 540nr transcript 2013 online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit california 540nr transcript 2013. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

CA FTB 540NR Short Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out california 540nr transcript 2013

How to fill out California 540NR transcript 2013:

01

Gather all necessary documents: Before filling out the transcript, ensure you have all relevant financial documents, such as W-2 forms, 1099 forms, and any additional supporting documentation.

02

Obtain the California 540NR tax form: You can find the California 540NR tax form for the year 2013 on the official website of the California Franchise Tax Board or visit local tax offices. Download and print the form.

03

Fill out personal information: Begin by entering your full name, Social Security number, address, and other relevant personal information accurately in the designated fields on the form.

04

Determine your filing status: Choose the appropriate filing status that applies to you for the tax year 2013. The options include single, head of household, married filing jointly, married filing separately, or qualifying widow(er).

05

Calculate your income: Enter your income details in the appropriate sections of the form. This includes income from wages, self-employment, interest, dividends, capital gains, rental income, and any other relevant sources. Ensure accuracy and double-check your calculations.

06

Deductions and exemptions: Deduct eligible expenses and claim any exemptions you qualify for. These may include deductions for student loan interest, education expenses, health savings account contributions, and other applicable deductions.

07

Compute your tax liability: Use the provided instructions and tax tables to determine your tax liability based on your income and deductions. Be sure to check the correct table that corresponds to the year 2013.

08

Report any credits: If you qualify for any tax credits, such as the Child Tax Credit, the Savers Credit, or the Earned Income Tax Credit, enter the relevant information in the appropriate section of the form.

09

Review for accuracy: Take the time to carefully review your filled-out California 540NR transcript for any errors or omissions. Ensure all calculations are accurate, and all required fields are complete.

10

Sign and submit: Once you have reviewed and confirmed the accuracy of your transcript, sign and date it. Make a copy for your records and submit the original transcript to the appropriate tax authority along with any required payments.

Who needs California 540NR transcript 2013?

Individuals who were non-residents of California but earned income from California sources in the tax year 2013 may need to file the California 540NR tax form and obtain the corresponding transcript. This includes individuals who met the criteria for non-residency, such as temporary workers, students, or individuals living out of state but earning income from California-based investments, rental properties, or businesses. The 540NR transcript serves as proof of income and tax liability for the specified year. Remember to consult with a tax professional or the California Franchise Tax Board if you have any specific questions or concerns regarding your filing requirements.

Fill form : Try Risk Free

People Also Ask about california 540nr transcript 2013

Who must file form 540?

Is a non resident required to file income tax return?

Who is considered California resident?

What is the tax rate for California group nonresident return?

Who needs to file California nonresident tax return?

What is California 540 use tax?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is california 540nr transcript form?

The California 540nr transcript form is a tax form used by nonresident aliens and certain other nonresident individuals to report California source income.

Who is required to file california 540nr transcript form?

Nonresident aliens and certain other nonresident individuals who have California source income are required to file the California 540nr transcript form.

How to fill out california 540nr transcript form?

The California 540nr transcript form can be filled out manually or electronically by providing all the required information such as personal details, income sources, deductions, and credits.

What is the purpose of california 540nr transcript form?

The purpose of the California 540nr transcript form is to report California source income and calculate the amount of tax owed to the state.

What information must be reported on california 540nr transcript form?

Information such as personal details, California source income, deductions, and credits must be reported on the California 540nr transcript form.

When is the deadline to file california 540nr transcript form in 2023?

The deadline to file the California 540nr transcript form in 2023 is April 15th.

What is the penalty for the late filing of california 540nr transcript form?

The penalty for late filing of the California 540nr transcript form is a percentage of the tax owed, with a minimum penalty of $135.

Where do I find california 540nr transcript 2013?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the california 540nr transcript 2013. Open it immediately and start altering it with sophisticated capabilities.

How do I make changes in california 540nr transcript 2013?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your california 540nr transcript 2013 and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How can I edit california 540nr transcript 2013 on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing california 540nr transcript 2013 right away.

Fill out your california 540nr transcript 2013 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.