I am a resident of Washington State. My Washington State mailing address is shown below.

For residents who are out-of-state:

I am a resident of: City State (if your state doesn't accept zip codes): I am an out-of-state resident. What state are you from?

How old are you? (I'm under 18 for federal income tax purposes)

I am an individual who is the qualified widow(er) of a tax-exempt person. My husband who is not a qualified widow(er) of a tax-exempt person died in 2015 so that I am the sole surviving wife. How old do you want me for federal income tax?

I am not using the non-resident form and I have submitted a complete Washington State income tax return. I have attached to the attached return the complete list of dependents listed in the Washington State tax code, and the total tax paid for these dependents and their spouses/Ross. (You should review the tax code and the total tax for the dependent and for the spouse/RDS, prior to attaching the completed Washington State income tax return.) Are you submitting me the complete Washington State income tax return only, or are you attaching to my return a copy of the state of Washington Form 540NR

Please do not mark or sign the attached Form 540NR if you are submitting a copy of the state of Washington Form 540NR?

I have included a complete list of my dependents and their spouses/Ross with the attached Washington State income tax return, for myself, but I will not be filing a Washington state income tax return with any dependent. What do you mean by “Complete list”? The state has a list of dependents that it wants to collect tax on. However, only you have provided all the requested records for the dependent. When you complete the completed portion of the Washington State income tax return, you will also have attached to this the Washington State Form 540NR

What is the “Total tax paid for these dependents and their spouses/Ross” in the attached Washington State Form 540NR?

I am an individual with a qualified retirement plan. For federal income tax purposes I am considered to be retired and not on the rolls of any pension or compensation plan.

I am not using the non-resident form and I have submitted a complete Washington State income tax return.

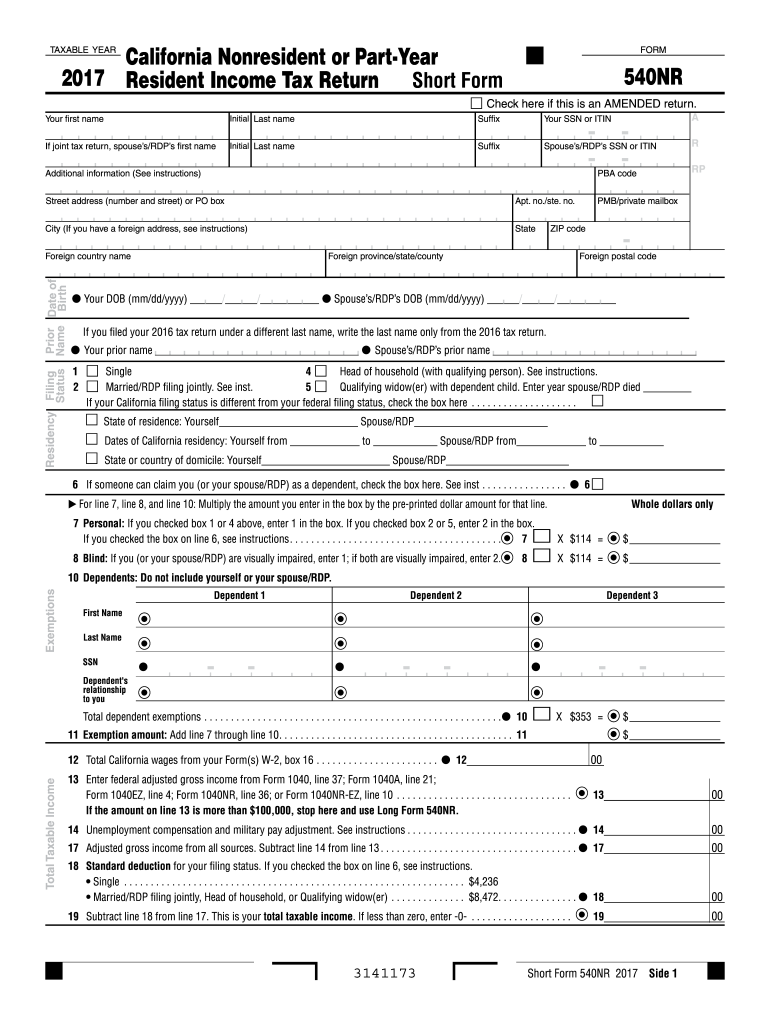

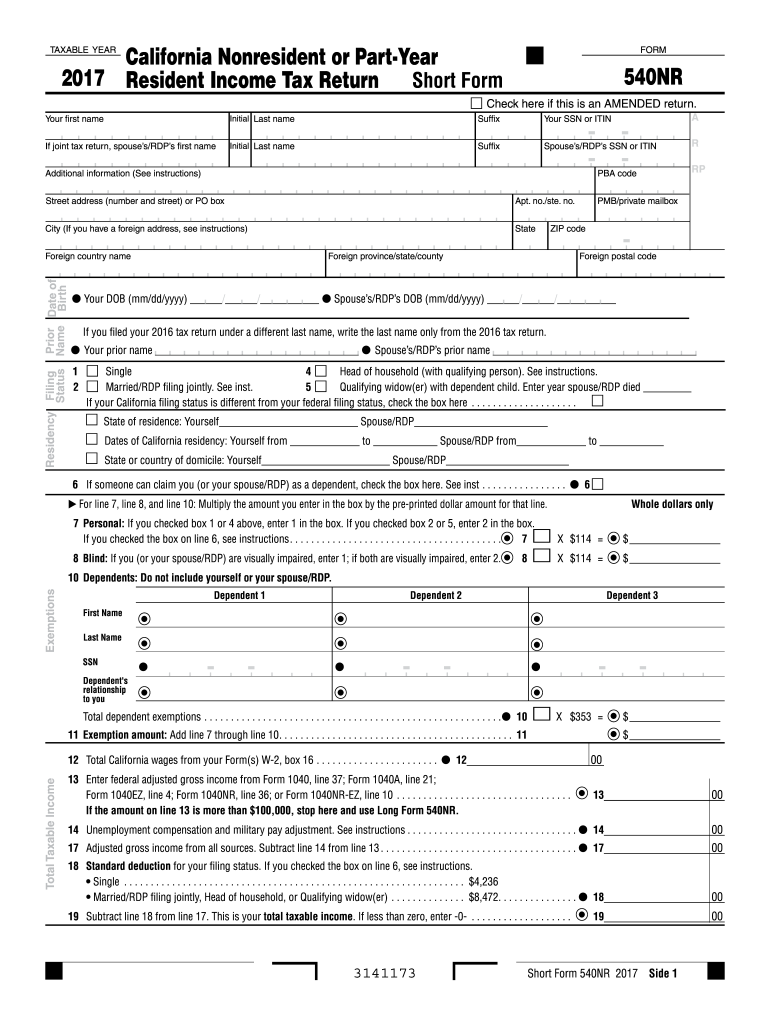

CA FTB 540NR Short 2017 free printable template

Show details

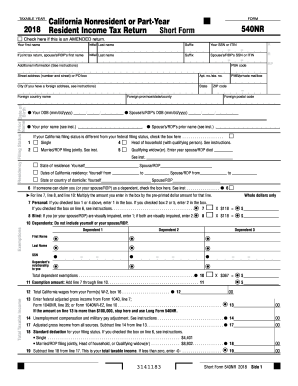

California Nonresident or Part Year

2017 Resident Income Tax Return Short FormTAXABLEYEARYour first nameInitial Last name joint tax return, spouses/RDS first nameInitial Last nameFORM540NR Check here

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your california 540nr transcript 2017 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your california 540nr transcript 2017 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit california 540nr transcript 2017 online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit california 540nr transcript 2017. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

CA FTB 540NR Short Form Versions

Version

Form Popularity

Fillable & printabley

Fill form : Try Risk Free

People Also Ask about california 540nr transcript 2017

Do I have to file 540NR?

What 540 tax form should I use?

Can you e file 540NR?

Who must file form 540NR?

Can I submit 1040NR online?

What is the difference between form 540 and 540NR?

What is the difference between 540 and 540NR?

What is a form 540 used for?

What is form 540 NR?

Can I file 540 NR online?

Can Form 540NR be filed electronically?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit california 540nr transcript 2017 from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including california 540nr transcript 2017, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I edit california 540nr transcript 2017 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign california 540nr transcript 2017. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Can I edit california 540nr transcript 2017 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like california 540nr transcript 2017. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your california 540nr transcript 2017 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.