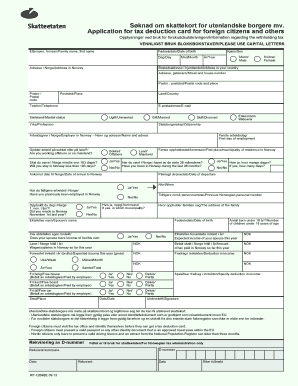

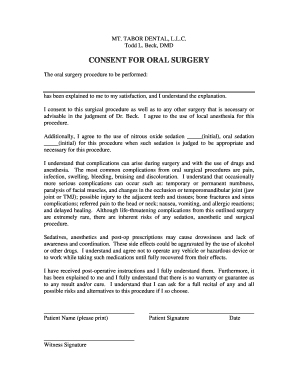

Skatteetaten RF-1209BE 2011 free printable template

Show details

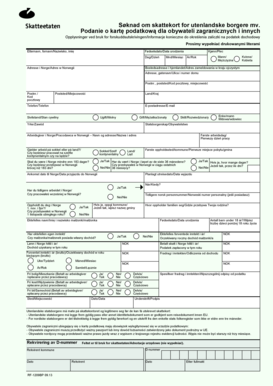

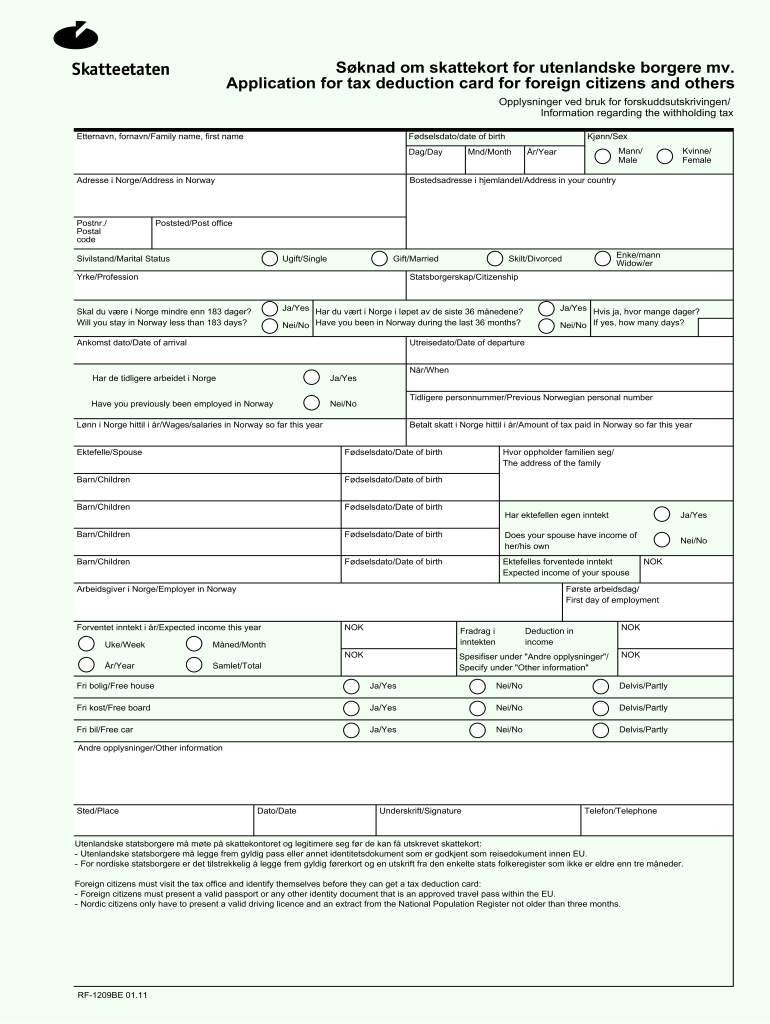

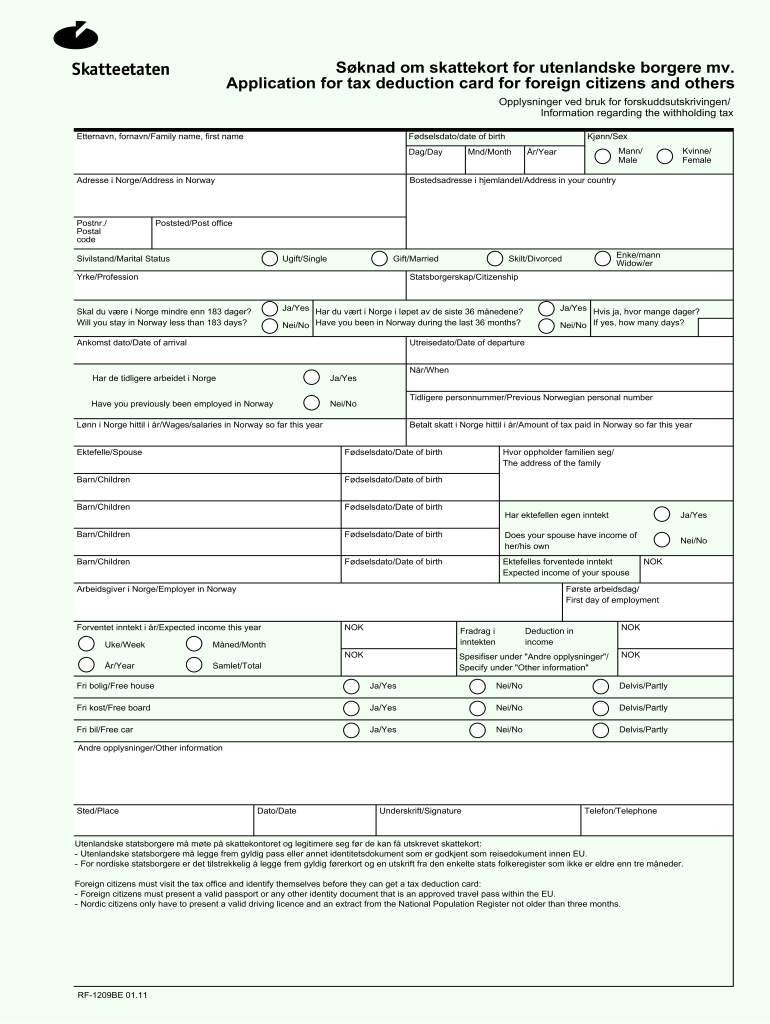

S NAD on skattekort for utenlandske bergère MV. Application for tax deduction card for foreign citizens and others Skatteetaten Opplysninger led Brut for forskuddsutskrivingen/ Information regarding

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Skatteetaten RF-1209BE

Edit your Skatteetaten RF-1209BE form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Skatteetaten RF-1209BE form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Skatteetaten RF-1209BE online

Follow the steps below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit Skatteetaten RF-1209BE. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Skatteetaten RF-1209BE Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Skatteetaten RF-1209BE

How to fill out Skatteetaten RF-1209BE

01

Read the instructions provided by Skatteetaten carefully.

02

Obtain the Skatteetaten RF-1209BE form from the Skatteetaten website or local office.

03

Fill in your personal information, including name, address, and identification number.

04

Specify the income details for the relevant year as required on the form.

05

Provide any deductions or allowances applicable to your situation.

06

Double-check all entered information for accuracy.

07

Sign and date the completed form.

08

Submit the form via the method specified by Skatteetaten (online or by mail).

Who needs Skatteetaten RF-1209BE?

01

Individuals or entities receiving a tax refund from Skatteetaten.

02

Taxpayers who have overpaid taxes in the previous year.

03

Those claiming deductions or allowances on their tax returns.

04

Residents or citizens of Norway who have taxable income.

Fill

form

: Try Risk Free

People Also Ask about

How much is tax in Norway for foreigners?

General income is taxed at a flat rate of 22%. The general income tax base comprises all categories of taxable income (i.e. income from employment, business, and capital). Tax allowances, expenses, and certain losses are deductible when computing general income.

What is a tax deduction card Norway?

All who works in Norway must have a tax deduction card. A tax deduction card is an electronic document that shows how much tax your employer must deduct before they pay your salary. The amount that your employer deducts is known as a 'tax deduction', 'withholding tax' or "advance tax payment".

How do I get a tax exemption card in Norway?

An exemption card is a tax deduction card that shows that your employer does not need to deduct tax if you earn NOK 70,000 or less. From the year you turn 13, you'll automatically receive a tax exemption card if you earned less than the tax exemption card cap the year before.

What is the 10 tax deduction for foreigners in Norway?

The standard deduction for foreign workers You are entitled to claim the standard deduction for the first two years you live in Norway. The deduction is 10% of your gross income from employment, up to a maximum NOK 40,000.

Do foreigners pay tax in Norway?

If you're going to live in Norway, you must pay tax under the general tax rules after one year. If you're not living in Norway, but travelling to Norway for temporary work assignments, you'll become part of the PAYE scheme every time you apply for a tax deduction card.

Is Norway tax free for tourists?

Tax refunds of 12 - 19% are available to all tourists except for those with legal residence in Sweden, Denmark or Finland. Over 3,000 shops across Norway offer tax-free shopping, and you can identify a participating store by the TAX FREE logo, which is usually displayed near the front entrance or by the register.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in Skatteetaten RF-1209BE?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your Skatteetaten RF-1209BE and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I fill out the Skatteetaten RF-1209BE form on my smartphone?

Use the pdfFiller mobile app to fill out and sign Skatteetaten RF-1209BE. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I complete Skatteetaten RF-1209BE on an Android device?

Use the pdfFiller mobile app and complete your Skatteetaten RF-1209BE and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is Skatteetaten RF-1209BE?

Skatteetaten RF-1209BE is a tax form used in Norway for reporting certain income and taxes related to specific financial activities.

Who is required to file Skatteetaten RF-1209BE?

Individuals or entities who have received specific types of income or who are subject to certain tax obligations related to those incomes must file Skatteetaten RF-1209BE.

How to fill out Skatteetaten RF-1209BE?

To fill out Skatteetaten RF-1209BE, one must gather the necessary financial information, complete the required fields accurately, and submit it to the tax authorities by the designated deadline.

What is the purpose of Skatteetaten RF-1209BE?

The purpose of Skatteetaten RF-1209BE is to ensure that the correct amount of tax is reported and collected on specific types of income, helping to maintain tax compliance.

What information must be reported on Skatteetaten RF-1209BE?

The information that must be reported on Skatteetaten RF-1209BE includes details about income types, amounts, and relevant tax deductions, as well as other financial data as required by the tax authorities.

Fill out your Skatteetaten RF-1209BE online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Skatteetaten RF-1209be is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.