ME Finance Authority of Maine Balance Sheet 2001-2024 free printable template

Show details

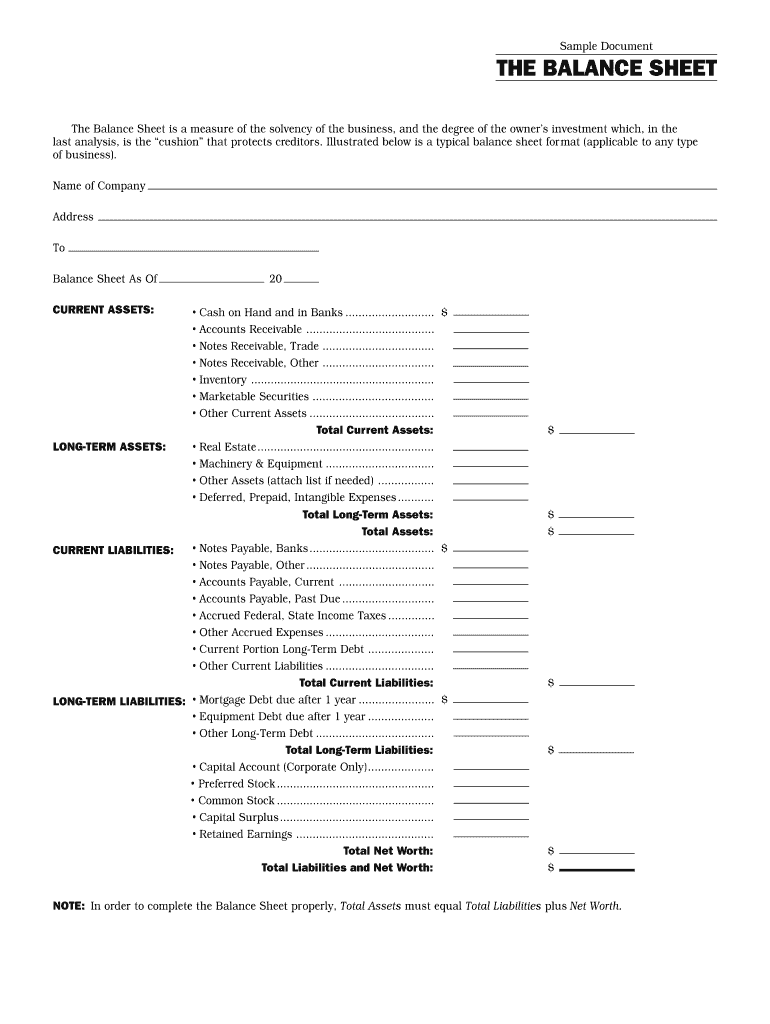

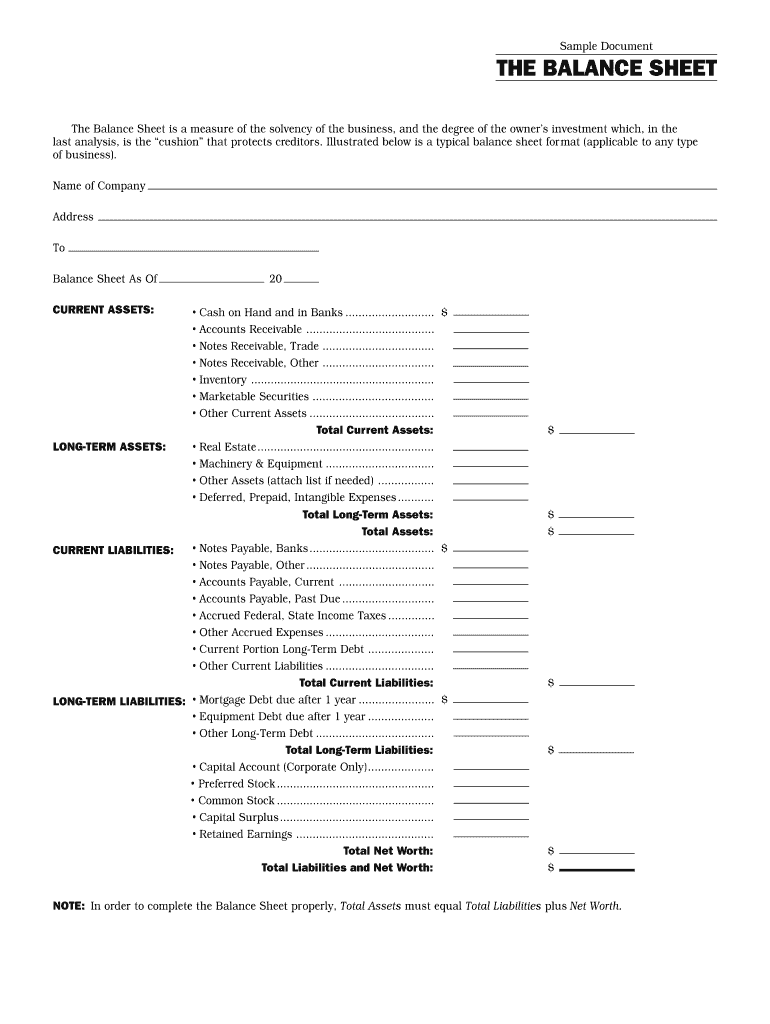

Sample Document THE BALANCE SHEET The Balance Sheet is a measure of the solvency of the business, and the degree of the owner s investment which, in the last analysis, is the cushion that protects

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your year to date balance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your year to date balance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit year to date balance sheet online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ytd balance sheet form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

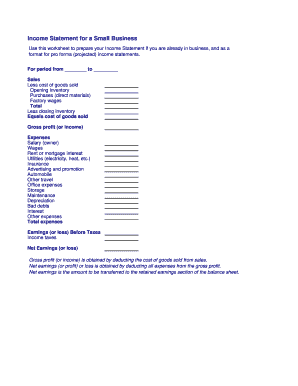

How to fill out year to date balance

How to fill out ytd balance sheet?

01

Gather all relevant financial documents, such as income statements and cash flow statements.

02

Review the beginning balances for each account, including assets, liabilities, and equity.

03

Update the balances for each account based on the financial transactions that occurred during the year.

04

Calculate the net income or loss for the year by subtracting expenses from revenues.

05

Adjust the equity section for any additional capital contributions or ownership withdrawals.

06

Reconcile all accounts to ensure accuracy and proper recording.

07

Prepare a summary of the financial information in the proper format and layout of a balance sheet.

Who needs ytd balance sheet?

01

Business owners or managers who want to assess the financial health and performance of their company.

02

Investors who are interested in evaluating the financial stability and profitability of a company.

03

Lenders or creditors who need to determine the creditworthiness and repayment capacity of a company.

04

Tax authorities who require accurate financial statements to assess tax liabilities.

05

Potential buyers or partners who want to evaluate the financial position and potential risks of a company before making a decision.

Fill balance sheet : Try Risk Free

People Also Ask about year to date balance sheet

What is a YTD balance sheet?

What should interim financial reports include?

How do you prepare interim financial statements?

Are interim financial statements required?

What is an example of an interim statement?

What is an interim balance sheet?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is interim ytd balance sheet?

Interim YTD (year-to-date) balance sheet is a snapshot of a company’s financial position at a particular point in time during the current year. It shows the assets, liabilities, and equity of a business as of the interim date. It can help management assess the financial health of the business and identify areas that need attention.

Who is required to file interim ytd balance sheet?

Interim YTD balance sheets are typically required by the SEC for publicly traded companies. They are also often required by private companies when applying for loans or investment capital.

How to fill out interim ytd balance sheet?

1. Begin by adding up all your assets and liabilities from the start of the period to the end of the period. This includes any transactions that have occurred during the period that need to be included.

2. Enter the total of assets and liabilities on the balance sheet.

3. Calculate the net income or loss for the period by subtracting total expenses from total income.

4. Add the net income or loss to the beginning balance of retained earnings to get the ending retained earnings balance.

5. Enter the total retained earnings on the balance sheet.

6. Calculate the equity section of the balance sheet by subtracting total liabilities from total assets.

7. Enter the total equity on the balance sheet.

8. Double-check the balance sheet to make sure all the totals are correct and the balance sheet balances.

What information must be reported on interim ytd balance sheet?

Typically, an interim YTD balance sheet will report the company’s assets, liabilities, and equity as of the date of the report. It should also include a reconciliation of the beginning and ending balances of the company’s accounts, as well as any significant changes to those accounts during the period. The interim YTD balance sheet should also report any changes to the company’s capital structure, such as the issuance of new stocks and bonds. Finally, the report should include any significant non-cash items, such as the depreciation of long-term assets or the amortization of intangible assets.

When is the deadline to file interim ytd balance sheet in 2023?

The deadline to file interim YTD balance sheet in 2023 will depend on the specific jurisdiction in which the company is located. Generally speaking, companies are expected to file their interim YTD balance sheets between the end of the company's fiscal year and the end of the following quarter. Therefore, for the 2023 fiscal year, the deadline to file the interim YTD balance sheet would be sometime in the fourth quarter of 2023.

What is the penalty for the late filing of interim ytd balance sheet?

The penalty for the late filing of an interim YTD balance sheet will depend on the specific jurisdiction and any applicable local laws. Generally, the penalty for not filing a balance sheet on time could range from a fine or penalty to potential criminal charges.

What is the purpose of interim ytd balance sheet?

The purpose of an interim year-to-date (YTD) balance sheet is to provide a snapshot of a company's financial position at a specific point in time during the year. It is typically prepared for reporting periods that are shorter than a full fiscal year, such as quarterly or semi-annually.

The interim YTD balance sheet allows stakeholders, such as management, investors, creditors, and regulatory authorities, to assess the financial health and performance of the company during the specified reporting period. It includes key information such as assets, liabilities, and shareholders' equity, providing insights into the company's liquidity, solvency, and overall financial stability.

By comparing interim YTD balance sheets from different reporting periods, stakeholders can analyze trends, identify changes in financial position, and make informed decisions about the company's future. It also facilitates tracking progress towards achieving financial objectives, identifying areas of concern, and adjusting strategies or making necessary corrections if needed.

How do I edit year to date balance sheet straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing ytd balance sheet form.

How can I fill out interim balance sheet template on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your ytd balance sheet template. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I fill out interim ytd balance sheet on an Android device?

On an Android device, use the pdfFiller mobile app to finish your year to date balance sheet template form. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your year to date balance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Interim Balance Sheet Template is not the form you're looking for?Search for another form here.

Keywords relevant to ytd balance sheet example form

Related to interim ytd balance sheet pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.