Balance Sheet Example

What is Balance Sheet Example?

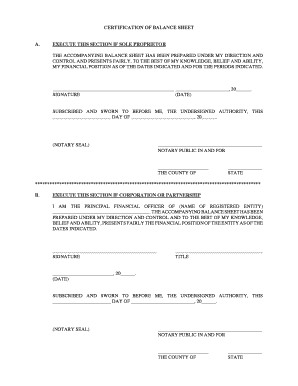

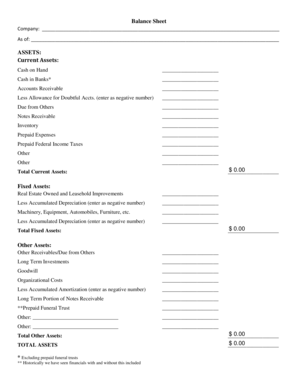

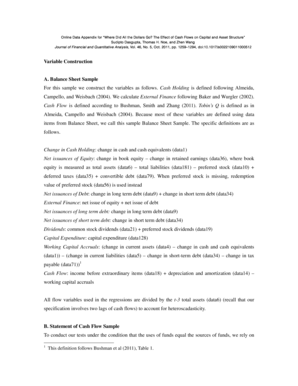

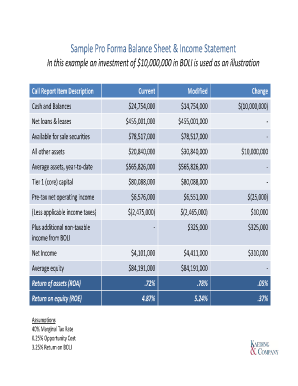

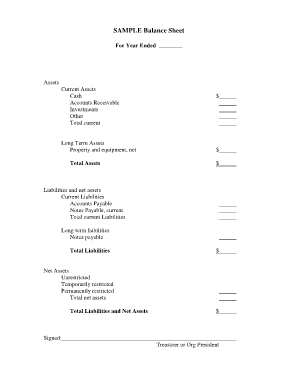

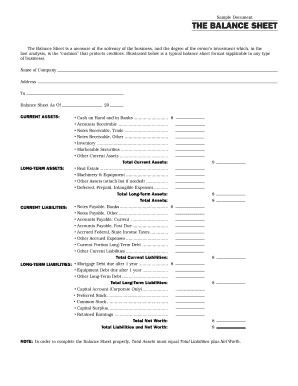

A balance sheet example is a financial statement that provides a snapshot of a company's financial position at a specific point in time. It presents the company's assets, liabilities, and shareholders' equity, showing how the company's resources are financed and allocated. By examining a balance sheet example, investors, creditors, and other stakeholders can gain insights into the financial health and stability of a company.

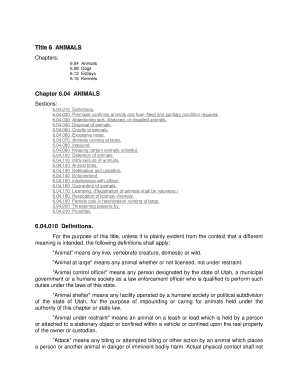

What are the types of Balance Sheet Example?

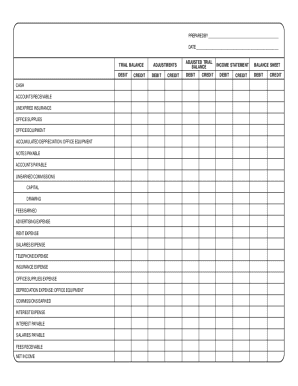

There are generally two types of balance sheet examples: classified balance sheet and unclassified balance sheet. 1. Classified Balance Sheet: A classified balance sheet organizes assets, liabilities, and shareholders' equity into specific categories. It provides more detailed information and helps users analyze the financial position of a company more effectively. 2. Unclassified Balance Sheet: An unclassified balance sheet does not have specific categories for assets, liabilities, and shareholders' equity. It provides a more simplified view of a company's financial position.

How to complete Balance Sheet Example

Completing a balance sheet example involves several steps: 1. Gather Financial Information: Collect all relevant financial documents, such as income statements, cash flow statements, and previous balance sheets. 2. Identify Assets: List all the company's assets, including cash, accounts receivable, inventory, property, plant, and equipment. 3. Determine Liabilities: Identify all the company's liabilities, including accounts payable, loans, and accrued expenses. 4. Calculate Shareholders' Equity: Calculate the shareholders' equity by subtracting the total liabilities from the total assets. 5. Organize the Balance Sheet: Once you have all the information, organize it into the appropriate categories, such as current assets, non-current assets, current liabilities, and non-current liabilities. Finally, present the shareholders' equity. 6. Review and Verify: Double-check all the figures and ensure that the balance sheet balances.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.