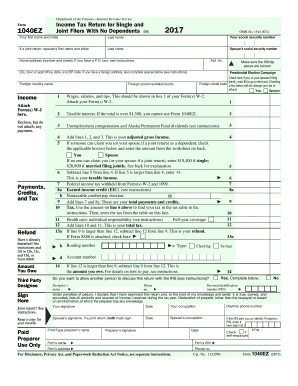

IRS 1040-EZ 2015 free printable template

Instructions and Help about IRS 1040-EZ

How to edit IRS 1040-EZ

How to fill out IRS 1040-EZ

About IRS 1040-EZ 2015 previous version

What is IRS 1040-EZ?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1040-EZ

What should I do if I realize I've made a mistake on my IRS 1040-EZ after submission?

If you discover an error after filing your IRS 1040-EZ, you can submit an amended return using Form 1040-X. Ensure that you correct the specific areas of your initial submission and clearly indicate the changes made. Keep a copy of both the original and amended forms for your records.

How can I check the status of my IRS 1040-EZ submission?

To verify the status of your IRS 1040-EZ, you can use the 'Where's My Refund?' tool available on the IRS website. This service allows you to track the processing status of your return and any associated refund. Ensure you have your Social Security number, filing status, and the exact amount of your refund at hand for accurate tracking.

Are electronic signatures accepted for IRS 1040-EZ?

Yes, electronic signatures are accepted for the IRS 1040-EZ when you e-file your return. The IRS considers a self-selected PIN as a valid signature for electronic submissions. This method ensures the integrity and authenticity of your filing.

What should I do if my IRS 1040-EZ is rejected?

If your IRS 1040-EZ is rejected, carefully review the rejection notice to understand the reason for the rejection. Common causes include incorrect information or mismatched data. Make the necessary corrections and resubmit as soon as possible to avoid delays in processing.

How long should I keep my IRS 1040-EZ records?

It is recommended to keep your IRS 1040-EZ records, including any supporting documents, for at least three years after the due date of the return or the date it was filed, whichever is later. This period allows you to substantiate your claim in case of audits or inquiries from the IRS.

See what our users say