Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

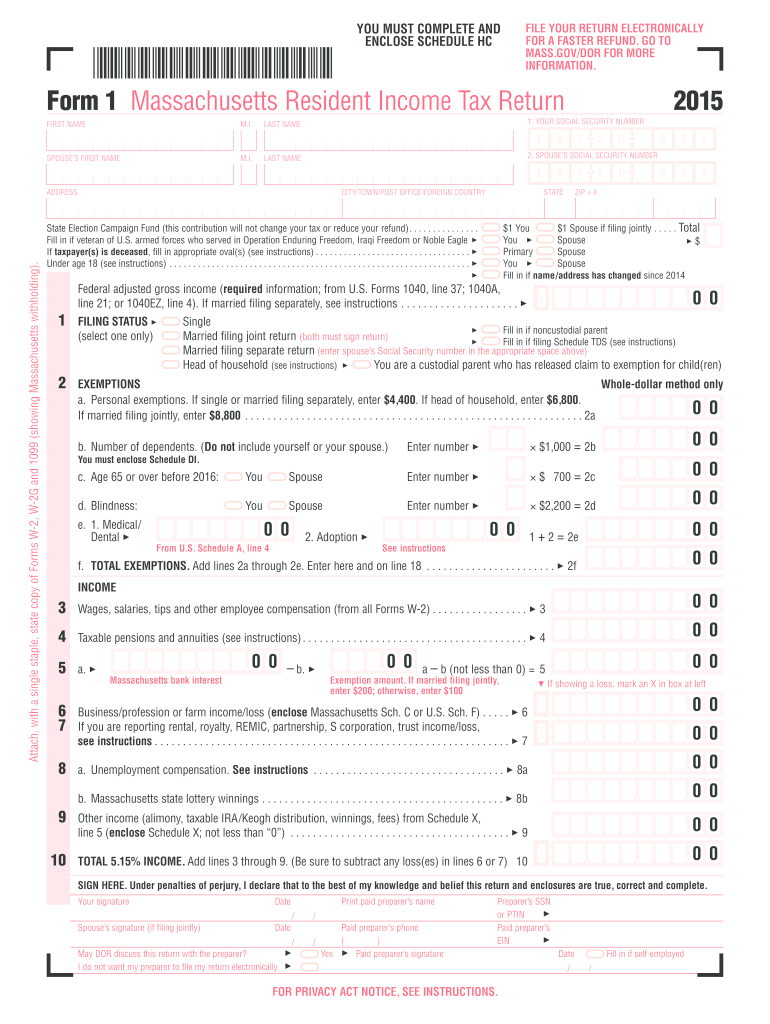

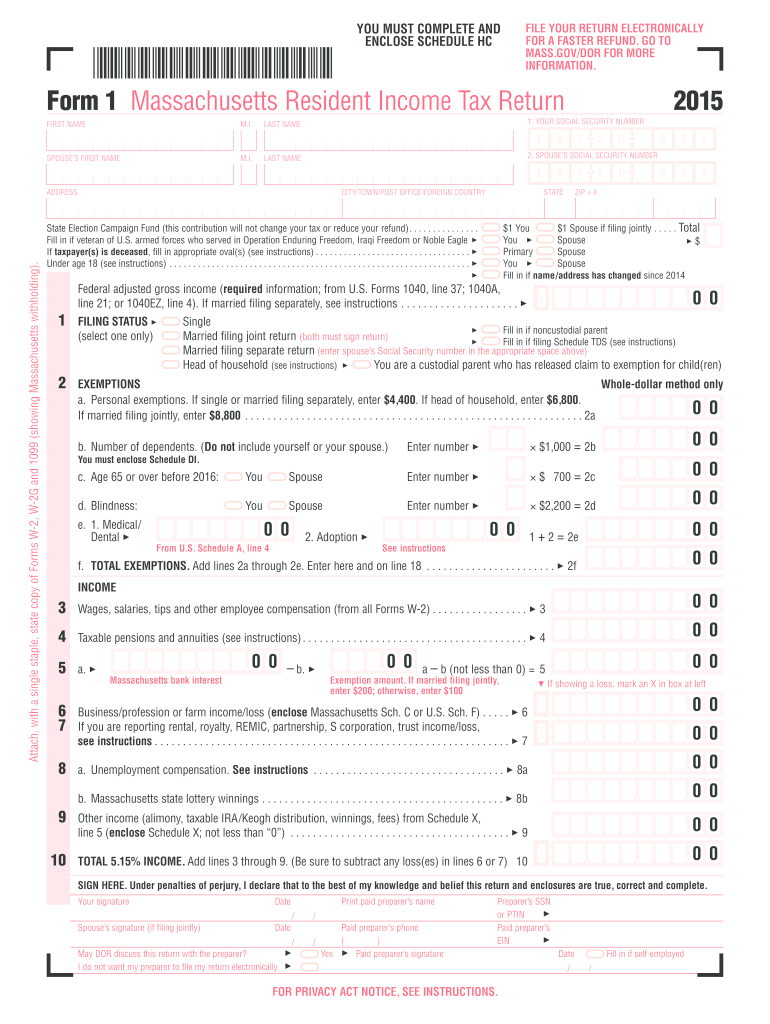

What is massachusetts form?

Massachusetts Form refers to the various tax forms and documents that individuals and businesses in the state of Massachusetts are required to complete and file with the Massachusetts Department of Revenue. These forms are used to report income, calculate and pay taxes, claim deductions and credits, and fulfill other tax obligations in accordance with Massachusetts state tax laws. Examples of Massachusetts tax forms include Form 1 (Individual Income Tax Return), Form 355S (S Corporation Excise Return), and Form M-941 (Employer's Quarterly Return of Income Taxes Withheld).

Who is required to file massachusetts form?

Individuals whose income is subject to Massachusetts income tax are required to file a Massachusetts Form. This includes residents of Massachusetts, as well as non-residents who earn income in the state. The specific filing requirements may vary based on factors such as filing status, age, and income level. It is recommended to review the Massachusetts Department of Revenue guidelines or consult a tax professional for specific filing requirements.

How to fill out massachusetts form?

Filling out the Massachusetts form will depend on the specific form you are referring to. However, as a general guide, here are the steps to fill out a form in Massachusetts:

1. Read the instructions: Carefully read through the instructions provided with the form. It will outline the purpose of the form and provide guidance on how to complete it correctly.

2. Gather necessary information: Collect all the relevant information and supporting documents that you will need to complete the form. This may include personal information, financial details, or any other information specific to the form's purpose.

3. Fill out the form: Start by providing the required personal details in the designated sections. Remember to print legibly and use black ink if required. Follow the instructions for each section, providing accurate and complete information where necessary.

4. Complete additional sections: Some forms may have additional sections or questions that need to be filled out based on your specific circumstances. Make sure to fill out these sections accordingly.

5. Consider attachments: Certain forms may require additional documents or attachments to support the information provided. For example, tax forms often require supporting documents like W-2s, 1099s, or other financial statements. Make sure to attach all the necessary documents as instructed.

6. Review and double-check: Before submitting the form, take the time to review it thoroughly. Check for any errors, omissions, or inconsistencies. Verify that all the required sections have been completed accurately. Make any necessary corrections or additions.

7. Sign and date: Once you are satisfied with the accuracy of the completed form, sign and date it as required. Some forms may require additional signatures, such as those requiring a witness or notary.

8. Make copies and retain documentation: Make copies of the completed form and any supporting documents for your records. Keep them in a safe place in case you need to reference or provide them in the future.

9. Submit the form: Follow the instructions provided on where and how to submit the completed form. This may involve mailing it to a specific address or filing it electronically through an online portal.

Note: It is essential to consult with a professional or seek guidance from the relevant Massachusetts state government agency if you have specific questions or are unsure about how to complete a particular form accurately.

What is the purpose of massachusetts form?

Massachusetts forms are used for various purposes within the state, typically related to taxation, business registration, real estate transactions, and legal matters. The specific purpose of each form depends on its type and designation. Some common reasons for using Massachusetts forms can include:

1. Income Tax: Filing individual and business income tax returns, claiming deductions and credits, and reporting taxable income.

2. Sales and Use Tax: Reporting and remitting sales tax collected by businesses.

3. Employer Tax: Reporting employee payroll tax withholding and unemployment tax.

4. Business Registration: Establishing and registering a business entity in the state.

5. Real Estate: Transferring and recording property ownership, mortgages, leases, and other related documents.

6. Health and Human Services: Applying for benefits, such as MassHealth (Medicaid), food assistance, and other social services.

7. Corporation and LLC: Incorporating a business or forming a limited liability company (LLC) by submitting required documentation.

It is important to identify the specific form number and read the instructions provided by the state to understand its purpose and proper usage.

What information must be reported on massachusetts form?

There are several different forms in Massachusetts that require reporting of different types of information. Some common forms and the corresponding information that must be reported on each include:

1. Massachusetts Tax Return (Form 1): This form is used to report an individual's income and taxes owed or refunded. Information required includes details about income (wages, dividends, rental income, etc.), deductions, exemptions, and credits.

2. Massachusetts Partnership Return (Form 3): Partnerships in Massachusetts are required to report their income, deductions, and credits on this form. Information includes details about partnership income, distributive shares, partner information, and credits.

3. Massachusetts Corporate Excise Return (Form 355): Corporations operating in Massachusetts report their income, deductions, and credits on this form. Information includes details about corporate income, apportionment factor, shareholder information, and credits.

4. Massachusetts Sales and Use Tax Return (Form ST-9): Businesses that make sales or purchases subject to sales tax in Massachusetts must accurately report these transactions on this form. Information includes details about sales, use tax due, tax exemptions, and other relevant information.

5. Massachusetts Employer's Quarterly Return of Income Taxes Withheld (Form M-941): Employers are required to report the wages paid and income taxes withheld from their employees on a quarterly basis using this form. Information includes details about wages, withheld taxes, and other payroll-related information.

It's important to note that the above list is not exhaustive, and there are additional forms and reporting requirements in Massachusetts based on specific circumstances, such as estate taxes, property taxes, etc. It is advisable to consult the official Massachusetts Department of Revenue website or seek professional advice for specific reporting obligations.

What is the penalty for the late filing of massachusetts form?

In Massachusetts, the penalty for the late filing of forms can vary depending on the specific form being filed and the circumstances surrounding the late filing. Different penalties might apply for late filing of income tax returns, sales tax returns, or other forms.

For example, in the case of late filing of Massachusetts Personal Income Tax Returns (Form 1), there is a penalty of 1% of the tax due per month or partial month, up to a maximum penalty of 25% of the tax due.

However, it is always advisable to consult the official Massachusetts Department of Revenue (DOR) website or seek professional advice to obtain accurate and up-to-date information on specific penalties for late filing.

How can I send massachusetts form to be eSigned by others?

When you're ready to share your massachusetts tax forms, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit massachusetts form straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing massachusetts tax forms.

How do I edit massachusetts form on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share massachusetts tax forms from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.