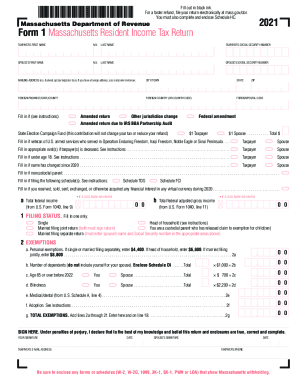

MA Form 1 2022 free printable template

Get, Create, Make and Sign

How to edit massachusetts form 1 fillable pdf online

MA Form 1 Form Versions

How to fill out massachusetts form 1 pdf

How to fill out Massachusetts form 1 pdf:

Who needs Massachusetts form 1 pdf:

Video instructions and help with filling out and completing massachusetts form 1 fillable pdf

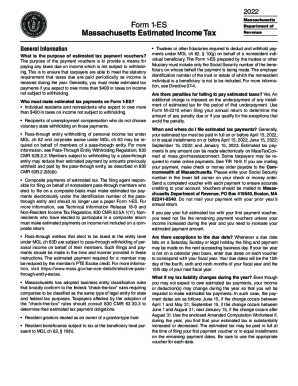

Instructions and Help about massachusetts tax form

Free income tax filing for full year residents Filing your income tax return through MassTaxConnect will electronically send your state tax return to FOR. The return must be e-filed. A printed version of the return will not be accepted. You may save a copy of your completed return for your records after it has been initially processed usually within 24 hours. To file a personal income tax return through MassTaxConnect, choose sign up on the MassTaxConnect homepage. Select create my logon if you haven't already created a logon and follow the prompts. Select the option to sign up as an individual. The account type is personal income tax. You will need to provide either a social security number or ITIN. You'll also need to provide one of the following so have these items handy. This filing method also provides an opportunity for taxpayers who are eligible for a circuit breaker credit or a household dependent credit and may only need to file a state income tax return. Before you begin, you should review the Form 1 instructions located in the video description. For the 2021 personal income tax return for recent tax law changes common errors, important definitions of terms...

Fill massachusetts tax forms : Try Risk Free

People Also Ask about massachusetts form 1 fillable pdf

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your massachusetts form 1 pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.